Office Depot 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.85 Office Depot 2003 / Proxy Statement

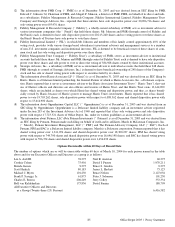

(2) The information about FMR Corp. (“ FMR”) is as of December 31, 2003 and was derived from an SEC filing by FMR,

Edward C. Johnson 3d, Chairman of FMR, and Abigail P. Johnson, a director of FMR. FMR, on behalf of its direct and indi-

rect subsidiaries, Fidelity Management & Research Company, Fidelity International Limited, Fidelity Management Trust

Company and Strategic Advisers, Inc., reported that these entities have sole dispositive power over 20,906,716 shares and

sole voting power over 693,476 shares.

(3) Fidelity Management & Research Company (“ Fidelity”), a wholly-owned subsidiary of FMR, acts as investment advisor to

various investment companies (the “ Funds”) that hold these shares. Mr. Johnson and FMR (through control of Fidelity and

the Funds) each is deemed to have sole dispositive power over 20,213,240 shares and no voting power over these shares as

the Funds’Boards of Trustees have sole power to vote these shares.

(4) Fidelity International Limited (“ FIL”), in which Mr. Johnson and members of his family control approximately 40% of the

voting stock, provides (with various foreign based subsidiaries) investment advisory and management services to a number

of non-U.S. investment companies and institutional investors. FIL is deemed to be beneficial owner of these shares of com-

mon stock and has sole voting and dispositive power over these shares.

(5) Fidelity Management Trust Company (“ Fidelity Trust”), a subsidiary of FMR, serves as investment adviser to institutional

accounts that hold these shares. Mr. Johnson and FMR (through control of Fidelity Trust) each is deemed to have sole dispositive

power over these shares and sole power to vote or direct the voting of 586,928 shares owned by these institutional accounts.

(6) Strategic Advisers, Inc., a subsidiary of FMR, serves as investment advisor to individual accounts that hold these 248 shares.

FMR (through its control of Strategic Advisers, Inc.) is deemed to have beneficial ownership of 248 shares of the Company’s

stock and has sole or shared voting power with respect to securities held by its clients.

(7) The information about Harris Associates LP (“ Harris”) is as of December 31, 2003 and was derived from an SEC filing by

Harris. Harris is a Delaware limited partnership, the General Partner of which is Harris Associates, Inc., a Delaware corpora-

tion. Harris reported that it serves as investment adviser to the Harris Associates Investment Trust (“ Harris Trust”), that vari-

ous of Harris’s officers and directors are also officers and trustees of Harris Trust, and that Harris Trust owns 13,614,900

shares, which are included as shares over which Harris has shared voting and dispositive power, and thus, as shares benefi-

cially owned by Harris because of Harris’s power to manage Harris Trust’s investments. Harris reported that it has shared

power to vote 19,703,262 shares, sole dispositive power with respect to 6,088,362 shares and shared dispositive power with

respect to 13,614,900 shares.

(8) The information about Oppenheimer Capital LLC (“ Oppenheimer”) is as of December 31, 2003 and was derived from an

SEC filing by Oppenheimer. Oppenheimer is a Delaware limited liability company and an investment adviser registered

under Section 203 of the Investment Advisers Act of 1940 and reported that it has sole voting power and sole dispositive

power with respect 17,723,321 shares of Office Depot, Inc. under its written guidelines as an investment adviser.

(9) The information about Putnam, LLC d/b/a Putnam Investments (“ Putnam”) is as of December 31, 2003 and was derived from

an SEC filing by Putnam. Putnam made such filing on behalf of itself and its affiliates, Marsh & McLennan Companies, Inc.

(“ Marsh”), Putnam Investment Management, LLC (“ PIM”) and The Putnam Advisory Company, LLC (“ PAC”). Each of

Putnam, PIM and PAC is a Delaware limited liability company. Marsh is a Delaware corporation. Putnam reported that it has

shared voting power over 1,341,074 shares and shared dispositive power over 18,300,237 shares. PIM has shared voting

power with respect to 744,700 shares and shared dispositive power over 16,646,198 shares, and PAC has shared voting power

with respect to 596,374 shares and shared dispositive power over 1,654,039 shares.

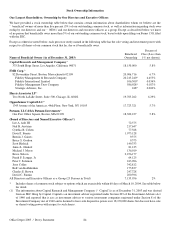

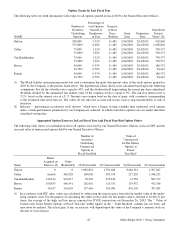

Options Exercisable within 60 Days of Record Date

The number of options which are or will be exercisable within 60 days of March 10, 2004 for each person named in the table

above and for our Executive Officers and Directors as a group is as follows:

Lee A. Ault III 39,375

Cynthia Cohen 75,456

Brenda Gaines 9,375

Scott Hedrick 80,183

Michael J. Myers 101,250

Frank P. Scruggs, Jr. 61,875

Charles E. Brown 206,249

Rolf van Kaldekerken 175,836

All Executive Officers and Directors

as a Group (Twenty-three (23) Persons)

Neil R. Austrian 69,375

David I. Fuente 1,970,211

Bruce S. Gordon 9,375

James L. Heskett 73,125

Bruce Nelson 2,127,056

Peter J. Solomon 101,250

Jerry Colley 333,334

David Fannin 180,799

6,416,582