Office Depot 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.stores and warehouses are expensed as incurred and included

in other operating expenses.

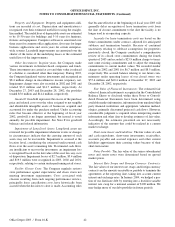

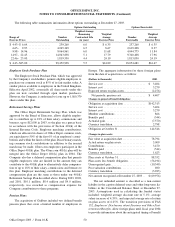

Self-Insurance: Office Depot is primarily self-insured for

workers’compensation, auto and general liability and employee

medical insurance programs. Self-insurance liabilities are

based on claims filed and estimates of claims incurred but not

reported. These liabilities are not discounted.

Comprehensive Income: Comprehensive income repre-

sents the change in stockholders’equity from transactions and

other events and circumstances arising from non-stockholder

sources. Comprehensive income consists of net earnings, for-

eign currency translation adjustments, realized or unrealized

gains (losses) on investment securities that are available for

sale, net of applicable income taxes, and proceeds and related

amortization of qualifying cash flow hedges.

Derivative Financial Instruments: Certain derivative

financial instruments may be used to hedge the exposure to

foreign currency exchange rate and interest rate risks, subject

to established risk management policies. Such approved

financial instruments include swaps, options, caps, forwards

and futures. Use of derivative financial instruments for trading

or speculative purposes is prohibited by Company policies.

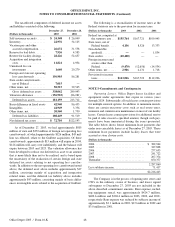

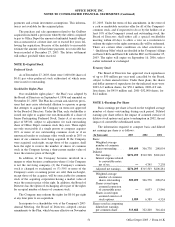

New Accounting Standards: In November 2003, the

Emerging Issues Task Force (“ EITF”) reached a consensus on

EITF 03-10, Application of Issue No. 02-16 by Resellers to

Sales Incentives Offered to Consumers by Manufacturers.

Generally under this guidance, vendor funded coupons that

can be redeemed broadly across companies should be consid-

ered revenue, but vendor funded coupons that are unique to a

specific retailer should be considered a reduction of the product

cost sold. Most retailers, including Office Depot, have histori-

cally recognized both types of arrangements as revenue. Our

sales for fiscal years 2003, 2002, and 2001 include approxi-

mately $12.3 million, $4.5 million, and $7.6 million relating

to Company-specific vendor funded coupon arrangements.

Beginning in 2004, future vendor funded arrangements will be

classified as a reduction of cost of goods sold.

In December 2003, the Financial Accounting Standards

Board (“ FASB”) issued FASB Interpretation (“ FIN”) No.

46(R), Consolidation of Variable Interest Entities. FIN 46(R)

replaces FIN 46 and addresses consolidation by business

enterprises of variable interest entities. The provisions of FIN

46(R) are effective for the first reporting period that ends after

December 15, 2003 for variable interests in those entities

commonly referred to as special-purpose entities. Application

of the provisions of FIN 46(R) for all other entities is effective

for the first reporting period ending after March 15, 2004. We

have no interest in any entity considered a special purpose

entity; therefore, the initial adoption of FIN 46(R) did not have

an impact on the Company. We believe the adoption of the pro-

visions of FIN 46(R) in the first quarter of 2004 will have no

impact on our net earnings, cash flows or financial position.

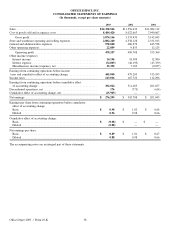

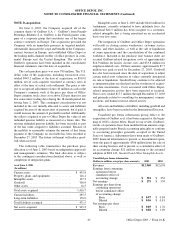

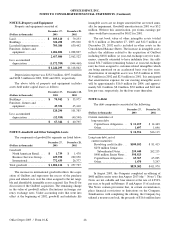

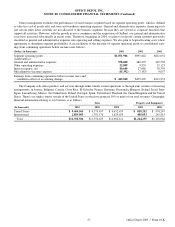

NOTE B—Discontinued Operations

In August 2002, the Company announced its decision to

sell its Australian operations. Accordingly, the Australian por-

tion of the Company’s business is reported as a discontinued

operation in the International segment disclosure and in the

consolidated financial statements. The sale was completed in

January 2003 with no significant impact on net earnings.

Australia’s sales and pre-tax profit (loss), respectively,

were $80.9 million and $(1.0) million for 2002; and $72.0

million and $0.2 million for 2001. Diluted earnings per share

was not affected by discontinued operations in the three years

presented. Basic per share amounts were $(0.01) and $(0.01),

for 2002 and 2001, respectively. Australia’s assets and liabili-

ties were considered held for sale and at December 28, 2002,

with $33.0 million included in prepaid expenses and other

current assets and $7.0 million included in accrued expenses

and other current liabilities in the accompanying Consolidated

Balance Sheet.

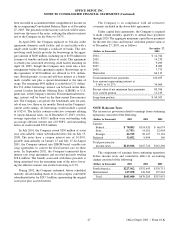

NOTE C—Cumulative Effect of Accounting Change

At the beginning of fiscal year 2003, we adopted EITF

02-16. This guidance primarily affects our accounting for

cooperative advertising arrangements. Under these rules, there

is a presumption that amounts received from vendors should

be considered a reduction of product costs. This presumption

can be overcome if certain restrictive provisions are met. We

adopted a policy of considering all cooperative advertising

arrangements to be a reduction of product cost, because the

cost of tracking actual advertising costs by vendor to meet

these criteria would exceed the benefit. These arrangements

were previously accounted for as a reduction of advertising

expense. A portion is now deferred in inventory and reduces

the cost of products as they are sold, similar to the current

practice for vendor rebate arrangements.

To record the initial amount of cooperative advertising

deferred in inventory at the beginning of the year, we recorded

an after-tax cumulative effect adjustment of $25.9 million, or

$0.08 per share. The impact on continuing operations of

applying this method in 2003 decreased cost of goods sold by

$240.4 million and increased advertising expense by $234.2

million. Operating profit increased by $6.2 million, net earn-

ings by $4.3 million and diluted earnings per share by $0.01.

Prior periods have not been restated. However, the estimated

impact of applying this method in 2002 would have been to

decrease the cost of goods sold by $241.3 million and increase

advertising expense by $242.7 million. Pro forma operating

profit would have decreased by $1.4 million, net earnings by

$1.0 million and would have had no impact on diluted earn-

ings per share.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Office Depot 2003 / Form 10-K 44