Office Depot 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

been recorded in accumulated other comprehensive income on

the accompanying Consolidated Balance Sheet as of December

27, 2003. The proceeds on the treasury rate lock will be amor-

tized over the term of the notes, reducing the effective interest

rate to the Company on the Notes to 5.87%.

In April 2002, the Company replaced its 364-day credit

agreement, domestic credit facility, and its yen facility with a

single credit facility through a syndicate of banks. This new

revolving credit facility provides for borrowings in the aggre-

gate amount of $600 million, including up to $150 million for

issuance of standby and trade letters of credit. This agreement

is a three-year, unsecured revolving credit facility maturing on

April 24, 2005, though the Company may enter into a new

arrangement before this agreement expires. Borrowings up to

the equivalent of $100 million are allowed in U.S. dollars,

euro, British pounds, or yen and will bear interest at a bench-

mark variable rate plus a spread determined at the time of

usage. The remaining $500 million is available in U.S. dollars.

For U.S. dollar borrowings, interest can be based on the then-

current London Interbank Offering Rate (LIBOR) or U.S.

prime rate, at the Company’s election. For international borrow-

ings, interest will be based on the then-current Eurocurrency

rate. The Company can specify the benchmark rates for peri-

ods of one, two, three or six months. Based on the Company’s

current credit ratings, all borrowings would include a spread

of 0.925%. The facility contains restrictive covenants relating

to various financial ratios. As of December 27, 2003, yen bor-

rowings equivalent to $100.1 million were outstanding with

an average effective interest rate of 0.988%, and outstanding

letters of credit totaled $72.8 million.

In July 2001, the Company issued $250 million of seven

year, non-callable, senior subordinated notes due on July 15,

2008. The notes have a coupon interest rate of 10.00%,

payable semi-annually on January 15 and July 15. In August

2001, the Company entered into LIBOR-based variable rate

swap agreements to convert the fixed interest rate on these

notes. In September 2002, the Company terminated these

interest rate swap agreements and received proceeds totaling

$18.8 million. The benefit associated with these proceeds is

being amortized over the remaining term of the notes, lower-

ing the effective interest rate on this borrowing to 8.7%.

During 2002, the Company redeemed, before scheduled

maturity, all outstanding shares of its zero coupon, convertible

subordinated notes for $243.3 million, representing the original

issue price plus accrued interest.

The Company is in compliance with all restrictive

covenants included in the above debt agreements.

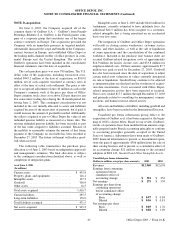

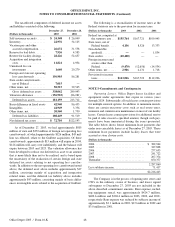

Under capital lease agreements, the Company is required

to make certain monthly, quarterly or annual lease payments

through 2020. The aggregate minimum capital lease payments

for the next five years and beyond, with their present value as

of December 27, 2003, are as follows:

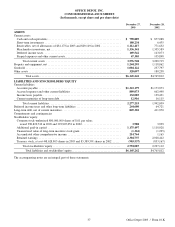

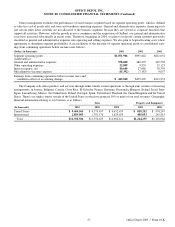

December 27,

(Dollars in thousands) 2003

2004. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 16,766

2005. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,270

2006. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,490

2007. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,083

2008. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,773

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64,113

Total minimum lease payments . . . . . . . . . . . . . 120,495

Less amount representing interest at

5.00% to 10.27%. . . . . . . . . . . . . . . . . . . . . . . 39,909

Present value of net minimum lease payments . . 80,586

Less current portion . . . . . . . . . . . . . . . . . . . . . . 11,219

Long-term portion. . . . . . . . . . . . . . . . . . . . . . . . $ 69,367

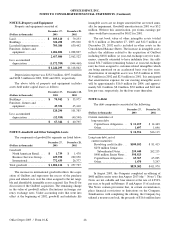

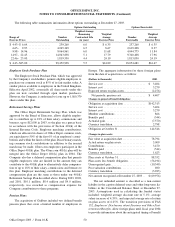

NOTE H—Income Taxes

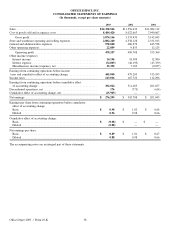

The income tax provision related to earnings from continuing

operations consisted of the following:

(Dollars in thousands) 2003 2002 2001

Current:

Federal. . . . . . . . . . . $70,802 $114,420 $ 66,074

State. . . . . . . . . . . . . (3,753) 14,181 12,904

Foreign. . . . . . . . . . . 42,915 29,127 33,122

Deferred . . . . . . . . . . . 33,052 9,994 196

Total provision for

income taxes . . . . . . $143,016 $167,722 $112,296

The components of earnings from continuing operations

before income taxes and cumulative effect of accounting

change consisted of the following:

(Dollars in thousands) 2003 2002 2001

North America . . . . . . . $227,962 $352,645 $176,711

International . . . . . . . . 217,078 126,560 137,242

Total. . . . . . . . . . . . . $445,040 $479,205 $313,953

47 Office Depot 2003 / Form 10-K