Office Depot 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.increase in our deferred income tax expense, an increase in our

closed store reserve, and various asset impairments. The addi-

tional depreciation includes the impact of Guilbert assets. Cash

flows provided by operating activities in 2002 reflect higher

net income, partially offset by an increase in overall inventory

at the end of the year.

Investing activities for 2003 include approximately $919

million for payments made in connection with our acquisition

of Guilbert, net of cash acquired. The purchase price of

Guilbert is subject to an upward adjustment of euro 40 million,

payable in Office Depot common stock or cash, if Office Depot

stock closes above $20 per share for five consecutive days over

an 18-month period following the closing date of the acquisi-

tion. See Note D to our Consolidated Financial Statements for

additional discussion of the purchase transaction. Investing

activities in 2003 also include $100 million we invested in a

mutual fund that primarily invests in U.S. Government agency

obligations and cash proceeds from selling our Australian

business in January 2003.

Excluding the acquisition of Guilbert, our primary invest-

ing activity is the acquisition of capital assets. The majority of

our capital asset acquisitions relate to opening or remodeling

retail stores and warehouses, as well as internal infrastructure

upgrades. During 2003, we added or relocated a total of 48

stores and consolidated two CSCs in North America.

Internationally, we opened 16 retail stores. We currently plan

to open approximately 70 to 80 stores in our North American

Retail Division and approximately 5 to 10 stores in our

International Division during 2004. We estimate that our cash

investing requirements will be approximately $1.0 million for

each new domestic office supply store. The $1.0 million

includes approximately $0.4 million for leasehold improve-

ments, fixtures, point-of-sale terminals and other equipment,

and approximately $0.6 million for the portion of our invento-

ries that will not be financed by our vendors. In addition, our

average new office supply store requires pre-opening expenses

of approximately $0.2 million.

In late 2003, we announced our decision to build a new

corporate support center in Boca Raton, Florida. We estimate

that the center will be completed in the early part of 2006 at a

cost in excess of $100 million, of which approximately $30

million will be paid in 2004.

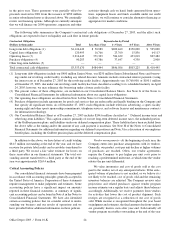

Financing Activities

Our existing credit facility provides us with a maximum

of $600 million in funds, including up to $150 million for

issuance of standby and trade letters of credit. This facility is

a three-year, unsecured revolving credit agreement maturing

on April 24, 2005, though the Company may enter into a new

arrangement before this agreement expires. The agreement

provides for the availability of borrowings up to the equivalent

of $100 million in U.S. dollars, euro, British pounds or yen.

The remaining $500 million is available in U.S. dollars.

Borrowings will bear interest at a benchmark variable rate

plus a spread determined at the time of usage. For U.S. dollar

borrowings, interest can be based on the then-current London

Interbank Offering Rate (LIBOR) or U.S. prime rate, at the

Company’s election. For international borrowings, interest

will be based on the then-current Eurocurrency rate. We can

specify interest periods to be one, two, three or six months.

Based on our current credit ratings, borrowings would include

a spread of 0.925%. As of December 27, 2003, we had out-

standing yen borrowings equivalent to $100.1 million, which

had an effective interest rate of 0.9875%, and $72.8 million of

the Company’s total $81.5 million outstanding letters of credit

were under this agreement. The agreement contains restrictive

covenants relating to various financial statement ratios. We are

in compliance with all such covenants.

In August 2003, the Company completed an offering of

$400 million senior notes due August 2013. The notes are not

callable and bear interest at the rate of 6.25% per year, to be

paid on February 15 and August 15 of each year. The Notes

contain provisions that, in certain circumstances, place financial

restrictions or limitations on the Company. Simultaneous with

completing the offering, the Company liquidated a treasury

rate lock. The proceeds on the treasury rate lock will be amor-

tized over the term of the notes, reducing the effective interest

rate to the Company for the Notes to 5.87%. Also, in January

2004, we entered into a fixed-for-variable interest rate swap

with a notional amount of $100 million.

In July 2001, we issued $250 million of seven year, non-

callable, senior subordinated notes due on July 15, 2008. The

notes contain provisions that, in certain circumstances, place

financial restrictions or limitations on our Company. The notes

have a coupon interest rate of 10.00%, payable semi-annually

on January 15 and July 15. In August 2001, we entered into

LIBOR-based variable rate swap agreements with notional

amounts aggregating $250 million. In September 2002, we ter-

minated the swap agreements and received a payment of $18.8

million plus accrued interest receivable. The proceeds from

settlement are being amortized as a partial offset to interest

expense over the remaining life of the notes, lowering the

effective interest rate on these borrowings to 8.7%.

In October 2003, our Board of Directors authorized the

Company to repurchase up to $50 million of its common

stock. The repurchased shares are to be added to the Company’s

treasury shares and will effectively offset a portion of the

Company’s near-term requirements for its stock option and

other benefit plans. Under this program, we purchased approx-

imately 3.2 million shares of our stock during 2003 at a total

cost of $50.1 million. A similar program was authorized in

late 2001, and during 2002, we purchased 2.9 million shares

of our stock at a total cost of $45.9 million and 252,000 shares

during 2001 at a cost of $4.2 million.

During 2002, we exercised our option and redeemed all of

the outstanding shares of convertible subordinated notes, origi-

nally issued in 1992 and 1993. The shares were redeemed at

original issue price plus accrued interest, totaling $243 million.

Our 2001 net cash used in financing activities consisted

mainly of long- and short-term debt payments of $400.5 mil-

lion to pay off borrowings under our domestic credit facility

that accumulated during the fourth quarter of 2000, mainly to

support the repurchase of convertible subordinated notes

23 Office Depot 2003 / Form 10-K