Office Depot 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sales in our North American Retail Division decreased

3% in 2003 and 1% in 2002. Comparable sales in 2003 from

the 870 stores that were open for more than one year were

down 4%. In 2002, comparable sales in the 848 stores that

were open for at least one year were down 2%. The decrease

in both years reflects both lower average transaction size and

fewer comparable transactions. Additionally, our 2003 holiday

sales were below expectations. We believe our sales in 2002

and part of 2003 were negatively impacted by the overall soft

U.S. economy at that time. In 2004, we expect to drive traffic

and sales in our retail channel as we remodel our existing

stores, identify and expand alternative store formats, and

introduce new merchandising initiatives. As a result of these

activities, comparable sales in the opening weeks of 2004

have turned positive.

The trends in product mix experienced in 2001 continued

throughout 2002 and 2003, as overall sales shifted away from

lower margin technology products in both periods. Comparable

sales of lower margin technology products declined 11%

in 2003 and 7% in 2002; and comparable sales of business

furniture declined 4% in 2003 and 6% in 2002. Sales of core

supplies and paper were relatively flat in both periods. Sales

of machine supplies, which include ink and toner, were up 4%

in 2003, aided in part by our ink and toner initiatives in the

second half of the year. However, with the more open presen-

tation of ink and toner in our stores, we experienced increased

shrink levels in 2003. Gross margins in 2003 were also nega-

tively impacted by increased clearance activity as we launched

several new retail initiatives.

Adopting EITF 02-16 reduced the cost of goods sold for

2003 by $135.3 million and increased advertising expense by

$132.5 million. Had this change been effective for 2002, the

pro forma impact would have decreased cost of goods sold by

$150.9 million and increased advertising expense by $151.5

million. Cooperative advertising credits for 2001 totaled

$167.1 million.

Reflecting the impact of EITF 02-16 on all periods, total

operating and selling expenses in our North American Retail

Division increased in 2003 after a decrease in 2002. Overall

personnel-related costs, which represent the largest compo-

nent of costs in this caption, decreased in both 2003 and 2002.

Increases in wage rates and in certain employee benefit costs

were more than offset by streamlining certain operational

processes which reduced the amount of labor required to

operate the stores and by reduced incentive costs in 2003

because the segment did not meet overall performance expec-

tations. Lower sales in both periods contributed to lower

credit card fees. Facility and facility maintenance expense

increased in 2003 as we added stores and made changes to our

store layout to handle various initiatives. Operating and selling

expenses in 2002 also include $14.4 million to settle potential

class action litigation in the state of California relating to cer-

tain employee classifications as exempt from overtime.

During 2001, we closed 73 stores, 70 of which were iden-

tified as part of our comprehensive business review completed

in late 2000. We also identified ten additional under-performing

stores that were closed in 2002. Because of continued uncer-

tainty relating to sublease assumptions for properties previously

closed, the Company conducted a comprehensive review of its

closed store commitments during the fourth quarter of 2003

and recorded a $23.9 million charge to terminate some exist-

ing commitments and adjust the remaining commitments to

current market values. We recorded similar charges in 2002

and 2001 for $6.7 million and $8.5 million, respectively.

Additionally, charges for asset impairments for under-

performing stores were $2.7 million, $5.4 million, and $35.2

million in 2003, 2002 and 2001, respectively. We regularly

review actual and projected store performance and record any

asset impairment charges as a component of store and ware-

house operating expenses.

19 Office Depot 2003 / Form 10-K

BSG

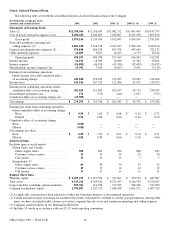

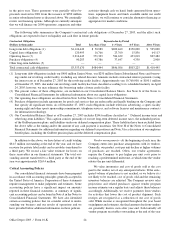

(Dollars in millions) 2003 2002 2001

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,965.3 100.0% $3,913.9 100.0% $3,763.0 100.0%

Cost of goods sold and occupancy costs . . . 2,671.2 67.4% 2,684.7 68.6% 2,574.0 68.4%

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . 1,294.1 32.6% 1,229.2 31.4% 1,189.0 31.6%

Operating and selling expenses . . . . . . . . . . . 906.2 22.9% 864.6 22.1% 897.8 23.9%

Segment operating profit . . . . . . . . . . . . . . . . $387.9 9.7% $ 364.6 9.3% $ 291.2 7.7%

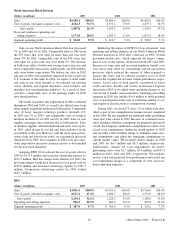

North American Retail Division

(Dollars in millions) 2003 2002 2001

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,650.1 100.0% $5,804.4 100.0% $5,842.6 100.0%

Cost of goods sold and occupancy costs . . . 4,162.3 73.7% 4,351.2 75.0% 4,479.1 76.7%

Gross profit . . . . . . . . . . . . . . . . . . . . . . 1,487.8 26.3% 1,453.2 25.0% 1,363.5 23.3%

Store and warehouse operating and

selling expenses . . . . . . . . . . . . . . . . . . . . . 1,173.8 20.8% 1,033.5 17.8% 1,055.2 18.0%

Segment operating profit . . . . . . . . . . . . . . . . $314.0 5.5% $ 419.7 7.2% $ 308.3 5.3%