Office Depot 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

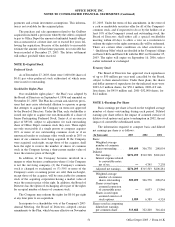

NOTE A—Summary of Significant Accounting Policies

Nature of Business: Office Depot, Inc. and subsidiaries

(the “ Company”) is a global supplier of office products and

services, with sales in 21 countries outside the United States

and Canada under the Office Depot威,Viking Office Products威,

Viking Direct威, 4Sure.com威, Guilbert威, and NiceDay娃brand

names. Products and services are offered through wholly

owned retail stores, contract business-to-business sales rela-

tionships, commercial catalogs and multiple web sites provid-

ing a wide range of office products, computers and technical

support functions.

Basis of Presentation: The consolidated financial state-

ments of Office Depot, Inc. and its subsidiaries have been

prepared in accordance with accounting principles generally

accepted in the United States of America. All intercompany

transactions have been eliminated in consolidation. Non-

controlling investments in joint ventures selling office products

and services in Mexico and Israel are accounted for using the

equity method. The Company’s share of joint ventures’opera-

tions is included in the Consolidated Statements of Earnings

in miscellaneous income (expense), net.

Certain prior year amounts have been reclassified to con-

form to current year presentation.

Fiscal Periods: Fiscal years are based on a 52- or 53-week

period ending on the last Saturday in December. All periods

presented consist of 52 weeks.

Estimates and Assumptions: Preparation of these financial

statements in conformity with accounting principles generally

accepted in the United States of America requires manage-

ment to make estimates and assumptions that affect amounts

reported in the financial statements and related notes. Actual

results may differ from those estimates.

Foreign Currency: Assets and liabilities of international

operations are translated into U.S. dollars using the exchange

rate at the balance sheet date. Revenues and expenses are

translated at average monthly exchange rates. Translation

adjustments resulting from this process are recorded in stock-

holders’ equity as a component of other comprehensive

income (loss).

Monetary assets and liabilities denominated in a currency

other than a consolidated entity’s functional currency result in

transaction gains or losses from the remeasurement at spot

rates at the end of the period. Foreign currency gains and

losses that relate to non-operational accounts, such as cash

and investments, are recorded in other income (expense), net

in the Consolidated Statements of Earnings. During 2003,

approximately $11.8 million was recognized as a foreign cur-

rency gain resulting from holding euro investments in a dollar

functional currency subsidiary in advance of the acquisition of

Guilbert. Foreign currency gains and losses on operational

accounts, such as receivables and payables, are included as a

component of operating expenses, though historically these

amounts have been immaterial.

Cash Equivalents: Highly liquid securities with maturities

of three months or less from the date of acquisition are classi-

fied as cash equivalents.

Short-term Investments: In October 2003, the Company

invested $100 million in a mutual fund that primarily invests

in U.S. Government agency obligations. This investment is

recorded as available for sale, and accordingly, changes in fair

value are recognized as a component of other comprehensive

income. Interest earned on these funds is used to purchase

additional units. At December 27, 2003 the historical cost and

fair value of this investment was $100.2 million.

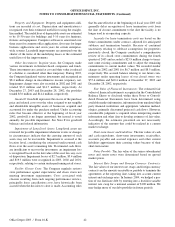

Receivables: Trade receivables, net, totaled $797.7 million

and $482.5 million at December 27, 2003 and December 28,

2002, respectively. An allowance for doubtful accounts has

been recorded to reduce receivables to an amount expected to

be collectible from customers. The allowance recorded at

December 27, 2003 and December 28, 2002 was approximately

$34.2 million and $29.1 million, respectively. Receivables

generated through a private label credit card program are

transferred to financial services companies, a portion of which

have recourse to Office Depot.

The Company’s exposure to credit risk associated with

trade receivables is limited by having a large customer base that

extends across many different industries and geographic regions.

However, the Company’s receivables may be adversely affected

by an economic slowdown in the U.S. or internationally.

Other receivables, totaling $314.7 million and $289.1

million as of December 27, 2003 and December 28, 2002,

respectively, consist primarily of amounts due from vendors

under purchase rebate, cooperative advertising and various

other marketing programs.

Merchandise Inventories: Inventories are stated at the

lower of cost or market value. The weighted average method

is used to determine the cost of a majority of our inventory and

the first-in-first-out method is used for international operations.

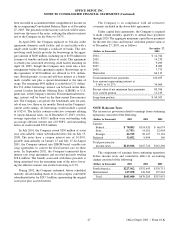

Income Taxes: Income tax expense is recognized at appli-

cable U.S. or international tax rates. Certain revenue and

expense items may be recognized in one period for financial

statement purposes and in a different period’s income tax

return. The tax effects of such differences are reported as

deferred income taxes.

Essentially all earnings of foreign subsidiaries are

expected to be reinvested in overseas expansion. Accordingly,

no provision has been made for incremental U.S. taxes on

undistributed earnings considered permanently invested.

Cumulative undistributed earnings of our foreign subsidiaries

for which no Federal income taxes have been provided was

$1,046.2 million and $778.7 million as of December 27, 2003

and December 28, 2002, respectively.

41 Office Depot 2003 / Form 10-K