Office Depot 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other factors, our ability to use the Internet and electronic

commerce to substantially increase sales in international loca-

tions may not progress at the same rate as in North America.

Integration of Guilbert in Europe: In June 2003, we com-

pleted the acquisition of Guilbert, S.A., a leading contract sta-

tioner in Europe and formerly a wholly owned subsidiary of

the PPR Group in France. In addition to the risks associated

with making a large investment (nearly $1 billion in U.S.

dollars at year-end exchange rates), we also face a formidable

challenge in the integration of the Guilbert organization into

our European Office Depot and Viking businesses. We

appointed new country managers in nearly every country in

which we operate in Europe. Some of these managers came

from the Guilbert organization and some from the Office

Depot/Viking organization. Failures of any of these managers

to adapt to new cultures and the challenges in most cases of

managing substantially larger businesses in their respective

countries could have a material impact on our results of opera-

tions in Europe. In addition to the merger of somewhat different

cultures, we also face the challenges of physically integrating

facilities from both the former Guilbert side of the business

and the former Office Depot/Viking side of the business. In

many cases, we have duplicate distribution facilities in close

proximity to one another. We must choose wisely which facil-

ities to consolidate, or which ones to emphasize for future

growth and expansion. To the extent that we close or consoli-

date facilities, we are likely to face high social costs associated

with such moves, and the possibility of work stoppages in the

form of strikes in some locales in Europe. Any or all of these

integration issues could have a material impact on our future

financial performance and results of operations.

Global Sourcing of Products/Private Label: In recent

years, we have substantially increased the number and types

of products which we sell under our own Office Depot威,

Viking娃, Guilbert威,NiceDay娃and other private label brands.

We expect this trend to continue and even accelerate in the

future. We source many of these products from outside the

United States, particularly in the Far East. While these prod-

ucts have attractive margins and may enhance our brand

image, the increased reliance on foreign sourced products

introduces its own set of risks and uncertainties. Sources of

supply may prove to be unreliable, or the quality of the glob-

ally sourced products may vary from our expectations.

Economic and civil unrest in areas of the world where we

source such products could adversely impact the availability or

cost of such products, or both. Moreover, this increased

reliance on globally sourced products also subjects our

Company to other risks, such as the protracted dockworkers

strike on the U.S. West Coast that adversely impacted imported

products for a substantial period of time in 2002. Moreover,

while we seek indemnities from the manufacturers of these

products, the uncertainty of realizing on any such indemnity

and the lack of understanding of U.S. product liability laws in

certain parts of the Far East make it more likely that we may

have to respond to claims or complaints from our customers as

if we were the manufacturer of the products. For this reason, we

have incurred the expense of purchasing separate product liabil-

ity insurance for sourced products. The availability and

expense of such insurance, while satisfactory to date, may

change in the future, making our procurement of foreign

sourced products materially less attractive than is the case

today. In addition, while the initial margins on such products

is generally more attractive than we can achieve by sourcing

from traditional sources of supply, other factors, such as the

lack of program dollars, including cooperative advertising

contributions, may make such sourcing less attractive in the

future. Any of these circumstances could have a material

adverse effect on our financial performance in the future.

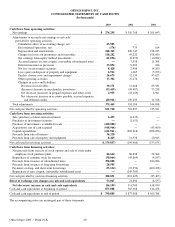

Sources and Uses of Cash: We believe that our current

level of cash and cash equivalents, future operating cash

flows, lease financing arrangements and funds available under

our credit facilities and term loans should be sufficient to fund

our planned expansion, integration and other operating cash

needs for at least the next year. However, there can be no

assurance that additional sources of financing will not be

required during the next twelve months as a result of unantic-

ipated cash demands, opportunities for expansion, acquisition

or investment, changes in growth strategy, changes in our

warehouse integration plans or adverse operating results. We

could attempt to meet our financial needs through the capital

markets in the form of either equity or debt financing.

Alternative financing will be considered if market conditions

make it financially attractive. There can be no assurance that

any additional funds required by us, whether within the next

twelve months or thereafter, will be available to us on satis-

factory terms. Our inability to access needed financial

resources could have a material adverse effect on our financial

position or operating results.

M&A Activity: In 2003, we made a major investment in the

growth of our business in Europe through the acquisition of

Guilbert, S.A. from the PPR Group, at a cost of almost $1 bil-

lion (U.S. dollars at year-end exchange rates). This followed

by five years our previous major acquisition of Viking in

1998. Other than these two acquisitions, we have otherwise

limited our merger and acquisition activity to relatively small

acquisitions. However, as we seek ways to more aggressively

expand and grow our business, it appears more likely that we

will increase our interest in M&A activity, both domestically

and internationally. While the opportunities from such activity

cannot be ignored, neither can the clear reality that many

acquisitions do not measure up to the expectations of the

acquiring company, for a host of reasons. M&A activity may

divert attention of our executive management team away from

our existing core businesses. We may do a less than optimal

job of due diligence or evaluation of target companies, and, as

always, the task of integrating two substantial businesses can

prove daunting. Failure to grow our businesses through M&A

activity, or failure to execute M&A activity in a satisfactory

manner, as well as adding substantial leverage to our balance

sheet in order to accomplish major acquisitions, could have a

significant and material adverse effect on our future business

prospects and/or our financial performance in the future.

Effects of Certain Charges: From time to time in the past,

we have recorded charges and credits to adjust past estimates,

such as facility closure costs, to reflect current conditions.

Office Depot 2003 / Form 10-K 30