Office Depot 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

additional borrowing. Similarly, 2002 reflects the impact of a

full year of interest on the $250 million of senior subordinated

notes issued in July 2001 and which mature in 2008. The

effective interest rate on the $400 million notes has been

reduced by the amortization of proceeds from an interest rate

lock of $16.6 million. Additionally, the effective interest rate

on the $250 million notes has been reduced by the amortiza-

tion of $18.8 million from the September 2002 termination of

an interest rate swap agreement. The proceeds received from

both the interest rate lock and the interest rate swaps are being

amortized to interest expense over the remaining term of the

respective notes.

When a facility is closed before the end of an operating

lease commitment, we record a liability at the present value of

the lease obligation, offset by anticipated sublease income.

For facilities closed prior to 2003, the imputed interest cost on

the discounted obligations is recognized as interest expense

each period. The recorded obligations primarily relate to the

store closures following the 2000 business review and total

$57.6 million at December 27, 2003 and $60.4 million at

December 28, 2002.

Our net miscellaneous income (expense) consists of equity

in the earnings of our joint venture investments, royalty and

franchise income that we generate from licensing and fran-

chise agreements, and realized gains and impairments of other

investments. All of our equity investments involve operations

outside of the United States and Canada. In 2003, we sold or

abandoned a majority of our interest in certain Internet com-

panies, resulting in a fourth quarter charge of $8.4 million. In

2002 and 2001, we recorded charges of $3.0 million and

$14.7 million, respectively, related to the impairment of these

investments. In 2003, this category also includes recognition

of approximately $11.8 million of net foreign currency gains,

primarily resulting from holding euro investments in anticipa-

tion of purchasing Guilbert in June 2003.

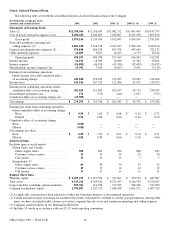

Income Taxes

(Dollars in thousands) 2003 2002 2001

Income Taxes . . . . . . . . $143,016 $167,722 $112,296

Effective income

tax rate* . . . . . . . . . . 32% 35% 36%

*Income Taxes as a percentage of earnings from continuing

operations before income taxes.

The effective income tax rate has decreased over the three

years presented, reflecting an increased proportion of interna-

tional activity, which may be taxed at lower rates and, in 2003,

realization of certain state tax credits. The effective tax rate in

future periods can be affected by variability in our mix of

income and tax rates in the various jurisdictions and therefore

may be higher or lower than it has been over the past three

years. The effective tax rate is expected to be somewhat lower

at the beginning of 2004 and will be monitored and adjusted

throughout the year for the actual mix of income.

Liquidity and Capital Resources

Cash provided by (used in) our operating, investing and

financing activities is summarized as follows:

(Dollars in thousands) 2003 2002 2001

Operating activities. . . $651,740 $ 701,897 $ 745,941

Investing activities . . . (1,179,837) (199,466) (233,071)

Financing activities. . . 388,851 (212,625) (85,403)

Operating and Investing Activities

We have consistently satisfied operating liquidity needs

and planned capital expenditure programs through our normal

conversion of sales to cash. Over the three years ended in

2003, we generated over $2 billion of cash flows from operat-

ing activities. From time to time, we use our revolving credit

facility for normal operating needs, primarily near the time of a

significant non-operating cash outlay. We have also accessed

the capital markets to supplement our cash position following

acquisitions and for refinancings.

Our major sources of cash from operations include: store

sales, a majority of which are generated on a cash and carry

basis, our private label credit card program, which is adminis-

tered by a third party financial services company and converted

to cash daily, and collection of our receivables. We generate

receivables from our contract and certain direct mail customers,

and as we expand this business here and abroad, we anticipate

our accounts receivable portfolio will grow. Additionally,

amounts due us under rebate and cooperative advertising

programs with our vendors comprised over 25% of total

receivables at the end of 2003 and 35% at the end of 2002.

These receivables tend to fluctuate seasonally (growing during

the second half of the year and declining during the first half),

because certain collections do not occur until specified mile-

stones are reached or the program year is complete. These

receivables, however, are typically high quality and are col-

lected quickly after reaching specified milestones. Our primary

outflow of cash from operations is the purchase of inventory,

net of customary credit arrangements with vendors, operational

costs, and the payment of current taxes.

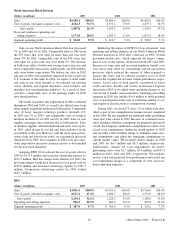

Cash flows provided by operating activities in 2003 reflect

lower net income as compared to 2002 and changes in working

capital, more than offset by increases in non-cash charges and

depreciation. Changes in working capital reflect an increase in

inventories coupled with a decrease in accrued liabilities. The

decrease in current liabilities reflects payments on closed store

liabilities, accrued employee compensation, and settlement of

accrued expenses, as well as the timing of year-end purchases

and vendor payments. The increase in inventories reflects

lower than expected sales in our North American Retail

Division during the fourth quarter, and an intentional build up

of certain products to support the holiday season and, our new

retail merchandising initiatives. We do not believe that the

additional inventories add to our product life cycle or obsoles-

cence risk. The non-cash operating items primarily include an

Office Depot 2003 / Form 10-K 22