Office Depot 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.are collected within the three months immediately following

year-end.

We also have arrangements with our vendors where we are

reimbursed for a portion of the costs of advertising a vendor’s

product. Prior to 2003, these arrangements reduced advertis-

ing expense for the period. Effective at the beginning of 2003,

such cooperative arrangements are treated in the same manner

as vendor rebates and reduce the costs of our inventory.

Advertising is a component of store and warehouse operating

and selling expenses. See Note C of the Notes to Consolidated

Financial Statements for information regarding the impact of

adopting EITF 02-16.

While agreements reached with vendors generally cover

at least one year, vendor program and cooperative advertising

arrangements can change between years. These arrangements

can be influenced by increases or reductions in inventory pur-

chases compared to company plans and programs offered by

the vendors. While there are long-standing volume and pric-

ing conventions in the office products business, such program

arrangements are regularly renegotiated, and as such, are

subject to change. If these vendor program arrangements were

materially less beneficial, we could either increase the selling

price of the vendor’s product, which may impact sales

volume, or experience a decline in profitability.

Inventory valuation—Our selling model is predicated on

the breadth and availability of our product assortment, and our

profitability is dependent on high inventory turnover rates.

Our merchants monitor inventory on hand by location, partic-

ularly as it relates to trailing and projected sales trends. Once

a product has been flagged for discontinuance, we record a

charge to reduce the product cost to our assessment of the

lower of cost or market. This assessment is based on the quality

of the merchandise, the rate of sale, and our assessment of the

market conditions. Additional cost adjustments and sales

markdowns will be taken as considered appropriate until the

product is sold or otherwise disposed. Estimates and judg-

ments are required in determining what items to stock and at

what level, and what items to discontinue and how to value

them prior to sale.

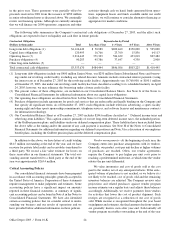

Goodwill testing—Under accounting rules that became

effective at the beginning of fiscal 2002, goodwill is no longer

amortized but is tested at least annually for impairment.

Our testing consists of comparing the estimated fair values

of each of our reporting units to their carrying amounts,

including recorded goodwill. We estimate the fair values of

each of our reporting units by discounting their projected cash

flows. Our projections are based on the budget for the succeed-

ing year and multi-year forecasts. Developing these future cash

flow projections requires us to make significant assumptions

and estimates regarding sales, gross margin and operating

expenses of our reporting units, as well as assumed economic

conditions. Since adoption of these accounting rules, our fair

value determination has exceeded reporting unit carrying val-

ues in all cases. Should future results or economic events

cause a change in our projected cash flows, or should our

operating plans or business model change, future determinations

of fair value may not support the carrying amount of one or

more of our reporting units, and the related goodwill would

need to be written down to an amount considered recoverable.

Any such write down would be included in operating expenses

of the business unit.

Closed store reserves and asset impairments—The

Company assesses the performance of each retail store against

historic patterns and projects future profitability on a regular

basis. These assessments are based on management’s estimates

for sales growth, gross margin attainments, and cash flow

generation. If as a result of these evaluations management

determines that a store will not achieve certain targets, the

decision may be made to close the store. At the end of

2000, for example, the Company decided to close 70 under-

performing stores following a comprehensive business review

and has closed additional stores in the following years. When

the decision is made to close a store, and the store is no longer

used for operating purposes, we recognize a liability for

remaining costs related to the property, reduced by an estimate

of any sublease income. The calculation of this liability requires

us to make assumptions and to apply judgment regarding the

remaining term on the lease (including vacancy period), antic-

ipated sublease income, and costs associated with vacating the

premises. With assistance from independent third parties, we

review these judgments and estimates and adjust the liability

accordingly. In 2003, as a result of a detailed portfolio review

and changes in commercial real estate markets where we have

lease commitments, we increased our liability for closed stores

by $23.9 million. A similar adjustment of $6.7 million was

made in 2002. Future fluctuations in the economy and the

market place demand for commercial properties can result in

material changes in the liability, which can result in a material

charge. Costs associated with facility closures are included in

store and warehouse operating expenses.

In addition to the decision whether or not to close a store,

store assets are regularly reviewed for recoverability of their

carrying amounts. The recoverability assessment requires

judgment and estimates of future store generated cash flows.

New stores may require two or more years to develop a cus-

tomer base necessary to achieve expected cash flows. If the

anticipated cash flows of a store cannot support the carrying

amount of the store’s assets, an impairment charge is recorded

to operations as a component of operating and selling

expenses. To the extent that management’s estimates of future

performance are not realized, future assessments could result

in material impairment charges.

Income taxes—Income tax accounting requires manage-

ment to make estimates and apply judgments to events that

will be recognized in one period under rules that apply to

financial reporting and in a different period in the Company’s

tax returns. In particular, judgment is required when estimating

the value of future tax deductions, tax credits, and net operating

loss carryforwards (NOLs), as represented by deferred tax

assets. Some tax credits and NOLs may expire before they can

be utilized and certain deductions by jurisdiction may not

meet the recognition standard. Accordingly, to the extent that

we believe the recovery of all or a portion of a deferred tax asset

25 Office Depot 2003 / Form 10-K