Office Depot 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sales in our BSG segment increased 1% in 2003 and 4%

in 2002. Sales in our contract channel increased in both 2003

and 2002. The increase in 2003 reflects growth in most

markets, with the large customer segment growing at faster

rates than the other customer segments. Contract sales in the

eastern U.S. have displayed a positive trend throughout

2003 and 2002 and in the western U.S. since mid-2002. The

catalog channel decreased in both 2003 and 2002. Domestic

e-commerce sales grew by 15% during the 2003 and 33% in

2002. We expect continued growth in our e-commerce sales

during 2004 as we allocate additional resources to that chan-

nel. Comparable sales of office supplies and machine supplies,

the largest category in BSG’s sales mix, increased 3% in both

2003 and 2002. Office furniture sales declined 3% in 2003

and 8% in 2002, while technology sales decreased 1% in 2003

following an increase of 5% in 2002.

Adopting EITF 02-16 reduced the cost of goods sold for

2003 by $63.7 million and increased advertising expense by

$60.0 million. Had this change been effective for 2002, the

pro forma impact would have decreased cost of goods sold by

$66.1 million and increased advertising expense by $66.6 mil-

lion. Cooperative advertising credits during 2001 totaled

$83.9 million.

Reflecting the impact of EITF 02-16 on all periods, gross

profit decreased in 2003 and 2002, reflecting the impact of

increased sales to larger accounts that tend to have lower

margin rates and the increasing proportion of 4Sure.com

sales, which operates primarily in the lower margin technology

business. During 2001, gross margin was higher following the

introduction of volume-dependent pricing arrangements. We

earn higher gross profit percentages in our BSG than in our retail

operations principally because of lower occupancy costs and a

sales mix that includes relatively fewer technology products.

Personnel, facility and delivery expenses are the largest

components of our BSG operating expenses. Reflecting the

impact of EITF 02-16 on all periods, operating and selling

expenses as a percentage of sales decreased in both 2003 and

2002 because of continued efforts to reduce costs and increase

productivity and efficiency. In 2003, we modified our delivery

model in certain markets, resulting in lower personnel costs

partially offset by increased third-party delivery costs follow-

ing our decision to outsource certain delivery functions in

some of our markets. In 2002, call center consolidation con-

tributed to lower personnel-related costs, and the introduction

of new technologies streamlined operations and reduced

delivery costs by 13%.

Office Depot 2003 / Form 10-K 20

International Division

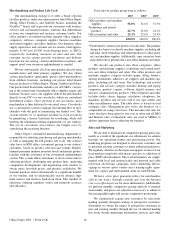

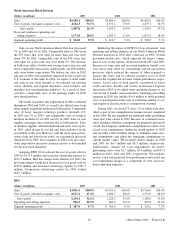

(Dollars in millions) 2003 2002 2001

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,746.5 100.0% $1,641.4 100.0% $1,480.1 100.0%

Cost of goods sold and occupancy costs . . . 1,652.7 60.2% 988.1 60.2% 888.4 60.0%

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . 1,093.8 39.8% 653.3 39.8% 591.7 40.0%

Operating and selling expenses . . . . . . . . . . . 723.1 26.3% 441.2 26.9% 379.5 25.7%

Segment operating profit . . . . . . . . . . . . . . . . $370.7 13.5% $ 212.1 12.9% $ 212.2 14.3%

Sales in our International Division grew 67% in 2003 and

11% in 2002. In local currencies, sales grew 52% in 2003 and

6% in 2002. Our purchase of Guilbert in June 2003 con-

tributed sales of $808.8 million. Excluding the impact of

exchange rates and the Guilbert acquisition, sales in both

2003 and 2002 reflect growth in most of our international

operations with the principal exceptions of Germany and

Japan, where local economic conditions were weak during

2002 and most of 2003.

In addition to our acquisition of Guilbert, during 2003 we

further expanded our existing European operations by starting

contract operations in Germany and launching our retail busi-

ness into Spain, where we opened six retail stores. In 2003,

we also opened three stores in France and a net of five stores

in Japan. In 2002, we added catalog operations in three coun-

tries; increased the size of our contract sales force in four

countries; initiated contract sales in Italy; added a net of seven

new stores in France; made several changes to our Japanese

operation and launched nine new web sites. We expect to con-

tinue to grow all sales channels in our European operations.

Adopting EITF 02-16 reduced the cost of goods sold for

2003 by $41.4 million and increased advertising expense by

$41.7 million. Had this change been effective for 2002, the

pro forma impact would have decreased cost of goods sold by

$24.3 million and increased advertising expense by $24.6 mil-

lion. Cooperative advertising credits during 2001 totaled

$20.9 million.

Reflecting the impact of EITF 02-16 on all periods, gross

profit as a percentage of sales decreased in both 2003 and

2002, reflecting a higher mix of lower margin contract sales,

growth in our existing contract business, and to a lesser

extent, the increased distribution of prospecting catalogs

(which feature lower priced products) in Europe to support

growth into new markets. In 2003, the decrease was partially

offset by better buying and increased purchasing discounts

following the Company’s recent Guilbert acquisition.

Operating and selling expenses as a percentage of sales

are higher in our International Division than in our other

segments primarily because we use an extensive marketing

program to drive sales in existing markets, particularly in our

catalog business where we use so-called prospecting catalogs

with lower-priced products intended to induce customers to

place first-time orders. We also had start-up activities in sev-

eral new markets. Similar to BSG, personnel and delivery

expenses are significant components of the International

Division’s operating and selling expenses. During 2003 and