Office Depot 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

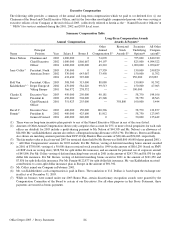

81 Office Depot 2003 / Proxy Statement

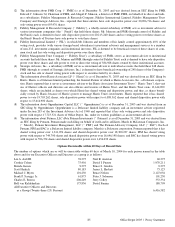

Audit & Other Fees

The aggregate fees billed by our independent accountants for professional services rendered in connection with (i) the audit of our

annual financial statements set forth in our Annual Report on Form 10-K for the fiscal years ended December 28, 2002 and

December 27, 2003, and (ii) the review of our quarterly financial statements set forth in our Quarterly Reports on Form 10-Q for

each of our fiscal quarters during 2002 and 2003, as well as fees paid to our audit firm for audit-related work, tax compliance, tax

planning and other consulting services are set forth below.

Audit & Other Fees Paid to Deloitte & Touche LLP 2002 2003

Audit Fees $1,641,000 $2,664,000

Audit Related Fees (as defined under the

Sarbanes-Oxley Act of 2002) **See footnote below 1,234,977

Tax Compliance Fees **See footnote below 685,932

Tax Planning Fees 1,973,000** 1,004,666

All Other Fees* 6,201,000 1,168,892

Total Fees $9,815,000 $6,758,467

Ratio of Audit Fees, Audit Related Fees and Tax

Compliance Fees To Total Fees paid to our Audit

Firm in the years indicated.** 17%—Audit fees 67.8%—Audit, Audit-Related and

Tax Compliance Fees

83%—All other fees** 32.2%—All other fees (including

tax planning fees)

*On April 15, 2003, our Audit Committee voted unanimously to discontinue the use of Deloitte & Touche LLP for any man-

agement consulting services, and to limit the services of our outside accountants to audit work, audit-related work, and tax

services, all of which must be preapproved by the Committee. The category “ all other fees”includes fees for consulting serv-

ices in 2003 paid for work instituted prior to this action by our Audit Committee. That consulting work included projects

focused on improving merchandising effectiveness and the efficiencies of our transportation and logistics operations.

** Prior to 2003, the Company did not maintain records sufficient to distinguish tax compliance and tax planning fees, so we

have included all fees paid in 2002 for tax-related services as if they were for ‘tax planning’services. Similarly, prior to 200 3,

the Company did not maintain records on ‘audit-related’fees.

Financial Information Systems Design and

Implementation Fees

We did not engage our independent accountants to provide

any professional services in connection with (i) operating or

supervising the operation of our information system or man-

aging our local area network; or (ii) designing or implement-

ing a hardware or software system that aggregates source data

underlying the financial statements or generates information

that is significant to the Company’s financial statements taken

as a whole.

All Other Fees

All audit work performed by Deloitte is approved in advance

by our Audit Committee, including the amount of fees due

and payable to them for such work. In addition, our Audit

Committee also approves all non-audit related work per-

formed by Deloitte in advance of the commencement of such

work. Our Audit Committee has delegated to the chairman of

the Committee the right to approve such non-audit related

assignments between meetings of the Committee, and the

Chairman then reports on all such approvals at the next meet-

ing of the Committee, which considers ratification of such

approvals by the Committee Chairman. In 2003, all fees paid

to Deloitte were approved by our Audit Committee in

advance of the performance of work by Deloitte, and no fees

were approved after the services were rendered by our

accounting firm.

The Audit Committee of our Board has determined that the

non-audit services rendered by our independent accountants

during our most recent fiscal year are compatible with main-

taining their independence.

Your Board of Directors Recommends a Vote FOR Item 3

on Your Proxy Card Ratification of Our Audit

Committee’s Appointment of Deloitte & Touche LLP as

our Independent Accountants