Nokia 2007 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2007 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8. Acquisitions (Continued)

and EUR 168 million, respectively. Goodwill has been allocated to the Multimedia segment and to the

Mobile Phone segment. The goodwill arising from these acquisitions is attributable to assembled

workforce and post acquisition synergies. None of the goodwill recognized in these transactions is

expected to be tax deductible.

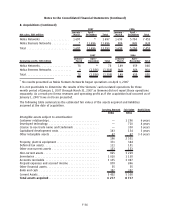

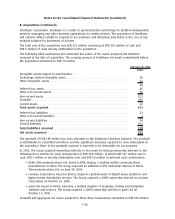

9. Depreciation and amortization

2007 2006 2005

EURm EURm EURm

Depreciation and amortization by function

Cost of sales ...................................................... 303 279 242

Research and development

(1)

........................................ 523 312 349

Selling and marketing

(1)

............................................ 232 99

Administrative and general .......................................... 148 111 99

Other operating expenses ........................................... —113

Total ............................................................ 1 206 712 712

(1)

In 2007, depreciation and amortization allocated to research and development and selling and

marketing included amortization of acquired intangible assets of EUR 136 million and EUR 214 mil

lion, respectively.

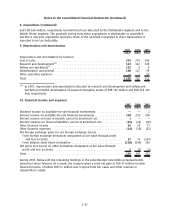

10. Financial income and expenses

2007 2006 2005

EURm EURm EURm

Dividend income on availableforsale financial investments ................. ——1

Interest income on availableforsale financial investments ................. 338 225 296

Interest income on loans receivable carried at amortised cost ............... 1——

Interest expense on financial liabilities carried at amortised cost ............. (43) (22) (18)

Other financial income .............................................. 43 55 77

Other financial expenses ............................................. (24) (18) (22)

Net foreign exchange gains (or net foreign exchange losses)

From foreign exchange derivatives designated at fair value through profit

and loss accounts ............................................... 37 75 (167)

From balance sheet items revaluation ................................ (118) (106) 156

Net gains (net losses) on other derivatives designated at fair value through

profit and loss accounts ............................................ 5(2) (1)

Total ............................................................. 239 207 322

During 2005, Nokia sold the remaining holdings in the subordinated convertible perpetual bonds

issued by France Telecom. As a result, the Group booked a total net gain of EUR 57 million in other

financial income, of which EUR 53 million was recycled from fair value and other reserves in

shareholders’ equity.

F37

Notes to the Consolidated Financial Statements (Continued)