Nokia 2007 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2007 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

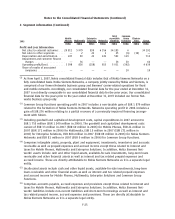

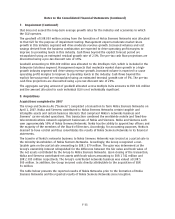

8. Acquisitions (Continued)

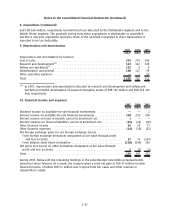

Carrying Amount Fair Value Useful lives

EURm EURm

Deferred tax liabilities ................................ 171 997

Longterm interestbearing liabilities .................... 34 34

Noncurrent liabilities................................. 205 1031

Shortterm borrowings ................................ 231 213

Accounts payable .................................... 1539 1491

Accrued expenses .................................... 1344 1502

Provisions .......................................... 463 397

Current liabilities .................................... 3577 3603

Total liabilities assumed ............................. 3 782 4 634

Minority interest.................................... 110 108

Net assets acquired ................................. 2 385 3 995

Cost of Acquisition ................................... 5500

Goodwill .......................................... 1 505

Less noncontrolling interest in goodwill ................. 753

Plus costs directly attributable to the acquisition ........... 51

Goodwill arising on formation of Nokia Siemens

Networks ........................................ 803

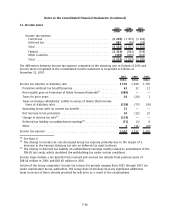

The goodwill of EUR 803 million has been allocated to the Nokia Siemens Networks segment. The

goodwill is attributable to assembled workforce and the synergies expected to arise subsequent to

the acquisition. None of the goodwill acquired is expected to be deductible for income tax purposes.

The amount of the loss specifically attributable to the business acquired from Siemens since the

acquisition date included in the Group’s profit for the period has not been disclosed as it is not

practicable to do so. This is due to the ongoing integration of the acquired Siemens’ carrierrelated

operations and Nokia’s networks business, and management’s focus on the operations and results of

the combined entity, Nokia Siemens Networks.

During 2007, the Group completed the acquisition of the following three companies. The purchase

consideration paid and goodwill arising from these acquisitions was not material to the Group.

• Enpocket Inc., based in Boston, USA, a global leader in mobile advertising providing technology

and services that allow brands to plan, create, execute, measure and optimise mobile

advertising campaigns around the world. The Group acquired 100% ownership interest in

Enpocket Inc. on October 5, 2007.

• Avvenu Inc., based in Palo Alto, USA, provides internet services that allow anyone to use their

mobile devices to securely access, use and share personal computer files. The Group acquired

100% ownership interest in Avvenu Inc. on December 5, 2007.

• Twango, provides a comprehensive media sharing solution for organising and sharing photos,

videos and other personal media. The Group acquired substantially all assets of Twango on

July 25, 2007.

Goodwill and aggregate net assets acquired in these transactions has been allocated to Common

Group Functions, Enterprise Solutions segment and Multimedia segment.

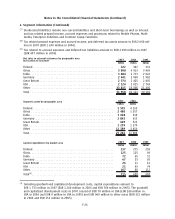

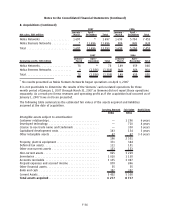

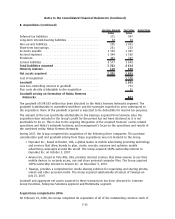

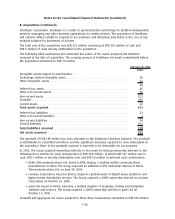

Acquisitions completed in 2006

On February 10, 2006, the Group completed its acquisition of all of the outstanding common stock of

F35

Notes to the Consolidated Financial Statements (Continued)