Nokia 2007 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2007 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

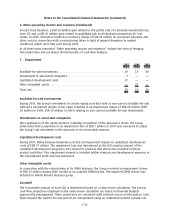

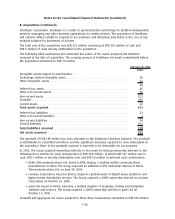

5. Pensions (Continued)

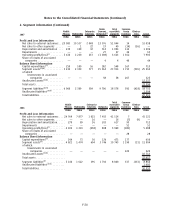

Movements in prepaid pension cost recognized in the balance sheet are as follows:

2007 2006

EURm EURm

Prepaid pension cost at beginning of year . .................................... 108 127

Net income (expense) recognized in the profit and loss account ................... (131) (112)

Contributions paid ........................................................ 163 91

Acquisitions ............................................................. (175) —

Foreign currency exchange rate change ....................................... (1) 2

Prepaid (accrued) pension cost at end of year

(1)

................................ (36) 108

(1)

included within prepaid expenses and accrued income/accrued expenses.

The prepaid pension cost above is made up of a prepayment of EUR 218 million (EUR 206 million in

2006) and an accrual of EUR 254 million (EUR 98 million in 2006).

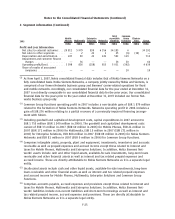

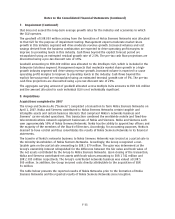

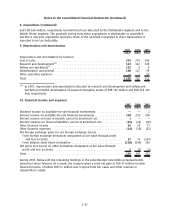

2007 2006 2005 2004 2003

EURm EURm EURm EURm EURm

Present value of defined benefit obligation ........... (2 266) (1 577) (1 385) (1 125) (1 009)

Plan assets at fair value........................... 2 174 1 409 1 276 1 071 887

Deficit ......................................... (92) (168) (109) (54) (122)

Experience adjustments arising on plan obligations amount to a loss of EUR 31 million in 2007

(EUR 25 million in 2006). Experience adjustments arising on plan assets amount to a loss of

EUR 3 million in 2007 (EUR 11 million in 2006).

The principal actuarial weighted average assumptions used were as follows:

Domestic Foreign Domestic Foreign

2007 2006

%%%%

Discount rate for determining present values ............... 5.50 5.40 4.60 4.78

Expected longterm rate of return on plan assets ............ 5.30 5.10 4.60 5.50

Annual rate of increase in future compensation levels ........ 3.00 3.30 3.50 3.59

Pension increases ..................................... 2.70 2.30 2.00 2.69

The expected longterm rate of return on plan assets is based on the expected return multiplied with

the respective percentage weight of the marketrelated value of plan assets. The expected return is

defined on a uniform basis, reflecting longterm historical returns, current market conditions and

strategic asset allocation.

F30

Notes to the Consolidated Financial Statements (Continued)