Nokia 2007 Annual Report Download - page 165

Download and view the complete annual report

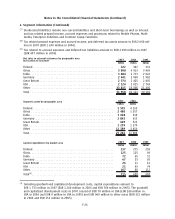

Please find page 165 of the 2007 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Accounting principles (Continued)

Sharebased compensation

The Group operates various types of equity settled sharebased compensation schemes for employees.

Fair value of stock options is based on certain assumptions, including, among others, expected

volatility and expected life of the options. Nonmarket vesting conditions attached to performance

shares are included in assumptions about the number of shares that the employee will ultimately

receive relating to projections of net sales and earnings per share. Significant differences in equity

market performance, employee option activity and the Group’s projected and actual net sales and

earnings per share performance, may materially affect future expense.

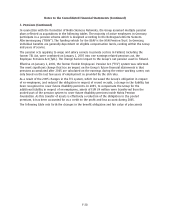

New accounting pronouncements under IFRS

The Group will adopt the following new and revised standards, amendments and interpretations to

existing standards issued by the IASB that are expected to be relevant to its operations:

IFRS 8, Operating Segments requires that segments are identified and reported based on how

management views and operates the business. Under IFRS 8, segments are components of an entity

regularly reviewed by an entity’s chief operating decisionmaker.

Amendment to IFRS 2, Sharebased payment, Group and Treasury Share Transactions, clarifies the

definition of different vesting conditions, treatment of all nonvesting conditions and provides further

guidance on the accounting treatment of cancellations by parties other than the entity.

IFRIC 13, Customer Loyalty Programs addresses the accounting surrounding customer loyalty programs

and whether some consideration should be allocated to free goods or services provided by a

company. Consideration should be allocated to award credits based on their fair value, as they are a

separately identifiable component.

Amendment to IAS 1, Presentation of financial statements, prompts entities to aggregate information

in the financial statements on the basis of shared characteristics. All nonowner changes in equity (i.e.

comprehensive income) should be presented either in one statement of comprehensive income or in

a separate income statement and statement of comprehensive income.

Amendment to IAS 23, Borrowing costs, changes the treatment of borrowing costs that are directly

attributable to an acquisition, construction or production of a qualifying asset. These costs will

consequently form part of the cost of that asset. Other borrowing costs are recognized as an expense.

Under the amended IAS 32 Financial Instruments: Presentation, the Group must classify puttable

financial instruments or instruments or components thereof that impose an obligation to deliver to

another party, a prorata share of net assets of the entity only on liquidation, as equity. Previously,

these instruments would have been classified as financial liabilities.

IFRS 3 (revised) Business Combinations replaces IFRS 3 (as issued in 2004). The main changes brought

by IFRS 3 (revised) include immediate recognition of all acquisitionrelated costs in profit or loss,

recognition of subsequent changes in the fair value of contingent consideration in accordance with

other IFRSs and measurement of goodwill arising from step acquisitions at the acquisition date.

Amendment to IAS 27 “Consolidated and Separate Financial Statements” clarifies presentation of

changes in parentsubsidiary ownership. Changes in a parent’s ownership interest in a subsidiary that

do not result in the loss of control are accounted for exclusively within equity. If a parent loses

control of a subsidiary it shall derecognize the consolidated assets and liabilities and any investment

retained in the former subsidiary shall be recognized at fair value at the date when control is lost.

Any differences resulting from this shall be recognized in profit or loss. When losses attributed to the

minority (noncontrolling) interests exceed the minority’s interests in the subsidiary’s equity, these

losses shall be allocated to the noncontrolling interests even if this results in a deficit balance.

F22

Notes to the Consolidated Financial Statements (Continued)