Nokia 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 20-F 2007

Nokia Form 20-F 2007

Table of contents

-

Page 1

Nokia Form 20-F 2007 Form 20-F 2007 -

Page 2

... on March 20, 2008. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20ÂF ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 Commission file number 1Â13202 Nokia Corporation (Exact name of... -

Page 3

... and Senior Management ...Compensation ...Board Practices ...Employees ...Share Ownership ...MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS ...Major Shareholders ...Related Party Transactions ...Interests of Experts and Counsel ...FINANCIAL INFORMATION ...Consolidated Statements and Other... -

Page 4

... and Listing Details ...Plan of Distribution ...Markets ...Selling Shareholders ...Dilution ...Expenses of the Issue ...ADDITIONAL INFORMATION ...Share Capital ...Memorandum and Articles of Association ...Material Contracts ...Exchange Controls ...Taxation ...Dividends and Paying Agents ...Statement... -

Page 5

... website at http://citibank.ar.wilink.com (enter "Nokia" in the Company Name Search). Holders may also request a hard copy of this annual report by calling the toll free number 1Â877ÂNOKIAÂADR (1Â877Â665Â4223), or by directing a written request to Citibank, N.A., Shareholder Services, PO Box... -

Page 6

... growth and profitability of the new market segments that we target and our ability to successfully develop or acquire and market products, services and solutions in those segments; our ability to successfully manage costs; the intensity of competition in the mobile communications industry and our... -

Page 7

... in emerging market countries where we do business; 20. our success in collaboration arrangements relating to development of technologies or new products, services and solutions; 21. the success, financial condition and performance of our collaboration partners, suppliers and customers; 22. exchange... -

Page 8

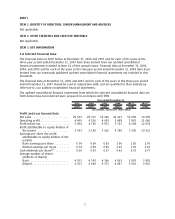

... consolidated financial data set forth below have been derived were prepared in accordance with IFRS. 2003 (EUR) Year ended December 31, 2004 2005 2006 2007(1) (EUR) (EUR) (EUR) (EUR) (in millions, except per share data) 2007(1) (USD) Profit and Loss Account Data Net sales ...Operating profit... -

Page 9

... basis. Nokia Siemens Networks, a company jointly owned by Nokia and Siemens, is comprised of our former Networks business group and Siemens' carrierÂrelated operations for fixed and mobile networks. Accordingly, our consolidated financial data for the year ended December 31, 2007 is not directly... -

Page 10

... shares in 2007. The amount authorized each year has been at or slightly under the maximum limit provided by the Finnish Companies Act. On January 24, 2008, we announced that the Board of Directors will propose for shareholders' approval at the Annual General Meeting convening on May 8, 2008 a new... -

Page 11

..., financial condition and share price from time to time. We need to have a competitive portfolio of products, services and solutions that are preferred by our current and potential customers to those of our competitors. If we fail to achieve or maintain a competitive portfolio, our business, market... -

Page 12

... of valueÂadding functionalities and services for all major consumer segments and price points designed, as appropriate, for the local requirements of different markets and supported by the Nokia brand, quality and competitive cost structure. In Nokia Siemens Networks' business, a competitive... -

Page 13

..., enterprise applications, navigation, music, video, TV, imaging, games and solutions and software for business mobility. With the increasing availability of high speed wireless Internet access and progressively more of our devices featuring advance multimediaÂtype capabilities, we see new business... -

Page 14

... a return on our investment as soon as we expect, or at all. We may also forego growth opportunities in new market segments of the mobile communications industry which we choose not to focus on or fail to timely identify. Moreover, the market segments that we target may be less profitable than... -

Page 15

... customers whose purchase preferences may differ from our current product portfolio. In addition to mergers, the consolidation among the industry participants may take place in form of various types of joint ventures, partnerships and other cooperation targeted to obtain potential economies of scale... -

Page 16

... market at the right time. We may also face difficulties accessing the technologies preferred by our current and potential customers, or at prices acceptable to them. Our products, services and solutions include increasingly complex technology involving numerous new Nokia and Nokia Siemens Networks... -

Page 17

... rights infringement created by suppliers of components and various layers in our products, services and solutions or by companies with which we work in cooperative research and development activities. Similarly, we and our customers may face claims of infringement in connection with our customers... -

Page 18

... Nokia Siemens Networks which could reduce or delay the realization of anticipated net sales, cost savings and operational benefits. On April 1, 2007, our Networks business group was combined with the carrierÂrelated operations for fixed and mobile networks of Siemens to form Nokia Siemens Networks... -

Page 19

... these businesses into one company has required and will continue to require significant managerial and financial resources and may divert management's attention from other business activities. The failure to successfully integrate Nokia Siemens Networks within the expected time frame could... -

Page 20

...which could be a number of years, or the consequences of the actual or alleged violations of law on the business of Nokia Siemens Networks, including its relationships with customers. Any actual or even alleged defects or other quality issues in our products, services and solutions could materially... -

Page 21

...and the value of the Nokia brand. Our sales and results of operations could be materially adversely affected if we fail to efficiently manage our manufacturing and logistics without interruption, or fail to ensure that our products, services and solutions meet our and our customers' quality, safety... -

Page 22

... affect our sales and results of operations or our reputation and brand value. See "Item 4.B Business Overview-Mobile Devices-Production" and "Nokia Siemens Networks-Production" for a more detailed discussion of our production activities. Possible consolidation among our suppliers could potentially... -

Page 23

...report for more detailed information on geographic location of net sales to external customers, segment assets and capital expenditures. We are developing a number of our new products, services and solutions together with other companies. If any of these companies were to fail to perform as planned... -

Page 24

...-Certain Other Factors-United States Dollar," "Item 5.A Operating Results-Results of Operations-Exchange Rates" and Note 35 of our consolidated financial statements included in Item 18 of this annual report. Providing customer financing or extending payment terms to customers can be a competitive... -

Page 25

... is subject to direct and indirect regulation in each of the countries in which we, the companies with which we work or our customers do business. As a result, changes in various types of regulations and trade policies applicable to current or new technologies, products or services could affect our... -

Page 26

...the end of 2007, we employed 112 262 people; had production facilities for mobile devices and network infrastructure around the world; sales in more than 150 countries; and a global network of sales, customer service and other operational units. History During our 141 year history, Nokia has evolved... -

Page 27

... groups-Mobile Phones, Multimedia, Enterprise Solutions and Networks-supported and serviced by two horizontal groups, Customer and Market Operations and Technology Platforms, in addition to various Corporate Functions. On April 1, 2007, Nokia's Networks business group was combined with Siemens... -

Page 28

... our offering of consumer Internet services and enterprise solutions and software; • Markets, responsible for the management of our supply chains, sales channels, brand and marketing activities; and • A Corporate Development Office, reported under Corporate Functions, which has been established... -

Page 29

..., listen to music, record video, watch TV, play games, surf the Internet, check eÂmail, navigate, manage their schedules, browse and create documents, and more. This trend-where mobile devices increasingly support the features of singleÂpurposed product categories such as music players, cameras... -

Page 30

... a PC and a mobile device. The Nokia Music Store went live in the United Kingdom in November 2007 and will go live in certain other markets during 2008. • Nokia Maps: offers search, routing, city guides and turnÂbyÂturn voiceÂguided navigation on a mobile device. • Nokia Internet communities... -

Page 31

...navigation and targeted advertising. • In December 2007, we acquired Avvenu, a company providing secure remote access and private sharing technology that allows users to access and view PC files remotely. Partnering In December 2007, we announced Nokia Comes With Music, a program that will enable... -

Page 32

... partners to support operators that use CDMA technology, with a particular focus on the United States. Nokia's own CDMA research, development and production ceased from April 2007. Highlights in 2007 included: • The announcement and shipments of the Nokia 2505, a sleek foldÂstyle CDMA phone... -

Page 33

... bringing new products and applications to market. Nokia Nseries multimedia computers offer consumers the ability to record video and still pictures, printÂquality images, watch TV, listen to music, access the web and eÂmail, use mapping services and make phone calls. In addition to supporting 3G... -

Page 34

...of wireless eÂmail, file synchronization and application synchronization features is designed to bring flexibility and costÂcontrol. • New device management features for Nokia Intellisync Mobile Suite were announced, including wider device support, remote control, improved theftÂloss protection... -

Page 35

... new Nokia for Business Channel Program came to market in January 2007 and more than 500 accredited partners joined during the year. In October 2007, we announced plans to expand the program to include operators and independent software vendors. Enterprise Solutions has four business units: Mobile... -

Page 36

... Solutions manages sales of its products and solutions to certain resellers or systems integrators who contribute value, such as consulting services or additional software, before distribution. Marketing The Business Week and Interbrand annual rating of 2007 Best Global Brands positioned Nokia... -

Page 37

... some price volatility from time to time. Management believes that our business relationships with our suppliers are stable, and they typically involve a high degree of cooperation in research and development, product design and manufacturing. See "Item 3.D Risk Factors-We depend on a limited number... -

Page 38

... for the open market. The revised chipset strategy is aimed at increasing the efficiency of our research and development efforts by allowing Nokia to leverage external innovation through working with the best partner in a specific chipset development area, and by freeing our own R&D resources to... -

Page 39

... Free Software Foundation to provide a freely distributable replacement for Unix. Research and Development Each of our mobile device business groups takes into account its own customer segment needs in its own productÂfocused research and development. The groups' products, services and solutions... -

Page 40

Our global network of relationships with universities and other industry research and development parties expands the scope of our longÂterm technology development. Highlights from 2007 included the establishment of a new Nokia Research Center site in Cambridge, UK, together with collaboration with... -

Page 41

... we fail to develop or otherwise acquire these complex technologies as required by the market, with full rights needed to use in our business, or to protect them, or to successfully commercialize such technologies as new advanced products, services and solutions that meet customer demand, or fail to... -

Page 42

... IP and multiÂaccess capabilities; fixed broadband access, transport, operations and billing support systems; and professional services such as managed services and consulting. Nokia Siemens Networks is also a vendor of mobile WiMAX solutions. In 2007, Nokia Siemens Networks started implementing... -

Page 43

... Nokia Siemens Networks has six business units: Radio Access; Converged Core; IP Transport; Opera tions and Business Software; Broadband Access; and Services. These are supported by Operations; Research, Technology & Platforms; and Customer and Market Operations. Radio Access develops GSM, EDGE... -

Page 44

... the customer management of the operator and ensures end users receive highÂquality services • Middleware provides a common software layer within the operator's network • Business Support Systems provides prepaid, charging and care solutions Broadband Access produces digital subscriber line... -

Page 45

...on both Nokia's devices business and Nokia Siemens Networks for the largest operator groups. Solution Sales Management and Marketing supports the sales process by managing bids and pricing for products and services, as well as positioning the Nokia Siemens Networks brand through marketing events and... -

Page 46

... our products, services and solutions successfully and on time." Technology-Nokia Siemens Networks Research, Technology & Platforms focuses on technology research, standardization teams, intellectual property rights, or IPR, R&D services and platform development. It supports all business units in... -

Page 47

... we fail to develop or otherwise acquire these complex technologies as required by the market, with full rights needed to use in our business, or to protect them, or to successfully commercialize such technologies as new advanced products, services and solutions that meet customer demand, or fail to... -

Page 48

... Nokia Siemens Networks Our business is subject to direct and indirect regulation in each of the countries in which we, the companies with which we work or our customers do business. As a result, changes in various types of regulations applicable to current or new technologies, products or services... -

Page 49

... speaking clock for customers with vision loss • Nokia Conversation, an application aimed at making it easier for customers who rely on text for communication to keep track of their messages Employees Values renewal at Nokia's devices business During 2007, we reviewed and refined our Nokia values... -

Page 50

... company. Information on the Nokia Code of Conduct is available in 19 languages, and we have also introduced a web training tool and online test for employees to confirm they understand the issues covered in the Nokia Code of Conduct. Nokia Siemens Networks' Code of Conduct In 2007, Nokia Siemens... -

Page 51

.... We held several focus groups bringing together managers, human resources experts and employee representatives. We also benchmarked our incentive systems against those offered by other companies. Compensation and benefits-Nokia Siemens Networks In 2007, Nokia Siemens Networks began the process of... -

Page 52

...time to community projects they care about through the Nokia Helping Hands employee volunteering program. In 2007, more than 5 900 employees in some 30 countries volunteered more than 32 000 hours of service. Nokia Siemens Networks During 2007, Nokia Siemens Networks defined the strategic direction... -

Page 53

... Electronic Equipment). The WEEE directive specifies that the costs of collecting and treating electronic waste in the EU are split among manufacturers according to their market share per product category in a given EU country. Energy saving in Nokia's device business Over the last nine years, we... -

Page 54

...appoint key officers and the majority of the members of its Board of Directors and, accordingly, Nokia consolidates Nokia Siemens Networks. 4.D Property, Plants and Equipment At December 31, 2007, Nokia operated 10 manufacturing facilities in nine countries for the production of mobile devices, and... -

Page 55

... Siemens Networks infrastructure equipment. Productive Capacity, Net (m2)(1) Country Location and Products BRAZIL CHINA FINLAND GERMANY HUNGARY INDIA MEXICO REPUBLIC OF KOREA UNITED KINGDOM (1) Manaus: mobile devices Beijing: mobile devices Dongguan: mobile devices Beijing: switching systems... -

Page 56

... Operating Profit by Business Group* 2007 Operating Profit/(Loss) Year Ended December 31, 2006 Net Operating Sales Profit/(Loss) (EUR millions) 2005 Operating Profit/(Loss) Net Sales Net Sales Mobile Phones ...25 083 Multimedia...10 538 Enterprise Solutions ...2 070 Nokia Siemens Networks ...13... -

Page 57

..., a company jointly owned by Nokia and Siemens, is comprised of our former Networks business group and Siemens' carrierÂrelated operations for fixed and mobile networks. Accordingly, the results of the Nokia Group and Nokia Siemens Networks for the year ended December 31, 2007 are not directly... -

Page 58

...emerging markets, particularly China, Middle East & Africa and emerging countries in AsiaÂPacific. Developed market device volumes were driven primarily by replacement sales. In those markets, replacement was driven primarily by device features such as color screens, cameras, music players, eÂmail... -

Page 59

...except North America and Latin America, where our market share declined. In Middle East & Africa, we had excellent market share gains in 2007. We continued to benefit in Middle East & Africa from our brand, broad product portfolio and extensive distribution system. Our significant market share gains... -

Page 60

on market share and pricing. The Business Week and Interbrand annual rating of 2007 Best Global Brands positioned Nokia as the fifth mostÂvalued brand in the world. At the end of 2007, we made over 1.5 million devices per day in our 10 main device manufacturing facilities globally. We also enjoy a ... -

Page 61

... expect to continue our investments in enterprise solutions and software. Our strategy in competing in this market is for our consumer Internet services to support our device ASPs, extend and enhance the Nokia brand, generate incremental net sales and profit streams, and create value and choice for... -

Page 62

... wireless and fixed network infrastructure, communications and networks service platforms, as well as professional services, to operators and service providers. At the end of 2007, Nokia Siemens Networks had approximately 58 500 employees, 1 400 customers in 150 countries, and systems serving in... -

Page 63

... that Nokia Siemens Networks will grow faster than the market in 2008. Nokia Siemens Networks net sales are also impacted by pricing developments. Like our mobile devices business, the products and solutions offered by Nokia Siemens Networks business are subject to price erosion over time, largely... -

Page 64

sales, software sales and services sales. Net sales are also impacted by regional mix-the mix of developed and emerging markets sales. There are several factors that drive the profitability at Nokia Siemens Networks. First, are the drivers of net sales as already discussed. Scale, operational ... -

Page 65

... systems, mobile navigation devices, InternetÂbased mapping applications, and government and business solutions. The NAVTEQ acquisition is still pending and subject to customary closing conditions, including regulatory approvals. For the year ended December 31, 2007, NAVTEQ reported revenues of USD... -

Page 66

...with the first quarter of the following year due to operators' planning, budgeting and spending cycle. Accounting developments The International Accounting Standards Board, or IASB, has and will continue to critically examine current International Financial Reporting Standards, or IFRS, with a view... -

Page 67

... sold through distribution channels is recognized when the reseller or distributor sells the product to the endÂuser. Mobile Phones, Multimedia and certain Enterprise Solutions and Nokia Siemens Networks service revenue is generally recognized on a straight line basis over the service period unless... -

Page 68

... warranty plans of varying periods, depending on local practices and regulations. While we engage in extensive product quality programs and processes, including actively monitoring and evaluating the quality of our component suppliers, our warranty obligations are affected by actual product failure... -

Page 69

..., terminal values, the number of years on which to base the cash flow projections, as well as the assumptions and estimates used to determine the cash inflows and outflows. Management determines discount rates to be used based on the risk inherent in the related activity's current business model and... -

Page 70

..., terminal values, the number of years on which to base the cash flow projections, as well as the assumptions and estimates used to determine the cash inflows and outflows. Management determines discount rates to be used based on the risk inherent in the related activity's current business model and... -

Page 71

... 5 to our consolidated financial statements and include, among others, the discount rate, expected longÂterm rate of return on plan assets and annual rate of increase in future compensation levels. A portion of our plan assets is invested in equity securities. The equity markets have experienced... -

Page 72

... groups to support new product introductions and the higher level of our net sales. Selling and marketing expenses represented 8.6% of our net sales in 2007, up from 8.1% in 2006. The increased selling and marketing expense was also impacted by the formation of Nokia Siemens Networks, which added... -

Page 73

... Solution and Group Common Functions in 2007 more than offset Nokia Siemens Network's operating loss. Our operating margin was 15.6% in 2007 compared with 13.3% in 2006. Results by Segments Mobile Phones The following table sets forth selective line items and the percentage of net sales that... -

Page 74

... in the products shipping in volumes. In 2007, Mobile Phones selling and marketing expenses increased by 4% to EUR 1 708 million as a result of increased sales and marketing spend to support launches of new products and costs related to further development of the distribution network, compared with... -

Page 75

...sales of our Multimedia products and effective cost control. Enterprise Solutions The following table sets forth selective line items and the percentage of net sales that they represent for the Enterprise Solutions business group for the fiscal years 2007 and 2006. Year Ended December 31, 2007 Year... -

Page 76

..., a company jointly owned by Nokia and Siemens, is comprised of our former Networks business group and Siemens' carrierÂrelated operations for fixed and mobile networks. Accordingly, the results of the Nokia Group and Nokia Siemens Networks for the year ended December 31, 2007 are not directly... -

Page 77

... purchase price accounting related items as well as pricing pressures, a greater proportion of sales from the emerging markets and a higher share of service sales. Group Common Functions Group Common Functions' operating profit totaled EUR 1 362 million in 2007 compared with Group Common Function... -

Page 78

... also negatively impacted by a decline in Networks' gross margin, which was primarily affected by pricing pressure and our efforts to gain market share, a greater proportion of sales from emerging markets and a higher share of service sales. Research and development, or R&D, expenses were EUR 3 897... -

Page 79

... to Nokia Siemens Networks. Our operating margin was 13.3% in 2006 compared with 13.6% in 2005. Results by Segments Mobile Phones The following table sets forth selective line items and the percentage of net sales that they represent for the Mobile Phones business group for the fiscal years 2006... -

Page 80

... coÂdevelopment partners, Nokia intends to selectively participate in key CDMA markets, with a special focus on North America, China and India. Accordingly, Nokia is ramping down its CDMA research, development and production, which will cease by April 2007. In 2006, Mobile Phones operating profit... -

Page 81

... growth was highest in China, North America, Europe, Latin America and AsiaÂPacific. Net sales declined in Middle East & Africa. The Nokia Eseries sold almost 2 million units since its introduction in the second quarter 2006. In Enterprise Solutions, gross profit increased by 12% to EUR 449 million... -

Page 82

... sales growth in Middle East & Africa, AsiaÂPacific, China and Latin America was partially offset by net sales decline in North America and Europe. Net sales growth for Networks was especially strong in the emerging markets, like India, where the market continued its robust growth and where Nokia... -

Page 83

...to Nokia Siemens Networks. The business group's operating margin for 2006 was 10.8% compared with 13.0% in 2005. The lower operating profit primarily reflected pricing pressure and our efforts to gain market share, a greater proportion of sales from the emerging markets and a higher share of service... -

Page 84

... of changes in exchange rates on net sales, average product cost as well as operating profit, we hedge all material transaction exposures on a gross basis. Our balance sheet is also affected by the translation into euro for financial reporting purposes of the shareholders' equity of our foreign... -

Page 85

... included production lines, test equipment and computer hardware used primarily in research and development, office and manufacturing facilities as well as services and software related intangible assets. Proceeds from maturities and sale of current availableÂforÂsale investments, liquid... -

Page 86

... customer financing as necessary to support our business and to engage in hedging transactions on commercially acceptable terms. We primarily invest in research and development, marketing and building the Nokia brand. However, over the past few years Nokia has increased its investment in services... -

Page 87

...consolidated financial statements included in Item 18 of this annual report for further information regarding commitments and contingencies. 5.C Research and Development, Patents and Licenses Success in the mobile communications industry requires continuous introduction of new products and solutions... -

Page 88

... of its net sales in 2007, down from 7.1% in 2006, reflecting continued efforts to gain efficiencies in our investments. See "Item 4.B Business Overview-Nokia Siemens Networks-Technology, Research and Development" and "-Nokia Siemens Networks-Patents and Licenses." 5.D Trends information See "Item... -

Page 89

... Companies Act and our articles of association, the control and management of Nokia is divided among the shareholders at a general meeting, the Board of Directors (or the "Board"), the President and the Group Executive Board chaired by the Chief Executive Officer. Board of Directors The current... -

Page 90

... Vice Chairman of the Boards of Directors of The Research Institute of the Finnish Economy ETLA and Finnish Business and Policy Forum EVA. Lalita D. Gupte, b. 1948 NonÂexecutive Chairman of the ICICI Venture Funds Manage ment Co Ltd. Board member since May 3, 2007. B.A. in Economics (University... -

Page 91

...President and CEO of Nokia Corporation. Board member since May 3, 2007. LL.M. (University of Helsinki). President and COO of Nokia Corporation 2005Â2006, Executive Vice President and General Manager of Nokia Mobile Phones 2004Â2005, Executive Vice President, CFO of Nokia 1999Â2003, Executive Vice... -

Page 92

... CEO of Nokia Corporation. Group Executive Board member since 1990, Chairman since 2006. With Nokia 1980Â1981, rejoined 1982. LL.M. (University of Helsinki). President and COO of Nokia Corporation 2005Â2006, Executive Vice President and General Manager of Nokia Mobile Phones 2004Â2005, Executive... -

Page 93

... President of Sales for Nokia Mobile Phones in Europe and Africa 1998Â2001. Various managerial positions within Nokia Mobile Phones, Nokia Consumer Electronics and Nokia Data 1985Â1998. Simon BeresfordÂWylie, b. 1958 Chief Executive Officer, Nokia Siemens Networks. Group Executive Board member... -

Page 94

...General Manager of Nokia Networks in Korea, 1999. Head of Radio Access Systems Research, Nokia Networks 1998Â1999, Principal Engineer, Nokia Research Center, 1997Â1998. A member of Young Global Leaders. Niklas Savander, b. 1962 Executive Vice President, Services & Software. Group Executive Board... -

Page 95

... Nokia Mobile Software, Strategy, Marketing & Sales 2001Â2002, Vice President and General Man ager of Nokia Networks, Mobile Internet Applications 2000Â2001, Vice President of Nokia Network Systems, Market ing 1997Â1998. Holder of executive and managerial positions at HewlettÂPackard Company... -

Page 96

... Executive Vice President and General Manager of Mobile Phones 2005Â2007. Senior Vice President, Business Line Man agement, Mobile Phones 2004Â2005, Senior Vice President, Mobile Phones Business Unit, Nokia Mobile Phones 2002Â2003, Vice President, TDMA/GSM 1900 Product Line, Nokia Mobile Phones... -

Page 97

...for 2007-Summary Compensation Table 2007". When preparing the Board of Directors' remuneration proposal, it is the policy of the Corporate Governance and Nomination Committee of the Board to review and compare the level of board remuneration paid in other global companies with net sales and business... -

Page 98

...May 3, 2007. For information with respect to the Nokia shares and equity awards held by the members of the Board of Directors, please see "Item 6.E Share Ownership" below. Change in Pension Value Fees NonÂEquity and Nonqualified Earned or Incentive Deferred Paid in Plan Compensation Stock All Other... -

Page 99

... Our executive compensation philosophy and programs have been developed to enable Nokia to effectively compete in an extremely complex and rapidly evolving mobile communications industry. We are a leading company in our industry and conduct business globally. Our executive compensation programs have... -

Page 100

... the Group Executive Board (excluding that of the President and CEO of Nokia and Simon BeresfordÂWylie, Chief Executive Officer of Nokia Siemens Networks) and other direct reports to the President and CEO, including longÂterm equity incentives and goals and objectives relevant to compensation. The... -

Page 101

... net sales, operating profit and operating cash flow); and (b) Individual Strategic Objectives (as described below) (c) Total Shareholder Return(1)(2) 0% Total shareholder return reflects the change in Nokia's share price during a respective time period added with the value of dividends per share... -

Page 102

...Âyear periods. In the case of the President and CEO, the annual incentive award is also partly based on his performance compared against (d) strategic leadership objectives, including entry into new markets and services and executive development. Instead of Nokia's shortÂterm cash incentive plan... -

Page 103

... Siemens Networks are generally forfeited if the executive leaves employment prior to the end of the plan period. Information on the actual equityÂbased incentives granted to the members of our Group Executive Board is included in "Item 6.E Share Ownership." Actual Executive Compensation for 2007... -

Page 104

...of Enterprise Solutions; and Mr. O eral Manager of Mobile Phones. Bonus payments are part of Nokia's shortÂterm cash incentives. The amount consists of the bonus awarded and paid or payable by Nokia for the respective fiscal year. Amounts shown represent shareÂbased compensation expense recognized... -

Page 105

... mobile phone. History has been provided for those data elements previously disclosed. None of the named executive officers participated in a formulated, nonÂdiscretionary incentive plan. Annual incentive payments are included under the "Bonus" column. Equity Grants in 2007(1) Option Awards Stock... -

Page 106

... Executive Board The members of the Group Executive Board participated in the local retirement programs applicable to employees in the country where they reside. Executives in Finland participate in the Finnish TyEL pension system, which provides for a retirement benefit based on years of service... -

Page 107

... plans. Both executives and employees participate in these plans. In 2004, we introduced performance shares as the main element to the company's broadÂbased equity compensation program to further emphasize the performance element in employees' longÂterm incentives. Thereafter, the number of stock... -

Page 108

... share grants to the other Group Executive Board members and other direct reports of the CEO are made by the Personnel Committee. Stock Options Nokia's global stock option plans in effect for 2007, including their terms and conditions, were approved by the Annual General Meetings in the year... -

Page 109

... the other Group Executive Board members and other direct reports of the CEO are made by the Personnel Committee. Other Equity Plans for Employees In addition to our global equity plans described above, we have equity plans for NokiaÂacquired businesses or employees in the United States and Canada... -

Page 110

... or dividend rights associated with these performance shares. Stock Options The stock options to be granted in 2008 are out of the Stock Option Plan 2007 approved by the Annual General Meeting in 2007. For more information on Stock Option Plan 2007 see "EquityÂBased Compensation Programs-Stock... -

Page 111

... our website, www.nokia.com. We also have a company Code of Conduct which is equally applicable to all of our employees, directors and management and is accessible on our website, www.nokia.com. As well, we have a Code of Ethics for the Principal Executive Officers and the Senior Financial Officers... -

Page 112

...of three members of the Board who meet all applicable independence, financial literacy and other requirements of Finnish law and the rules of the stock exchanges where Nokia shares are listed, including the Helsinki Stock Exchange and the New York Stock Exchange. Since May 3, 2007, the Committee has... -

Page 113

...that Nokia follows the requirements of Finnish law with respect to the approval of equity compensation plans. Under Finnish law, stock option plans require shareholder approval at the time of their launch. All other plans that include the delivery of company stock in the form of newlyÂissued shares... -

Page 114

..., divided according to their activity and geographical location as follows: 2007 2006 2005 Mobile Phones ...Multimedia ...Enterprise Solutions ...Nokia Siemens Networks(1) ...Customer and Market Operations ...Technology Platforms ...Common Group Functions ... 3 3 2 50 28 6 6 475 708 095 336 739... -

Page 115

...: 25% after one year and 6.25% each quarter thereafter. The intrinsic value of the stock options in the above table is based on the dif ference between the exercise price of the options and the closing market price of Nokia shares on the Helsinki Stock Exchange as at December 28, 2007 of EUR 26.52... -

Page 116

... following table sets forth the number of shares and ADSs in Nokia (not including stock options or other equity awards which are deemed as being beneficially owned under the applicable SEC rules) held by members of the Group Executive Board as at December 31, 2007. Shares ADSs OlliÂPekka Kallasvuo... -

Page 117

...31, 2007. These stock options were issued pursuant to Nokia Stock Option Plans 2001, 2003, 2005 and 2007. For a description of our stock option plans, please see Note 22 to our consolidated financial statements in Item 18 of this annual report. Exercise Price per Share (EUR) Total Intrinsic Value of... -

Page 118

...Siemens Networks instead of the longÂterm equityÂbased plans of Nokia. (2) (3) (4) Performance Shares and Restricted Shares The following table provides certain information relating to performance shares and restricted shares held by members of the Group Executive Board as at December 31, 2007... -

Page 119

... Group Executive Board, Total ...All outstanding Performance Shares and Restricted Shares (Global plans), Total ...(1) 772 560 2 835 637 63 049 281 1 087 500 28 840 500 13 554 558 45 254 618 1 066 777 076 5 915 929 156 890 437 The performance period for the 2004 plan was 2004Â2007, with... -

Page 120

...) in 2007, the maximum number of Nokia shares deliverable under the performance share plan 2005 equals three times the number of performance shares originally granted (at threshold). (3) The intrinsic value is based on the closing market price of a Nokia share on the Helsinki Stock Exchange as at... -

Page 121

... October 22, 2007 of EUR 25.88. Stock Ownership Guidelines for Executive Management One of the goals of our longÂterm equityÂbased incentive program is to focus executives on building value for shareholders. In addition to granting the stock options, performance shares and restricted shares, we... -

Page 122

... applicable. 8.A.5 Not applicable. 8.A.6 See Note 2 to our audited consolidated financial statements included in Item 18 of this annual report for the amount of our export sales. 8.A.7 Litigation Product related litigation Nokia and several other mobile device manufacturers, distributors and network... -

Page 123

... associated with the expiration of a product distribution agreement and the termination of a product service agreement. Those suits are currently before various courts in Turkey. Basari Elektronik claims that it is entitled to compensation for goodwill it generated on behalf of Nokia during the term... -

Page 124

..., Qualcomm filed a complaint against Nokia in the ITC seeking an order forbidding the importation of our GSM handsets into the United States. The ITC instituted an investigation in July 2006. The trial was held in September 2007. On December 12, 2007, the Administrative Law Judge issued an initial... -

Page 125

... contends applies to the manufacture and sale of certain specified GSM handsets. These cases are covered by the stand down. In March 2007, Nokia petitioned the Chinese patent office to invalidate the patents. The case will proceed. In March 2007, we filed separate complaints against Qualcomm in... -

Page 126

..., provided overly optimistic business projections, issued incomplete and misleading financial statements and were in possession of material adverse information that was not disclosed to the investing public. The cases were consolidated and dismissed. The dismissal is currently on appeal. On... -

Page 127

..., the reported high and low quoted prices for our shares on the Helsinki Stock Exchange and the high and low quoted prices for the shares, in the form of ADSs, on the New York Stock Exchange. Helsinki Stock Exchange Price per share High Low (EUR) New York Stock Exchange Price per ADS High Low (USD... -

Page 128

... the Stockholm Stock Exchange. The last day of trading of Nokia SDRs on the Stockholm Stock Exchange was June 1, 2007. 9.D Selling Shareholders Not applicable. 9.E Dilution Not applicable. 9.F Expenses of the Issue Not applicable. ITEM 10. ADDITIONAL INFORMATION 10.A Share Capital Not applicable. 10... -

Page 129

... rights, stock options, warrants or convertible bonds issued by the company if so requested by the holder. The purchase price of the shares under our articles of association is the higher of a) the weighted average trading price of the shares on the Helsinki Exchange during the ten business... -

Page 130

... the Finnish Companies Act of 2006, as amended, a shareholder whose holding exceeds nine tenths of the total number of shares or voting rights in Nokia has both the right and the obligation to purchase all the shares of the minority shareholders for the current market price. The market price is... -

Page 131

... to purchase shares of NAVTEQ common stock outstanding as September 28, 2007, the aggregate purchase price would be approximately USD 8.1 billion. The Merger Agreement includes customary representations, warranties and covenants. The Merger Agreement also contains certain termination rights for... -

Page 132

... met. Dividends that Nokia pays with respect to its shares and ADSs generally will be qualified dividend income if Nokia was not, in the year prior to the year in which the dividend was paid, and is not, in the year in which the dividend is paid, a passive foreign investment company. Nokia currently... -

Page 133

...birth or business ID (if applicable) and address in the country of residence. US and Finnish Tax on Sale or Other Disposition A US Holder generally will recognize taxable capital gain or loss on the sale or other disposition of ADSs in an amount equal to the difference between the US dollar value of... -

Page 134

... is effectively connected with the conduct of a trade or business in the United States or (b) in the case of an individual, that individual is present in the United States for 183 days or more in the taxable year of the disposition and other conditions are met. US Information Reporting and Backup... -

Page 135

..., or COSO, framework. Management has excluded the nonÂintegrated Siemens' carrierÂrelated operations from the assessment of internal control over financial reporting as at December 31, 2007 because those operations were acquired by Nokia in a purchase business combination during 2007. See Item 15... -

Page 136

... our consolidated financial statements for the year ended December 31, 2007, has issued an attestation report on the effectiveness of the company's internal control over financial reporting under Auditing Standard No. 5 of the Public Company Accounting Oversight Board (United States of America... -

Page 137

... and planning (advise on stock based remuneration, local employer tax laws, social security laws, employment laws and compensation programs, tax implications on shortÂterm international transfers). The tax fees for 2007 include EUR 2.1 million of accrued tax fees that were not billed until... -

Page 138

... OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS The following table sets out certain information concerning purchases of Nokia shares and ADRs by Nokia Corporation and its affiliates during 2007. (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs... -

Page 139

... FINANCIAL STATEMENTS Not applicable. ITEM 18. FINANCIAL STATEMENTS The following financial statements are filed as part of this annual report: Consolidated Financial Statements Report of Independent Registered Public Accounting Firm ...FÂ1 Consolidated Profit and Loss Accounts ...FÂ3 Consolidated... -

Page 140

... of switching centers, radio base stations and transmission equipment. Converged device: A generic category of mobile device that can run computerÂlike applications such as eÂmail, web browsing and enterprise software, and can also have builtÂin music players, video recorders, mobile TV and other... -

Page 141

... lines connected to the exchange to use the facilities typical for private branch exchanges or key telephone system extensions. IPR (Intellectual Property Rights): Laws protecting the economic exploitation of intellectual property, a generic term used to describe products of human intellect... -

Page 142

Java: An objectÂoriented programming language that is intended to be hardware and software independent. LTE (LongÂTerm Evolution): 3GPP radio technology evolution architecture. Maemo: An application development platform for Nokia Internet Tablet products. Mobile device: A generic term for all ... -

Page 143

VAR (Value Added Reseller): A reseller that adds something to a product, thus creating a complete customer solution which it then sells under its own name. VDSL (very high bit rate digital subscriber line): A form of digital subscriber line similar to asymmetric digital subscriber line (ADSL) but ... -

Page 144

... on the Company's internal control over financial reporting based on our audits (which were integrated audits in 2007 and 2006). We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform... -

Page 145

...(b), management has excluded the nonÂintegrated activities from the acquisition of Siemens AG's carrierÂrelated operations from its assessment of internal control over financial reporting as of December 31, 2007 because it was acquired by the Company in a purchase business combination during 2007... -

Page 146

... Corporation and Subsidiaries Consolidated Profit and Loss Accounts Notes Financial Year Ended December 31 2007 2006 2005 EURm EURm EURm Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses ...Administrative and general expenses ...Other... -

Page 147

... parent Share capital...Share issue premium ...Treasury shares, at cost ...Translation differences ...Fair value and other reserves ...Reserve for invested nonÂrestricted equity ...Retained earnings ... ... 21 20 Minority interests ...Total equity ...NonÂcurrent liabilities LongÂterm interest... -

Page 148

... Group companies, net of acquired cash ...Purchase of current availableÂforÂsale investments, liquid assets ...Purchase of nonÂcurrent availableÂforÂsale investments ...Purchase of shares in associated companies ...Additions to capitalized development costs ...LongÂterm loans made to customers... -

Page 149

... of: Bank and cash ...Current availableÂforÂsale investments, cash equivalents ...15,35 2 125 4 725 6 850 1 479 2 046 3 525 1 565 1 493 3 058 The figures in the consolidated cash flow statement cannot be directly traced from the balance sheet without additional information as a result of... -

Page 150

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity Fair Reserve for value and Share invested Before Number of Share issue Treasury Translation other nonÂrestricted Retained minority Minority shares (000's) capital premium shares differences reserves equity... -

Page 151

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity (Continued) Fair value Reserve for Share and invested Before Number of Share issue Treasury Translation other nonÂrestricted Retained minority Minority shares (000's) capital premium shares differences ... -

Page 152

...The consolidated financial statements of Nokia Corporation ("Nokia" or "the Group"), a Finnish public limited liability company with domicile in Helsinki, in the Republic of Finland, are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting... -

Page 153

... as a component of shareholders' equity in the consolidated balance sheet. Profits realized in connection with the sale of fixed assets between the Group and associated companies are eliminated in proportion to share ownership. Such profits are deducted from the Group's equity and fixed assets and... -

Page 154

...the rates of exchange prevailing at the yearÂend. Foreign exchange gains and losses arising from balance sheet items, as well as fair value changes in the related hedging instruments, are reported in Financial Income and Expenses. Foreign Group companies In the consolidated accounts all income and... -

Page 155

.... For defined benefit plans, pension costs are assessed using the projected unit credit method: The pension cost is recognized in the profit and loss account so as to spread the service cost over the service lives of employees. The pension obligation is measured as the present value of the estimated... -

Page 156

...and receivables, bank and cash and financial assets at fair value through profit or loss. 1 Â 3 years 3 Â 10 years AvailableÂforÂsale investments The Group classifies the following investments as available for sale based on the purpose for acquiring the investments as well as ongoing intentions... -

Page 157

...ÂforÂsale investments are recognized in fair value and other reserves as part of shareholders' equity, with the exception of interest calculated using effective interest method and foreign exchange gains and losses on monetary assets, which are recognized directly in profit and loss. Dividends on... -

Page 158

... profit and loss account. Fair values of cash settled equity derivatives are calculated by revaluing the contract at year end quoted market rates. Changes in fair value are recognized in the profit and loss account. Forward foreign exchange contracts are valued at the market forward exchange rates... -

Page 159

...foreign exchange contracts, or changes in the time value for options, or options strategies, are recognized within other operating income or expenses. Accumulated fair value changes from qualifying hedges are released from shareholders' equity into the profit and loss account as adjustments to sales... -

Page 160

... account as financial income and expenses. Accumulated fair value changes from qualifying hedges are released from shareholders' equity into the profit and loss account only if the legal entity in the given country is sold, liquidated, repays its share capital or is abandoned. Income taxes Current... -

Page 161

...of the number of performance shares that are expected to be settled. ShareÂbased compensation is recognized as an expense in the profit and loss account on straight line basis over the service period. A separate vesting period is defined for each quarterly lot of the stock options plans. When stock... -

Page 162

...the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) received net of any transaction costs are credited to share premium and the reserve for invested non restricted equity. Treasury shares The Group recognizes acquired treasury shares as a deduction from equity at... -

Page 163

Notes to the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) stage of a longÂterm project, new technology, changes in the project scope, changes in costs, changes in timing, changes in customers' plans, realization of penalties, and other corresponding factors. ... -

Page 164

...to the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) feasibility, have been met. Should a product fail to substantiate its estimated feasibility or life cycle, material development costs may be required to be writtenÂoff in future periods. Business combinations... -

Page 165

Notes to the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) ShareÂbased compensation The Group operates various types of equity settled shareÂbased compensation schemes for employees. Fair value of stock options is based on certain assumptions, including, among... -

Page 166

...: Mobile Phones; Multimedia; Enterprise Solutions; and Nokia Siemens Networks. Nokia's reportable segments represent the strategic business units that offer different products and services for which monthly financial information is provided to the Board. Mobile Phones currently offers mobile phones... -

Page 167

... Financial Statements (Continued) 2. Segment information (Continued) 2007 Mobile Phones EURm Nokia Total Common Siemens Enterprise reportable Group Elimina (1) Multimedia Solutions Networks segments Functions tions EURm EURm EURm EURm EURm EURm Group EURm Profit and Loss Information Net sales... -

Page 168

... the Consolidated Financial Statements (Continued) 2. Segment information (Continued) 2005 Mobile Phones EURm Total Common Enterprise reportable Group Elimina Multimedia Solutions Networks segments Functions tions EURm EURm EURm EURm EURm EURm Group EURm Profit and Loss Information Net sales... -

Page 169

...to the Consolidated Financial Statements (Continued) 2. Segment information (Continued) (7) Unallocated liabilities include nonÂcurrent liabilities and shortÂterm borrowings as well as interest and tax related prepaid income, accrued expenses and provisions related to Mobile Phones, Multi media... -

Page 170

...of multiÂemployer, insured and defined contribution plans were EUR 289 million in 2007 (EUR 198 million in 2006 and EUR 206 million in 2005). 2007 2006 2005 Average personnel Mobile Phones ...Multimedia ...Enterprise Solutions ...Nokia Siemens Networks ...Common Group Functions ... ... 3 3 2 50 40... -

Page 171

Notes to the Consolidated Financial Statements (Continued) 5. Pensions (Continued) In connection with the formation of Nokia Siemens Networks, the Group assumed multiple pension plans reflected as acquisitions in the following tables. The majority of active employees in Germany participate in a ... -

Page 172

... that are recognized in the Group's consolidated balance sheet at December 31: 2007 Domestic Foreign Plans Plans EURm EURm 2006 Domestic Foreign Plans Plans EURm EURm Present value of defined benefit obligations at beginning of year ...Foreign exchange ...Current service cost ...Interest cost... -

Page 173

... longÂterm rate of return on plan assets is based on the expected return multiplied with the respective percentage weight of the marketÂrelated value of plan assets. The expected return is defined on a uniform basis, reflecting longÂterm historical returns, current market conditions and strategic... -

Page 174

... CDMA business and associated asset writeÂdowns. Working together with coÂdevelopment partners, Nokia intends to selectively participate in key CDMA markets, with special focus on North America, China and India. Accordingly, Nokia is ramping down its CDMA research, development and production which... -

Page 175

... amount of the capitalized development programs costs related to products that will not be included in future product portfolios. This impairment amount is included within research and development expenses in the consolidated profit and loss statement. Other intangible assets In connection with the... -

Page 176

..., for accounting purposes, Nokia is deemed to have control and thus consolidates the results of Nokia Siemens Networks in its financial statements. The transfer of Nokia's networks business to Nokia Siemens Networks was treated as a partial sale to the minority shareholders of Nokia Siemens Networks... -

Page 177

Notes to the Consolidated Financial Statements (Continued) 8. Acquisitions (Continued) Net sales, EUR million January  March 2007 April  December Total January  March 2006 April  December Total Nokia Networks ...Nokia Siemens Networks ...Total ... 1 697 * 1 697 * 11 696 11 696 2007 April ... -

Page 178

... of the acquired Siemens' carrierÂrelated operations and Nokia's networks business, and management's focus on the operations and results of the combined entity, Nokia Siemens Networks. During 2007, the Group completed the acquisition of the following three companies. The purchase consideration paid... -

Page 179

... of digital music platforms and digital media distribution services. The Group acquired a 100% ownership interest in Loudeye Corporation on October 16, 2006. • gate5 AG, based in Berlin, Germany, a leading supplier of mapping, routing and navigation software and services. The Group acquired a 100... -

Page 180

...allocated to research and development and selling and marketing included amortization of acquired intangible assets of EUR 136 million and EUR 214 mil lion, respectively. 10. Financial income and expenses 2007 EURm 2006 EURm 2005 EURm Dividend income on availableÂforÂsale financial investments... -

Page 181

... statement is reconciled as follows at December 31, 2007: 2007 EURm 2006 EURm 2005 EURm Income tax expense at statutory rate ...Provisions without tax benefit/expense ...NonÂtaxable gain on formation of Nokia Siemens Networks(1) ...Taxes for prior years ...Taxes on foreign subsidiaries' profits... -

Page 182

...Consolidated Financial Statements (Continued) 12. Intangible assets 2007 EURm 2006 EURm Capitalized development costs Acquisition cost January 1 ...Additions during the period ...Acquisitions ...Impairment losses... 31 ...(1 439) Net book value January 1 ...Net book value December 31 ...251 378 FÂ39 -

Page 183

... the Consolidated Financial Statements (Continued) 12. Intangible assets (Continued) 2007 EURm 2006 EURm Goodwill Acquisition cost January 1 ...Translation differences...Acquisitions ...Other changes ...Accumulated acquisition cost December 31 ...Net book value January 1 ...Net book value December... -

Page 184

Notes to the Consolidated Financial Statements (Continued) 13. Property, plant and equipment (Continued) 2007 EURm 2006 EURm Buildings and constructions ... depreciation December 31 ...Net book value January 1 ...Net book value December 31 ...Machinery and equipment Acquisition cost January 1 ...... -

Page 185

...Consolidated Financial Statements (Continued) 13. Property, plant and equipment (Continued) 2007... book value January 1 ...Net book value December 31 ... 22 (1) 2 (3) 20 (7) - 1 (3) (9) 15 11 2007 ...Other intangible assets...Buildings and constructions ...Machinery and equipment ...Net carrying amount... -

Page 186

... amount EURm Fair value EURm LongÂterm loans receivable carried at amortised cost ... 10 10 19 19 The longÂterm loans receivable mainly consist of loans made to suppliers and to customers principally to support their financing of network infrastructure and services or working capital. Their... -

Page 187

Notes to the Consolidated Financial Statements (Continued) 16. LongÂterm loans receivable (Continued) approximates the carrying value. See Note 35 for longÂterm and shortÂterm portion and related maturities. 17. Inventories 2007 EURm 2006 EURm Raw materials, supplies and other ... 591 360 600 ... -

Page 188

...: Net fair value gains/(losses) ...61 Transfer to profit and loss account as adjustment to Net Sales ...(243) Transfer to profit and loss account as adjustment to Cost of Sales ...414 AvailableÂforÂsale Investments: Net fair value gains/(losses) ...Transfer to profit and loss account on impairment... -

Page 189

... sales or purchases are transferred from the Hedging Reserve to the profit and loss account when the forecasted foreign currency cash flows occur, at various dates up to approximately 1 year from the balance sheet date. 21. The shares of the Parent Company Nokia shares and shareholders Shares... -

Page 190

...on May 3, 2007, Nokia shareholders authorized the Board of Directors to issue a maximum of 800 000 000 new shares through one or more issues of shares or special rights entitling to shares, including stock options. The Board of Directors may issue either new shares or shares held by the Company. The... -

Page 191

... Statements (Continued) 22. ShareÂbased payment (Continued) performance share plans, stock option plans and restricted share plans. Both executives and employees participate in these programs. The equityÂbased incentive grants are generally forfeited, if the employment relationship with the Group... -

Page 192

... 000 2007 1Q 2007 2Q 2007 3Q 2007 4Q October 1, 2008 October 1, 2011 December 31, 2012 January 1, 2009 January 1, 2012 December 31, 2012 (1) (2) The stock options under the 2001 plan were listed on the Helsinki Stock Exchange. The Group's current global stock option plans have a vesting schedule... -

Page 193

... information see "Other equity plans for employees" below. The weighted average exercise price and the weighted average share price do not incorporate the effect of transferable stock option exercises by option holders not employed by the Group. (2) The weighted average grant date fair value... -

Page 194

... the Nokia newly issued shares or existing treasury shares. The Group may also settle the plans by using Nokia shares purchased on the open market or by using cash instead of shares. The performance shares represent a commitment by Nokia to deliver Nokia shares to employees at a future point in time... -

Page 195

... number of performance shares granted under other than global equity plans. For further information see "Other equity plans for employees" below. The fair value of performance shares is estimated based on the grant date market price of the Company's share less the present value of dividends expected... -

Page 196

... minor equity plans for Nokia acquired businesses or employees in the United States or Canada, which do not result in an increase in the share capital of Nokia. These plans are settled by using Nokia shares or ADSs acquired from the market. When these treasury shares are issued on exercise of stock... -

Page 197

... other reserves, fair value gains/losses and excess tax benefit on shareÂbased compensation ...(1) 133 (43) In 2007, other temporary differences included a deferred tax liability of EUR 563 million arising from purchase price allocation related to Nokia Siemens Networks. Deferred taxes include... -

Page 198

... not designated in hedge accounting relationships carried at fair value through profit and loss: Forward foreign exchange contracts ...Currency options bought ...Interest rate futures ...Interest rate swaps...Cash settled equity options bought(3) ...Cash settled equity options sold(3) ... 22 - 89... -

Page 199

... investment in foreign subsidiaries: Forward foreign exchange contracts ...Currency options bought ...Cash flow hedges: Forward foreign exchange contracts ...Derivatives not designated in hedge accounting relationships carried at fair value through profit and loss: Forward foreign exchange contracts... -

Page 200

... in Nokia Siemens Networks in 2007 totaled EUR 1 110 million including mainly personnel related expenses as well as expenses arising from the elimination of overlapping functions, and the realignment of the product portfolio and related replacement of discontinued products at customer sites. These... -

Page 201

...Group's own commitments include availableÂforÂsale investments of EUR 10 mil lion in 2007 (EUR 10 million of availableÂforÂsale investments in 2006). Other guarantees include guarantees of EUR 2 429 million in 2007 (EUR 259 million in 2006) provided to certain Nokia Siemens Networks' customers... -

Page 202

...Group's Finnish employee benefit plans. These assets do not include Nokia shares. The Group recorded net rental expense of EUR 0 million in 2007 (EUR 2 million in 2006 and EUR 2 million in 2005) pertaining to a saleÂleaseback transaction with the Nokia Pension Foundation involving certain buildings... -

Page 203

... Share of results of associated companies ...Dividend income ...Share of shareholders' equity of associated companies ...Sales to associated companies...Purchases from associated companies...Receivables from associated companies ...Liabilities to associated companies ...Management compensation... -

Page 204

... 60% of the gross annual fee is paid in cash and the remaining 40% in Nokia shares purchased from the market and included in the table under "Shares Received." This table includes fees paid for Mr. Ollila, Chairman, for his services as Chairman of the Board, only. The 2007 fee of Ms. Scardino... -

Page 205

... 356 shares in 2006 and 3 340 in 2005. Pension arrangements of certain Group Executive Board Members OlliÂPekka Kallasvuo can, as part of his service contract, retire at the age of 60 with full retirement benefit should he be employed by Nokia at the time. The full retirement benefit is calculated... -

Page 206

... systems, mobile navigation devices, InternetÂbased mapping applications, and government and business solutions. NAVTEQ also owns Traffic.com, a web and interactive service that provides traffic information and content to consumers. Completion of the acquisition is subject to customary closing... -

Page 207

... 50.0 50.0 50.0 47.9 Associated companies Symbian Limited (1) Nokia Siemens Networks B.V., the ultimate parent of the Nokia Siemens Networks group, is owned approximately 50% by each of Nokia and Siemens and consolidated by Nokia. Nokia effectively controls Nokia Siemens Networks as it has the... -

Page 208

... and New York/Sao Paolo, and a Corporate Treasury unit in Espoo. This international organization enables Nokia to provide the Group companies with financial services according to local needs and requirements. Treasury activities are governed by policies approved by the CEO. Treasury Policy provides... -

Page 209

... Consolidated Financial Statements (Continued) 35. Risk Management (Continued) of less than a year. The Group does not hedge forecasted foreign currency cash flows beyond two years. Since Nokia has subsidiaries outside the Euro zone, the euroÂdenominated value of the shareholders' equity of Nokia... -

Page 210

... to market price risk as the result of market price movement in the quoted equity instruments held mainly for strategic business reasons. Nokia has certain strategic minority investments in publicly quoted equity shares. The fair value of the equity investments which are subject to market price risk... -

Page 211

.... Table 1 Foreign exchange position ValueÂatÂRisk VaR from financial instruments(1) 2007 2006 EURm EURm At December 31 ...246 Average for the year ...96 Range for the year ...57Â246 (1) 77 92 67Â134 The increase in the VaR in yearÂoverÂyear comparison is mainly attributable to increased... -

Page 212

Notes to the Consolidated Financial Statements (Continued) 35. Risk Management (Continued) Equity price risk The VaR for the Group equity investment in publicly traded companies is presented in Table 3 below. Table 3 Equity investment ValueÂatÂRisk 2007 EURm 2006 EURm At December 31 ...0.8 ... -

Page 213

... the Consolidated Financial Statements (Continued) 35. Risk Management (Continued) while the top three credit exposures by country amounted to 8.7%, 6.9% and 6.5% (2006: 8.7%, 7.6%, 7.1%) respectively. As at December 31, 2007, the carrying amount before deducting any impairment allowance of accounts... -

Page 214

...a situation where business conditions unexpectedly deteriorate and require financing. Transactional liquidity risk is defined as the risk of executing a financial transaction below fair market value, or not being able to execute the transaction at all, within a specific period of time. The objective... -

Page 215

... to a significant degree in 2007. Nokia's international creditworthiness facilitates the efficient use of international capital and loan markets. The ratings of Nokia from credit rating agencies have not changed during the year. The ratings as at December 31, 2007 were: ShortÂterm: Standard & Poor... -

Page 216

... 5 years EURm At December 31, 2007 NonÂcurrent financial assets LongÂterm loans receivable ...Other nonÂcurrent assets ...Loan commitments obtained ...Current financial assets Current portion of longÂterm loans receivable ...ShortÂterm loans receivable ...AvailableÂforÂsale investments... -

Page 217

... the Consolidated Financial Statements (Continued) 35. Risk Management (Continued) Due between 3 and 12 months EURm Due between 1 and 3 years EURm At December 31, 2006 Due within 3 months EURm Due between 3 and 5 years EURm Due beyond 5 years EURm NonÂcurrent financial assets LongÂterm loans... -

Page 218

... management measures or purchase of insurance. Insurance is purchased for risks, which cannot be internally managed. The objective is to ensure that Group's hazard risks, whether related to physical assets (e.g. buildings) or intellectual assets (e.g. Nokia) or potential liabilities (e.g. product... -

Page 219

... The registrant hereby certifies that it meets all of the requirements for filing on Form 20ÂF and that it has duly caused and authorized the undersigned to sign this annual report on its behalf. NOKIA CORPORATION By: /s/ ANJA KORHONEN Name: Anja Korhonen Title: Senior Vice President, Corporate... -

Page 220

Copyright © 2008. Nokia Corporation. All rights reserved. Nokia and Nokia Connecting People are registered trademarks of Nokia Corporation.