Nissan 2012 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2012 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

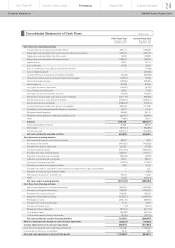

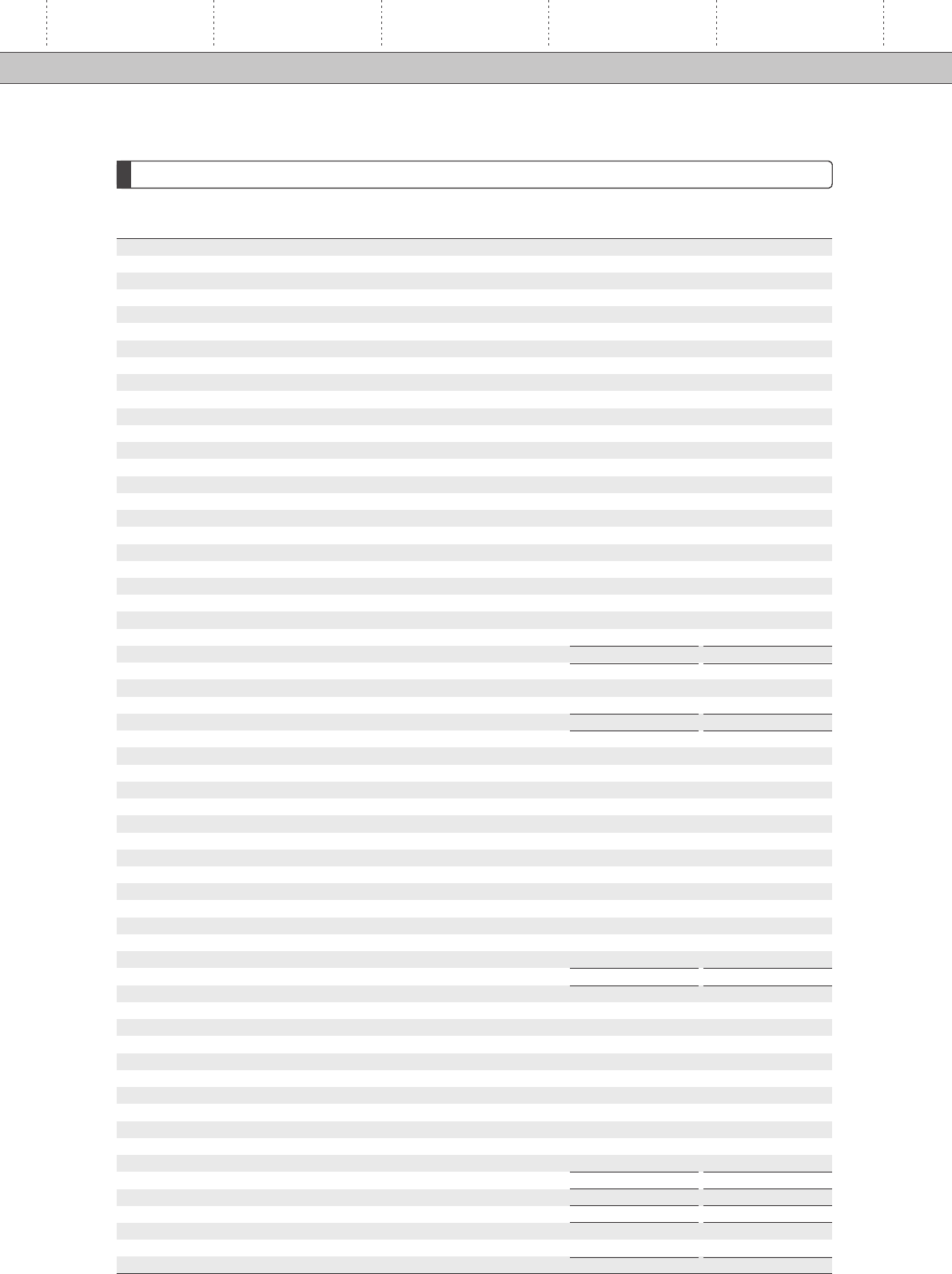

Cash flows from operating activities

Income before income taxes and minority interests

Depreciation and amortization (for fixed assets excluding leased vehicles)

Depreciation and amortization (for other assets)

Depreciation and amortization (for leased vehicles)

Impairment loss

Loss on disaster

Gain on contribution of securities to retirement benefit trust

Gain on negative goodwill

Increase (decrease) in allowance for doubtful receivables

Provision for residual value risk of leased vehicles (net changes)

Interest and dividend income

Interest expense

Loss (gain) on sales of fixed assets

Loss on disposal of fixed assets

Loss (gain) on sales of investment securities

Decrease (increase) in trade notes and accounts receivable

Decrease (increase) in sales finance receivables

Decrease (increase) in inventories

Increase (decrease) in trade notes and accounts payable

Amortization of net retirement benefit obligation at transition

Retirement benefit expenses

Retirement benefit payments made against related accrual

Other

Subtotal

Interest and dividends received

Interest paid

Income taxes paid

Net cash provided by operating activities

Cash flows from investing activities

Net decrease (increase) in short-term investments

Purchases of fixed assets

Proceeds from sales of fixed assets

Purchase of leased vehicles

Proceeds from sales of leased vehicles

Payments of long-term loans receivable

Collection of long-term loans receivable

Purchase of investment securities

Proceeds from sales of investment securities

Proceeds from sales of subsidiaries' shares resulting in changes in the scope of consolidation

Payments for restructuring of domestic dealers

Net decrease (increase) in restricted cash

Other

Net cash used in investing activities

Cash flows from financing activities

Net increase (decrease) in short-term borrowings

Proceeds from long-term borrowings

Proceeds from issuance of bonds

Repayment of long-term borrowings

Redemption of bonds

Proceeds from minority shareholders

Purchase of treasury stock

Repayment of lease obligations

Cash dividends paid

Cash dividends paid to minority shareholders

Net cash provided by (used in) financing activities

Effects of exchange rate changes on cash and cash equivalents

Increase (decrease) in cash and cash equivalents

Cash and cash equivalents at the beginning of the period

Increase due to inclusion in consolidation

Cash and cash equivalents at the end of the period

480,141

404,673

19,554

208,221

10,891

19,785

ー

ー

(3,032

(14,291

(15,596

80,933

(14,407

8,957

(2,422

(131,116

(319,874

(208,924

329,918

10,671

53,668

(33,675

(7,826

876,249

13,625

(81,641

(140,731

667,502

82,847

(281,952

59,120

(601,702

335,727

(29,343

13,251

(12,221

1,846

ー

ー

90,074

11,235

(331,118

360,057

724,529

233,087

(705,607

(394,147

4,116

(13

(87,401

(20,922

(3,124

110,575

(60,315

386,644

761,495

5,314

1,153,453

Current Fiscal Year

From April 1, 2011

To March 31, 2012

Prior Fiscal Year

From April 1, 2010

To March 31, 2011

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

529,329

364,122

20,852

195,370

12,117

8,245

(7,048)

(24,086)

(23,968)

10,095

(22,950)

87,890

(6,792)

7,106

(10,624)

(89,495)

(432,957)

(70,615)

317,945

10,146

55,141

(62,695)

(2,051)

865,077

23,070

(85,398)

(106,452)

696,297

1,597

(400,623)

27,458

(625,646)

317,211

(4,222)

22,816

(17,340)

6,124

537

(927)

17,336

(29,374)

(685,053)

(536,782)

1,379,490

135,329

(1,034,056)

(88,459)

2,606

(9,015)

(81,118)

(62,748)

(13,704)

(308,457)

(15,630)

(312,843)

1,153,453

261

840,871

Consolidated Statements of Cash Flows

(Millions of yen)

Innovation & Power of brandYear 2 Power 88

Performance

Corporate Data Corporate Governance

24

NISSAN Annual Report 2012Financial Statements