Nissan 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Efficient, Independent Internal Audits

Nissan has established Global Internal Audit unit, an

independent Department under the direct control of Chief

Operating Officer (COO), to handle internal auditing tasks.

Under control of Chief Internal Audit Officer (CIAO), audit

teams set up in each region carry out efficient and effective

auditing of Nissan’s activities on a group wide and global

basis. Audits are implemented based on Audit plan

approved by Operations Committee and the results are

reported to COO and other related parties. Additionally,

Audit plan and the results are also reported to Statutory

Auditors on a regular basis.

The Principle and Approach to Corporate Risk

Management

For Nissan, the term risk refers to any factor that may

prevent the Nissan Group from achieving its business

objectives. By detecting risk as early as possible, examining

it, planning the necessary measures to address it and

implementing those measures, we work to minimize the

materialization of risk and the impact of damage if it

realized. Risk management must be a real-world activity

closely linked at all times with concrete measures. Based on

its Global Risk Management Policy, Nissan carries out

activities on a comprehensive, group wide basis.

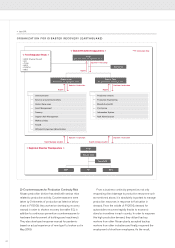

In order to respond swiftly to changes in its business

environment, Nissan set up the department in charge of risk

management, which carries out annual interviews of

corporate officers, carefully investigating various potential

risks, evaluate impact, frequency and control level and

revising the Corporate Risk Map. An executive-level

committee makes decisions on corporate risks that should

be handled at the corporate level and designates “risk

owners” to manage the risk. Under the leadership of these

owners, appropriate countermeasures are developed and

implemented. Additionally, the board member in charge of

internal controls (currently, COO) regularly reports to the

Board of Directors on progress being made.

With respect to individual business risks, each division is

responsible for taking the preventive measures necessary to

minimize the frequency of risk and its impact when realized

as their own business activities. The divisions also prepare

emergency measures to put in place when risk factors do

materialize. Nissan Group companies in Japan and overseas

are strengthening communication and sharing basic

processes and tools for risk management, as well as related

information, throughout the group.

Additionally, “Corporate Risk Management” web site was

launched on Nissan’s intra net in 2009, which puts out risk

management information to Nissan employees including US,

Europe and major subsidiaries in Japan.

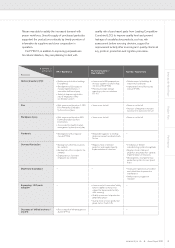

Risk Management Measures & Actions

1. Risks Related to Financial Market

1) Liquidity

Automotive

Liquidity risk is one of major risks facing any business

and 2008-2009 credit crisis has heightened importance

of managing this risk. Nissan recognizes this risk and has

put in place several countermeasures to manage this

risk.

Automotive business must have adequate liquidity to

provide for working capital needs of day-to-day normal

operations, capital investment needs for future expansion

and repayment of maturing debt. Liquidity can be

generated through internal free cash flows or external

borrowings. As of the end of fiscal year 2009 (March 31,

2010), Nissan’s automotive business had JPY 30 billion

of net automotive debt (compared with JPY 388 billion

as at March 31, 2009). Nissan’s automotive business

thus needs to borrow funds externally from banks and in

capital markets to meet its liquidity needs. To the extent

financial markets are frozen or credit is not available, this

creates liquidity risk for Nissan.

For automotive business, Nissan raises financing

through several sources including bonds issuance in

capital markets, long and short-term loans from banks

and commercial institutions, long-term loans from

government developmental financial institutions,

short-term commercial paper issuance, and committed

credit lines from banks. A significant portion of the

financing for the automotive business is raised by parent

company, Nissan Motor Co Limited (NML), in Japan with

some financing raised overseas by NML’s automotive

subsidiaries’.

In fiscal year 2009, automotive business raised JPY

311 billion in new long-term financing from various

funding sources described above while long-term debt

repayments amounted to JPY 102 billion. As of March

31, 2010, automotive business’ liquidity consists of cash

balance of JPY 747 billion and unutilized committed

credit facilities of approximately JPY 547 billion.

Additionally, short-term loans and commercial paper

continues to be available as incremental funding sources

to meet liquidity needs. As of the end of fiscal year,

commercial paper outstanding was JPY 25 billion which

is significantly lower than our peak utilization of

approximately JPY 516 billion in prior years. During the

fiscal year, automotive business reduced its reliance on

short-term loans and commercial paper to 7.5% of total

debt as at March 31, 2010 compared to 29.6% as at

March 31, 2009. Maturity of long-term debt is well

spread out with maturity in any one year not exceeding

JPY 400 billion.