Nissan 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

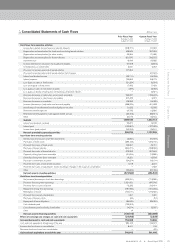

22

Financial Review

Performance:

Fiscal 2009 Financial Performance

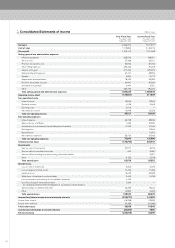

Net sales

For fiscal year 2009, consolidated net revenues decreased

10.9%, to ¥7.517 trillion, which reflected the strong yen

offsetting the increase in sales volume.

Operating profit

Consolidated operating profit totaled ¥311.6 billion,

compared to a negative ¥137.9 billion in fiscal year 2008. In

comparison to last year’s consolidated operating loss, the

variance was due to the following factors:

• Foreign exchange rates movement resulted in a

¥162.5 billion negative impact. By currency, the

majority of this variance was due to the impact of the

U.S. dollar at ¥86 billion, the Russian ruble at ¥28

billion and the Canadian dollar at ¥14 billion.

• Net purchasing cost reduction efforts were a positive

¥215.4 billion. This included the positive impact from

the decrease in raw material and energy costs by

¥81.0 billion.

• Volume and mix was a positive ¥26.9 billion due to the

increase in global sales volume. The fourth quarter was

positive by ¥153.1 billion due to the volume recovery in

most countries.

• The reduction in marketing and sales expenses was a

positive ¥27.1 billion. This was due mainly to savings in

fixed expenses, such as advertising. Incentive spending

was increased in Europe due to its tough market

conditions.

• The provisions for the residual risk on leased vehicles

in North America resulted in a positive variance of

¥141.7 billion, including gains on disposal because of

improved used-car prices in the company’s lease

portfolio.

• R&D costs decreased ¥64.5 billion.

• Sales financing contributed a positive ¥50.1 billion.

This was due mainly to improved borrowing costs

across the globe and lower loss provisions compared

to fiscal year 2008.

• The remaining variance was a positive ¥86.3 billion,

due mainly to savings in fixed expenses, including

manufacturing costs and G&A expenses, as well as

improved profits at the affiliate level.

Net income

Net non-operating expenses increased ¥69.1 billion to

¥103.9 billion from ¥34.8 billion in fiscal 2008. The

negative impact came from the decreased equity in earnings

of affiliates by ¥49.2 billion, despite foreign exchange

losses, which deteriorated by ¥15.6 billion to ¥10.6 billion

from last year’s gain of ¥5.0 billion.

Net extraordinary losses totaled ¥66.1 billion, a decrease

of ¥20.1 billion from the previous year’s loss of ¥46 billion.

The positive impact of ¥21.5 billion from the reduction of

special additions to retirement benefits at overseas

subsidiaries was offset by the reduction in gains on sale of

fixed assets of ¥41.6 billion.

Taxes totaled ¥91.5 billion, a decrease of ¥54.6 billion

from fiscal year 2008. Minority interests had a negative

contribution of ¥7.7 billion in fiscal year 2009.

Net income reached ¥42.4 billion, an increase of ¥276.1

billion from fiscal year 2008.

Financial Position

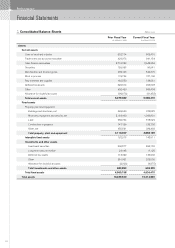

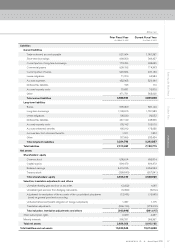

Balance sheet

Current assets increased by 5.7 percent to ¥5,580.4 billion

compared to March 31, 2009. This was mainly due to

increases in trade notes and accounts receivable by ¥212.1

billion and cash on hand and in banks by ¥169.7 billion.

Fixed assets decreased by 6.6% to ¥4,634.4 billion

compared to March 31, 2009. This was mainly due to the

decrease in machinery, equipment and vehicles, which was a

net of ¥168.7 billion.

As a result, total assets decreased by 0.2% to ¥10,214.8

billion compared to March 31, 2009.

Current liabilities decreased by 3.3 percent to ¥3,856.9

billion compared to March 31, 2009. This was mainly due to

increases in trade notes and accounts payable by ¥379.4

billion, offset by decreases in short-term borrowing by

¥311.5 billion and commercial papers by ¥464.8 billion.

Long-term liabilities increased by 0.5 percent to ¥3,342.9

billion compared to March 31, 2009. This was mainly due to

increases in long-term borrowing by ¥92 billion and

decrease in bonds by ¥88.2 billion.

Refer to Chart

05

Refer to Chart

07

Refer to Chart

06

/

08