Nissan 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

Credit rating

Nissan’s long-term credit rating with R&I is A- with a stable

outlook. S&P’s long-term credit rating for Nissan is BBB

with a stable outlook. Nissan’s rating with Moody’s is Baa2

with a stable outlook.

Sales finance

In conjunction with the decrease in retail sales, total

financial assets of the sales finance segment decreased by

6.1% to ¥4,355.9 billion from ¥4,638.9 billion in fiscal year

2009. The sales finance segment generated ¥77.5 billion in

operating profits. The improvement in profitability was due to

improved borrowing rates and the decrease in allowance for

bad debt, compared to the prior year.

Investment policy

Capital expenditures totaled ¥273.6 billion, which was 3.6

percent of net revenue. Due to the economic crisis, the

company reduced capital expenditures, compared to the

prior year. However, in order to ensure Nissan’s future

competitiveness, certain key projects were maintained. For

fiscal year 2010, the company remains committed to

strategic initiatives, such as the Zero-Emission Nissan LEAF

electric vehicle, and the V-Platform Global Compact Car.

R&D expenditures totaled ¥385.5 billion. These funds

were used to develop new technologies and products. One

of the company’s strength is its extensive collaboration and

development structure with Renault’s R&D team, resulting

from the Alliance.

Dividend

Nissan’s strategic actions reflect not only its long-term

vision as a global company that creates sustainable value

but also the company’s commitment to maximizing total

shareholder return. Based on the current state of the

industry and weighing in the risks and opportunities for this

year, Nissan is planning to reinstate dividend payments for

fiscal year 2010 at ¥10 for the full year (¥5 for the interim

and ¥5 at year-end).

Fiscal 2010 Outlook

In fiscal year 2010, risks include the continuing strong yen,

increasing raw material costs, ongoing uncertainly in world

markets and instability and volatility within the euro-zone.

Opportunities include favorable foreign exchange rates, the

TIV increase in China, acceleration of Alliance synergies

with Renault and further strategic cooperation with Daimler.

In light of the outlook for fiscal year 2010, the company filed

its forecast with the Tokyo Stock Exchange. Assumptions

included retail unit sales of 3,800,000 units, which is an

increase of 8.1 percent from the prior year, and

foreign-exchange-rates of ¥90 to the dollar and ¥120 to

the euro.

• Net revenues are expected to be ¥8,200 billion.

• Operating income is expected to be ¥350 billion.

• Net income is forecasted to be ¥150 billion.

• R&D expenses will amount to ¥430 billion.

• Capital expenditures are expected to be ¥360 billion.

The evolution in operating profit, compared to the fiscal

year 2009 results, is mainly linked to five key factors:

• The increase in raw material and energy costs is

expected to be a negative ¥100 billion.

• Marketing and Sales expenses are expected to be a

negative ¥140 billion due to normalization of fixed

expenses, such as advertising costs and the rise in

incentives as volume increases.

• Purchasing cost reduction is expected to be a positive

¥160 billion.

• Volume and mix should be a positive of ¥270 billion

due to the anticipated increase in sales volume.

• Others are a negative ¥151.6 billion, due mainly to

unfavorable foreign exchange, the increase in

manufacturing costs and a partial normalization in labor

costs to pre-crisis levels.

The company strives to achieve a positive free cash flow,

based on the assumptions above. The company believes

that this is an achievable target, as they will continue with

their efforts to improve working capital and control capital

expenditures.

(All figures for fiscal year 2010 are forecasts, as of May 12, 2010.)

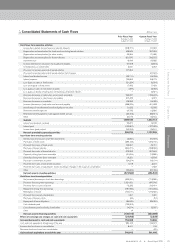

Refer to Chart

09

Refer to Chart

10

Refer to Chart

11