Nissan 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

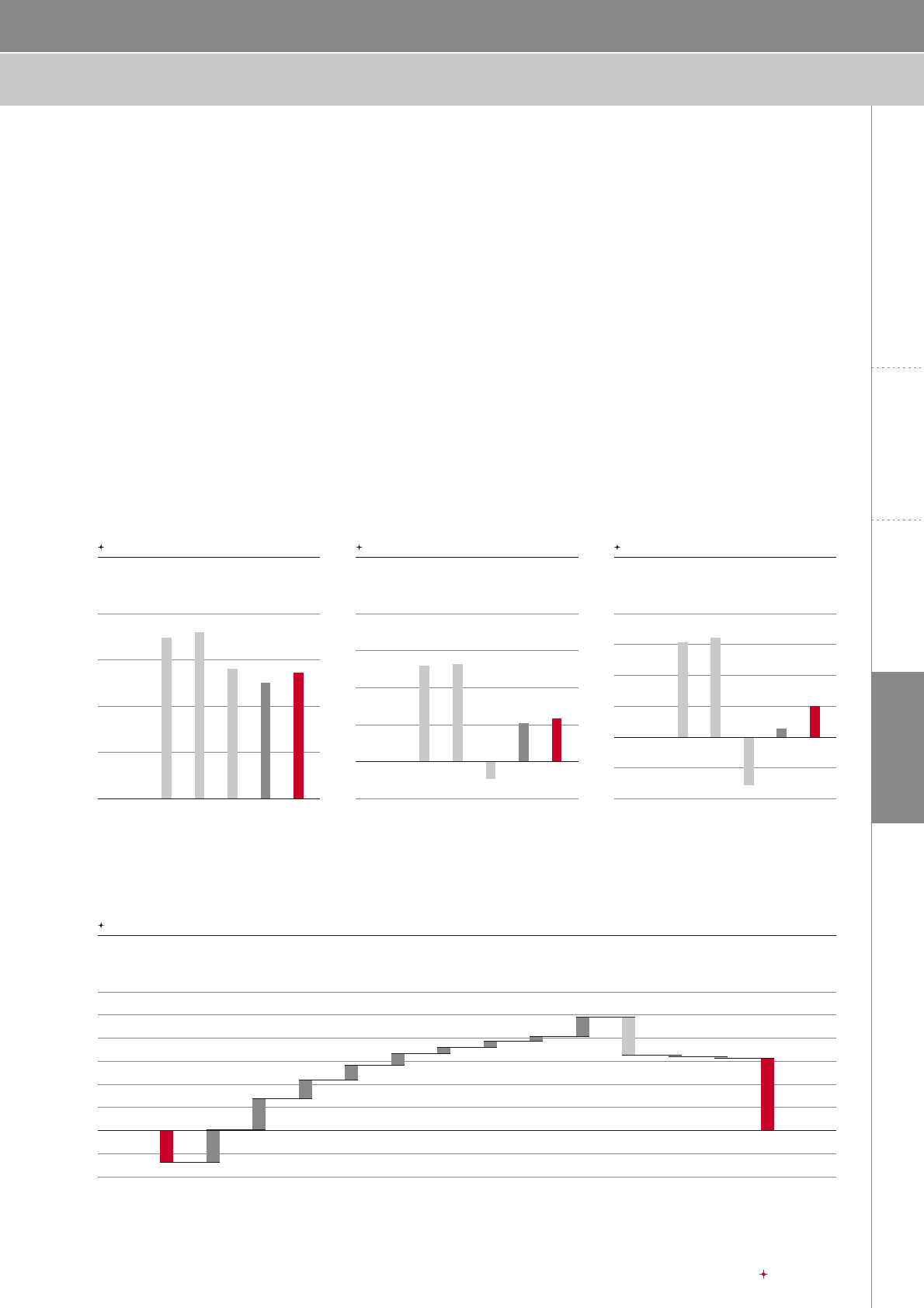

Entering the Next Phase Product Plan Performance

23Annual Report 2010NISSAN MOTOR CO., LTD.

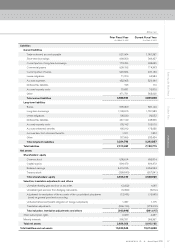

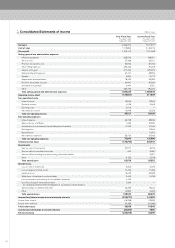

• Foreign exchange rates movement resulted in a

• Net purchasing cost reduction efforts were a positive

• Volume and mix was a positive ¥26.9 billion due to the

• The reduction in marketing and sales expenses was a

fixed expenses, such as advertising. Incentive spending

was increased in Europe due to its tough market

• The provisions for the residual risk on leased vehicles

in North America resulted in a positive variance of

• R&D costs decreased ¥64.5 billion.

• Sales financing contributed a positive ¥50.1 billion.

• The remaining variance was a positive ¥86.3 billion,

due mainly to savings in fixed expenses, including

manufacturing costs and G&A expenses, as well as

Net non-operating expenses increased ¥69.1 billion to

of affiliates by ¥49.2 billion, despite foreign exchange

Net extraordinary losses totaled ¥66.1 billion, a decrease

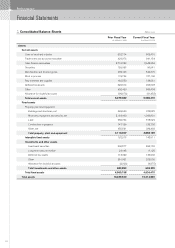

Net assets increased by 3.0 percent to ¥3,015.1 billion,

compared to ¥2,926.1 billion as of March 31, 2009. This

was mainly due to net income of ¥42.4 billion and a

favorable change in translation adjustments by ¥30.3 billion.

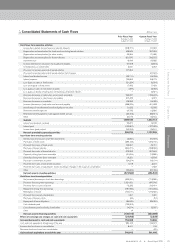

Free cash flow and net debt (auto business)

For fiscal year 2009, Nissan achieved a positive free cash

flow of ¥375.5 billion. On a gross and net basis, Nissan’s

auto debt position significantly improved. At the end of fiscal

year 2009, net debt stood at ¥29.7 billion, which was

¥358.2 billion lower than the debt balance at the end of

fiscal year 2008. The debt structure has also improved,

since the company reduced its reliance on short-term

borrowing.

For the fourth quarter, global production volume totaled

951,000 units. Nissan’s flexible production network

responded quickly to adjust production volume in line with

demand. Furthermore, due to careful inventory management,

inventory of new vehicles remained at a low level of

470,000 units at the end of fiscal year 2009. The company

continues to manage inventory carefully, in order to limit its

impact on free cash flow.

12,000

(Billions of yen)

9,000

6,000

3,000

0

(Billions of yen)

’06 ’10’07 ’08 ’09

FY08

O.P.

FY09

O.P.

(Forecast)

Chart

08

:

IMPACT ON OPERATING PROFIT

Chart

05

:

NET SALES

Purch.

cost

reduction

Mfg.

expenses

Price/

volume mix

Provision for

residual risk

on leased

vehicles

Sales

finance OthersRaw

material

/energy

costs

Selling

expenses

R&D

expenses Warranty

expenses

FOREX Product

enrich./

regulatory

costs

600

(Billions of yen)

450

300

150

0

-150

-300

’06 ’10’07 ’08 ’09

(Forecast)

Chart

07

:

NET INCOME

1,200

(Billions of yen)

900

600

0

300

-300

’06 ’10’07 ’08 ’09

(Forecast)

Chart

06

:

OPERATING PROFIT

10,468.6

8,200.0

10,824.2

8,437.0

7,517.3

460.8

150.0

482.3

-233.7

42.4

776.9

350.0

790.8

-137.9

311.6

-137.9

+311.6

+141.7

+134.4

+81.0

+50.1 +27.1 +26.9

+64.5

+20.4

+81.8

-162.5 -8.8 -7.1