Konica Minolta 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4KONICA

Alliances are a strategy that we will pursue to achieve our goal

of developing best-in-field products and businesses. In April

2000, we formed a tie-up with Minolta Co., Ltd., that will focus

on technological cooperation in the area of digital copiers and

copier supplies. Improved cost efficiencies and strengthened

R&D capabilities will significantly enhance our prospects in

the strategic digital copier/printer market.

Inkjet printing products, electronics materials, and optics

technology products are three business fields in which we

plan to invest aggressively and build new business pillars.

At the same time, in our existing core businesses we will

promote the transition to products suitable for use in digi-

tally networked environments.

Specifically, we intend to raise profitability by increasing

sales of consumable input and output materials for digital

equipment. We will also utilize our superior photographic and

chemical technologies to expand our shares of the markets

for copier supplies, inkjet ink and paper, and aspherical plastic

lenses.

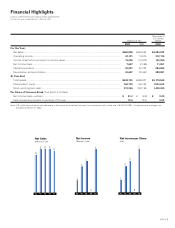

Increasing free cash flow remains a high priority under SAN

2003. In fiscal 2000, our consolidated free cash flow improved

dramatically, to ¥50 billion. While creating more streamlined

operations, we are also intent on securing fund resources to

support aggressive investment in new production capacity

and R&D. We have established six project teams to study

various ways in which we can lower our consolidated interest-

bearing debt, which we plan to reduce to ¥200.00 billion, from

¥212.4 billion, by the end of the current fiscal year.

At the completion of SAN 2003, in March 2004, we aim to

have consolidated net income of ¥20 billion, a return on equity

(ROE) of 10%, and a higher credit rating. Needless to say, these

targets may be revised in light of the market’s consensus of

Konica’s performance.

A MESSAGE FROM THE PRESIDENT

2000 2004

Net Sales 560.9 750.0

Net Income 7.6 20.0

Free Cash Flow 50.0 50.0

for 1 year for 4 years

Interest-Bearing Debt 212.4

less than

200

ROE (%) 4.7 10.0

Consolidated Results/Targets

March 31 Billions of yen