Konica Minolta 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA 27

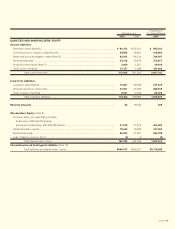

should be appropriated to a legal reserve until this reserve equals

25 per cent of stated capital. The legal reserve is not available for

cash dividends but may be used to reduce a deficit by a shareholders’

resolution or may be capitalized by a Board of Directors’ resolution.

On June 29, 2000, the shareholders approved a cash dividend

to be paid to shareholders on record as of March 31, 2000 totaling

¥1,788 million (US$16,844 thousand), at the rate of ¥5.00 (US$0.05)

per share of common stock. The related appropriation of retained

earnings to the legal reserve was made in the amount of ¥178 mil-

lion (US$1,677 thousand).

10. Commitments and Contingent Liabilities

The Company and its subsidiaries were contingently liable, as of

March 31, 2000, for trade notes discounted with banks of ¥89 mil-

lion (US$838 thousand) and for loans guaranteed of ¥4,923 million

(US$46,378 thousand).

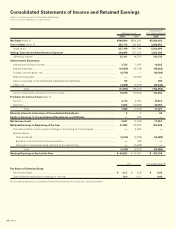

11. Lease Transactions

Information on the Company’s and consolidated subsidiaries’ finance

lease transactions (except for those which are deemed to transfer the

ownership of the leased assets to the lessee) and operating lease

transactions are presented below:

Lessee

1. Finance leases

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Machinery & equipment............. ¥12,154 ¥ 6,016 $114,498

Tools & furniture......................... 4,171 5,747 39,293

Others......................................... 647 422 6,095

.................................................... 16,973 12,185 159,886

Less: Accumulated depreciation

.... (5,907) (6,042) (55,648)

Net book value............................ ¥11,066 ¥ 6,143 $104,249

Depreciation ............................... ¥ 2,087 ¥ 1,998 $ 19,661

Depreciation is based on the straight-line method over the lease

terms of the lease assets.

The scheduled maturities of future lease rental payments on such

lease contracts as of March 31, 2000 and 1999 are as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Due within one year...................... ¥ 2,869 ¥1,844 $ 27,028

Due over one year ........................ 8,196 4,299 77,211

...................................................... ¥11,066 ¥6,143 $104,239

Lease rental expenses

for the year ................................. ¥ 2,087 ¥1,998 $ 19,661

2. Operating leases

The scheduled maturities of future lease rental payments on such

lease contracts as of March 31, 2000 and 1999 are as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Due within one year ................... ¥ 5,235 ¥ 6,565 $ 49,317

Due over one year ...................... 17,025 22,400 160,386

.................................................... ¥22,260 ¥28,965 $209,703

Lessor

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Leased tools & furniture:

Purchase cost ............................. ¥1,919 ¥1,880 $18,078

Accumulated depreciation .......... (1,564) (1,321) (14,734)

Net book value................................ ¥ 355 ¥ 559 $ 3,334

The scheduled maturities of future lease rental income on such

lease contracts as of March 31, 2000 and 1999 are as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Due within one year........................ ¥ 300 ¥ 367 $ 2,826

Due over one year .......................... 107 276 1,008

........................................................ ¥ 408 ¥ 643 $ 3,834

Lease rental income

for the year ................................... ¥1,318 ¥1,269 $12,416

Depreciation for the year ................ 1,146 1,104 10,796

As a result of the amendment to the Consolidated Financial State-

ment Regulations, the disclosure of information regarding leased

assets and finance lease contracts as a lessee/lessor has become

mandatory effective from the year ended March 31, 2000.

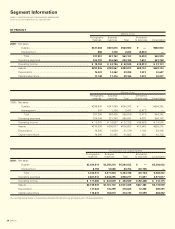

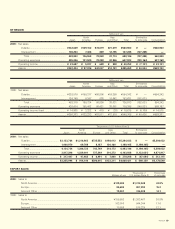

12. Segment Information

Segment information is reported in accordance with the requirements

of the MOF. The photographic materials segment includes photo-

graphic film, photographic paper, photofinishing equipment and

chemicals, videotapes and others. The business machines segment

includes plain-paper copiers, printers, facsimile machines, cameras,

optical products and others.