Konica Minolta 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA 25

Another pension plan provides for a portion of the retirement bene-

fits, the past service cost of which is being amortized over a period

of 20 years.

Employees of consolidated domestic subsidiaries are generally

covered by unfunded retirement benefit programs. Several of the

domestic subsidiaries have funded pension plans to cover a portion

of the retirement benefit payments.

(i) Income Taxes

Income taxes of the Company and its domestic subsidiaries consist

of corporate income taxes, local inhabitants taxes and enterprise

taxes. Deferred income taxes are provided for in respect of temporary

differences between the tax basis of assets and liabilities and those

as reported in the financial statements. The Company also provides

for the anticipated tax effect of future remittances of retained earn-

ings from overseas subsidiaries and affiliated companies.

( j) Research and Development Expenses

Expenses for research and development activities are charged to

income as incurred.

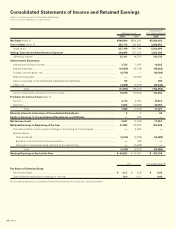

(k) Per Share Data

Net income per share of common stock has been computed based on

the weighted average number of shares outstanding during the year.

Cash dividends per share shown for each year in the accompany-

ing consolidated statements are dividends declared as applicable to

the respective years.

2. United States Dollar Amounts

Amounts in U.S. dollars are included solely for the convenience of

readers outside Japan. The rate of ¥106.15=US$1, the rate of exchange

on March 31, 2000, has been used in translation. The inclusion of

such amounts is not intended to imply that Japanese yen have been

or could be readily converted, realized or settled in U.S. dollars at this

rate or any other rate.

3. Cash and Cash Equivalents

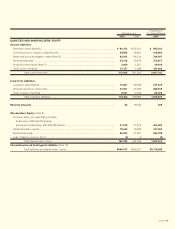

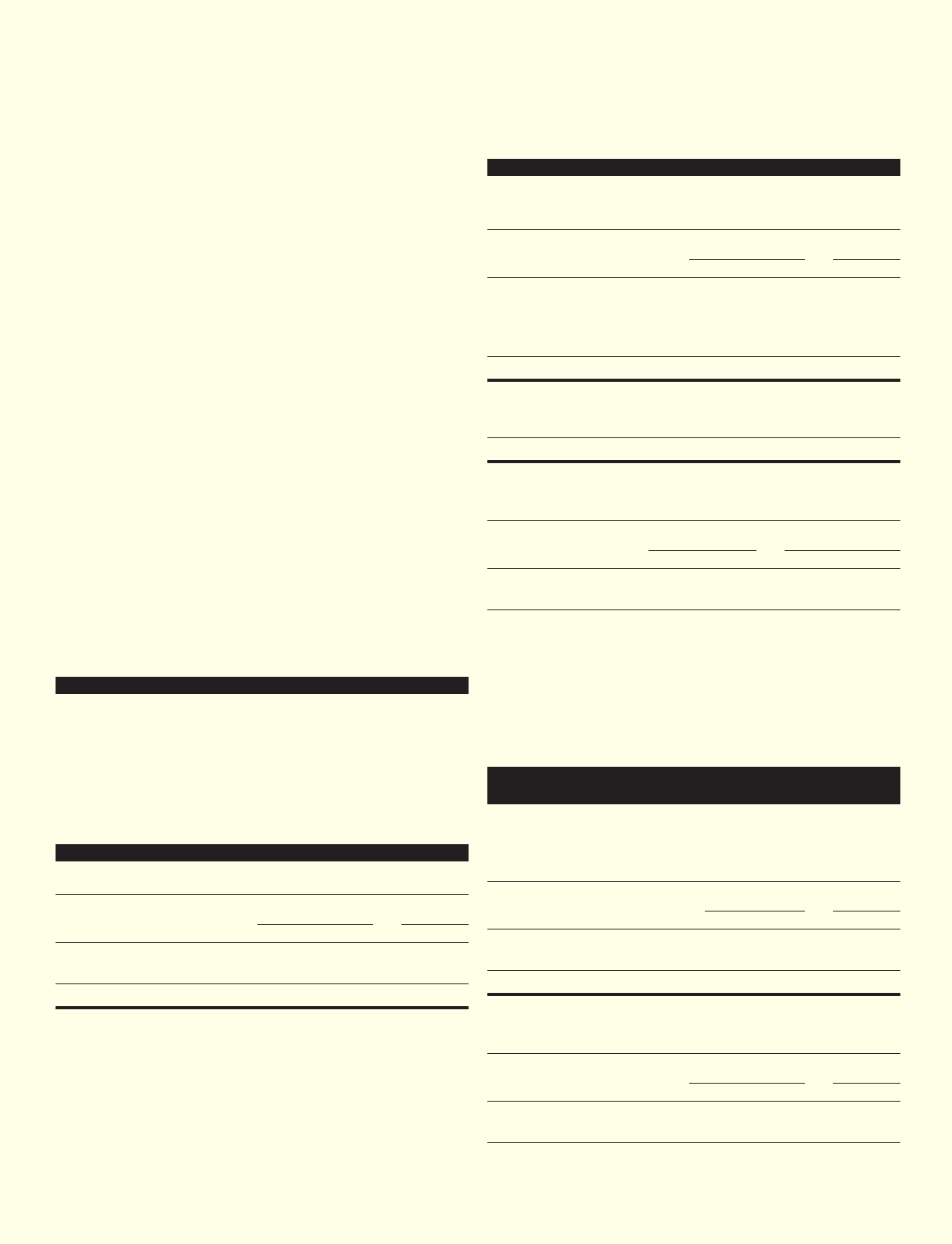

Cash and cash equivalents consisted of:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Cash and bank deposits.............. ¥53,618 ¥40,053 $505,115

Money management funds ........ 1,404 —13,227

Cash and cash equivalents ......... ¥55,022 ¥40,053 $518,342

4. Marketable Securities

The aggregate cost and market value of marketable securities included

in investment securities as of March 31, 2000 and 1999 were as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Marketable securities

included in current assets:

Market value........................... ¥19,129 ¥17,861 $180,207

Carrying amount ..................... 15,946 16,723 150,221

Unrealized gain ........................... ¥ 3,183 ¥ 1,138 $ 29,986

Investment securities:

Market value........................... ¥26,280 ¥26,358 $247,574

Carrying amount ..................... 15,706 13,943 147,960

Unrealized gain ........................... ¥10,574 ¥12,415 $ 99,614

Gross unrealized gains and losses pertaining to marketable equity

securities as of March 31, 2000 were as follows:

Thousands of

Millions of yen U.S. dollars

Gains Losses Gains Losses

Current............................. ¥ 5,961 ¥2,660 $56,156 $25,059

Non-current...................... 10,542 566 99,312 5,332

The net realized gains on marketable equity securities for the

fiscal years ended March 31, 2000 and 1999 were ¥172 million

(US$1,620 thousand) and ¥946 million, respectively.

The net valuation loss on marketable equity securities for the

fiscal years ended March 31, 2000 and 1999 were ¥1,657 million

(US$15,610 thousand) and ¥269 million, respectively.

5. Investments in and Loans to Unconsolidated Subsidiaries

and Affiliates

The following investments in and loans to unconsolidated subsidiaries

and affiliates as of March 31, 2000 and 1999 were included in invest-

ment securities:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Investments.................................... ¥6,298 ¥3,205 $59,331

Loans .............................................. 335 442 3,156

........................................................ ¥6,633 ¥3,647 $62,487

A summary of transactions at the balance sheet dates with these

unconsolidated subsidiaries and affiliates is as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Sales........................................... ¥16,480 ¥18,256 $155,252

Purchases................................... 21,436 21,739 201,941