Konica Minolta 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 KONICA

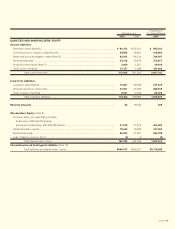

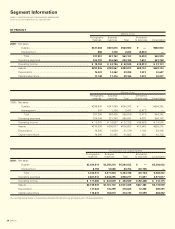

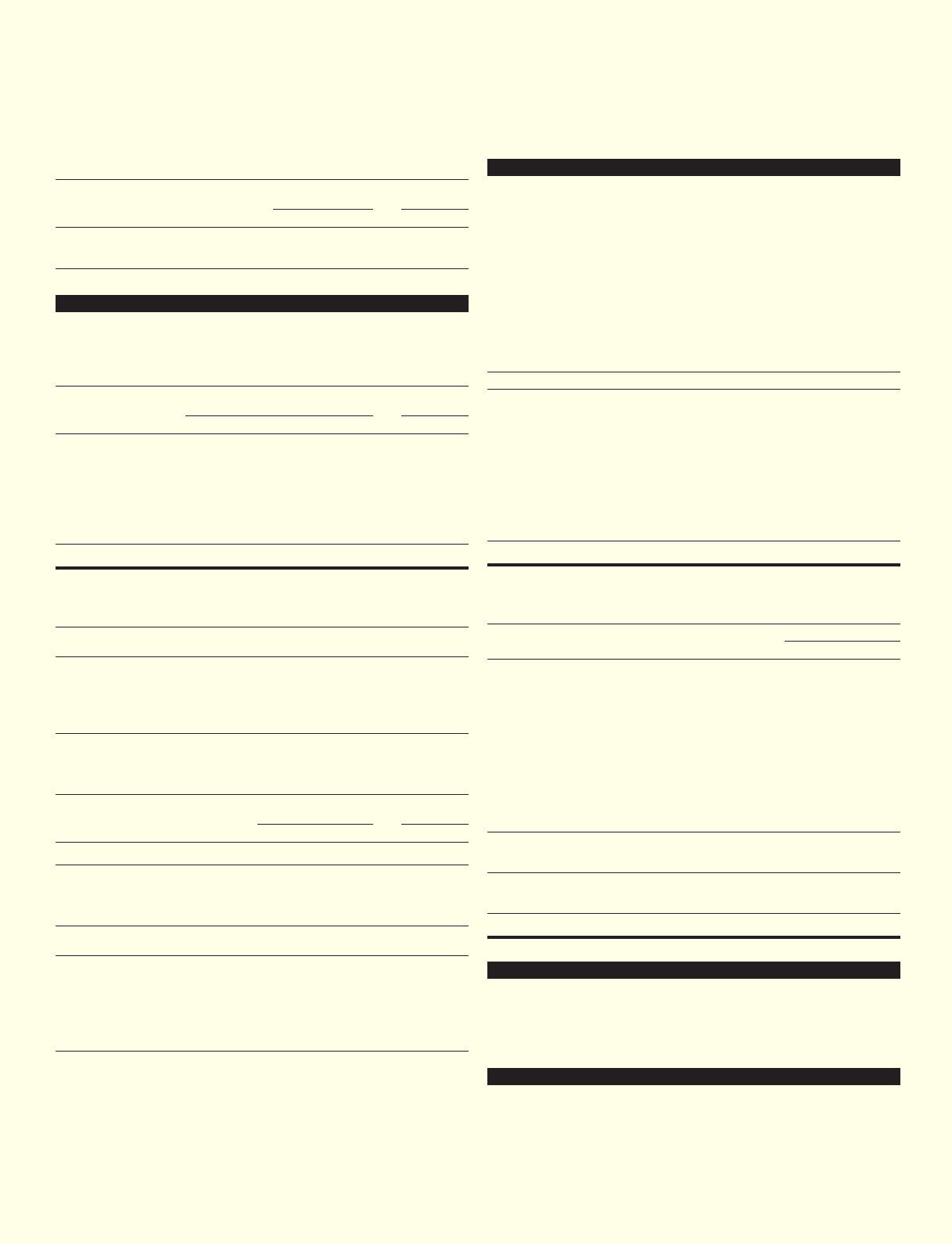

Transaction balances as of March 31, 2000 and 1999 were as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Trade receivables.......................... ¥7,282 ¥6,019 $68,601

Trade payables.............................. 7,530 6,104 70,937

6. Short-Term & Long-Term Debt

Loans

Short-term and long-term loans as of March 31, 2000 and 1999 are

summarized as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

(Interest

rate)

Short-term loans...... ¥ 94,722 4.51% ¥122,212 $ 892,341

Current portion of

long-term loans ..... 39,985 4.54% 25,822 376,684

Long-term loans ...... 16,907 3.16% 36,594 159,275

................................ ¥151,614 ¥184,629 $1,428,300

The annual maturities of long-term loans as of March 31, 2000 are

as follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2002........................................................ ¥10,195 $96,043

2003........................................................ 3,782 35,629

2004........................................................ 2,286 21,536

2005........................................................ 526 4,955

Bonds

Bonds as of March 31, 2000 and 1999 are summarized as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Bonds ......................................... ¥60,750 ¥57,570 $572,303

The annual maturity of long-term loans as of March 31, 2000 is

as follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2001........................................................ ¥ 0 $ 0

2002........................................................ 15,000 141,309

2003........................................................ 15,000 141,309

2004........................................................ 5,000 47,103

2005........................................................ 5,000 47,103

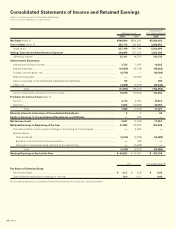

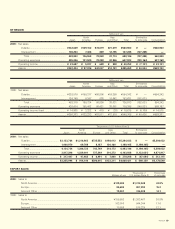

7. Income Taxes

The statutory tax rates used for calculating deferred tax assets and

deferred tax liabilities as of March 31, 2000 and 1999 were 42.1%

and 47.7%, respectively. Due to a change in the tax rate during the

year ended March 31, 1999, the balances of deferred tax assets

and deferred tax liabilities were ¥3,793 million and ¥239 million less,

respectively, than they would have been using the tax rate applicable

for the year ended March 31, 1998.

At March 31, 2000 and 1999, the reconciliation of the statutory tax

rate to the effective income tax rate was as follows:

2000 1999

Statutory tax rate....................................................... 42.1% 47.7%

Accumulated deficit .............................................. 9.9 1—

Tax effect on loss of a consolidated

subsidiary previously not recognized .................. —122.7

Valuation allowance............................................... —(16.1)

Effect of tax-rate change....................................... —(40.8)

Inventories, etc. ................................................... —(35.5)

Other, net.............................................................. (2.2) (7.8)

Effective tax rate ....................................................... 39.9 70.2

At March 31, 2000 and 1999, significant components of deferred

tax assets and liabilities were as follows:

Millions of yen

2000 1999

Gross deferred tax assets:

Tax effect on loss of a consolidated

subsidiary previously not recognized.............. ¥ 2,528 ¥12,814

Tax loss carryforward ....................................... 10,894 7,668

Temporary difference carrying

from restructuring .......................................... —1,886

Reserve for employees’ retirement allowance

.... 3,977 3,036

Inventories, etc. ............................................... 5,015 3,827

Other, net......................................................... 9,465 5,704

Subtotal ........................................................ 31,879 34,935

Valuation allowance.............................................. (4,980) (6,413)

Deferred tax assets total.............................. 26,899 28,522

Deferral of taxes on fixed assets.......................... (1,619) (1,798)

Net deferred tax assets........................................ ¥25,279 ¥26,724

8. Research and Development Expenses

Total amounts charged to income for the fiscal years ended March

31, 2000 and 1999 were ¥25,376 million (US$239,058 thousand) and

¥27,944 million, respectively.

9. Shareholders’ Equity

The Japanese Commercial Code provides that an amount equivalent

to at least 10 per cent of cash distributions (cash dividends and

bonuses to directors and corporate auditors) paid in a fiscal period