Konica Minolta 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 KONICA

FINANCIAL POSITION

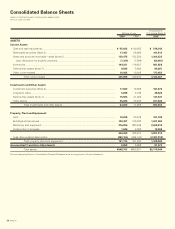

Total current assets as of March 31, 2000, stood at ¥335.9 bil-

lion, down ¥13.3 billion, or 3.8%, from the previous fiscal year-

end. Trade receivables fell ¥13.9 billion, to ¥138.5 billion, and

inventories dropped ¥15.6 billion, to ¥104.2 billion, reflecting

slower sales activity during the fiscal year and efforts to stream-

line inventories. These declines, together with sales of mar-

ketable securities, more than offset a ¥15.0 billion increase in

cash and cash equivalents and an ¥8.5 billion increase in other

current assets.

Investments and other assets fell ¥7.4 billion, to ¥64.0 billion,

mainly as a result of the write-off of investments in and loans

to unconsolidated subsidiaries and affiliates and a decline in

deferred income taxes prompted by the introduction of tax-

effect accounting. Net property, plant and equipment dropped

¥19.4 billion, or 4.6%, to ¥406.3 billion. A ¥13.3 billion decline

in machinery and equipment that accompanied the sale of busi-

nesses was the main contributor to this decline.

As a result, total assets at the end of the year stood at

¥549.7 billion, down ¥39.5 billion, or 6.7%, from the previous

fiscal year-end.

Total liabilities fell ¥43.5 billion, or 10.1%, to ¥386.9 billion.

Fund procurement and debt repayment activities resulted in total

short- and long-term interest-bearing debt falling ¥35.5 billion,

to ¥212.4 billion. Short-term loans plunged ¥27.5 billion, to

¥94.7 billion, as the Company reduced capital employed follow-

ing restructuring in fiscal 1999. The Company aims to reduce

total interest-bearing debt to ¥200.0 billion by March 2001.

Long-term debt fell ¥21.1 billion, to ¥77.7 billion, as a result

of the transfer of debt to current liabilities.

Total shareholders’ equity increased ¥4.1 billion, to ¥162.8 bil-

lion, in line with the increase in retained earnings. The equity

ratio was 29.6%, up 2.7 percentage points from the previous

fiscal year.

CASH FLOWS

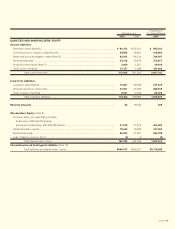

Net cash provided by operating activities amounted to ¥61.3 bil-

lion, compared with ¥16.9 billion in the previous fiscal year.

The main components of this amount were income before

income taxes of ¥15.2 billion, adjustments for depreciation and

amortization of ¥30.7 billion, and an increase in notes and

accounts payable, to ¥14.0 billion.

Konica spent ¥23.0 billion for the acquisition of property, plant

and equipment during the fiscal year, primarily to strengthen its

production network. As a consequence, net cash used in invest-

ing activities amounted to ¥11.2 billion.

Net cash used in financing activities totaled ¥34.0 billion, in

contrast with net cash provided by financing activities of ¥12.5 bil-

lion in fiscal 1999.The main reasons for the turnaround were

¥36.9 billion spent on the repayment of short- and long-term

debt and ¥18.7 billion on the redemption of preferred stock.

As a result of these activities, cash and cash equivalents at

the end of the year totaled ¥55.0 billion, compared with ¥40.1 bil-

lion at the previous fiscal year-end.