Konica Minolta 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA 17

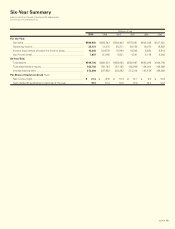

ROA

(%)

’96 ’97 ’98 ’99 ’00

0.39

0.79

0.90

–0.52

1.34

Current Ratio

(Times)

’96 ’97 ’98 ’99 ’00

1.2

1.3

1.2 1.21.2

’96 ’97 ’98 ’99 ’00

D/E Ratio

(Billions of yen, times)

Interest-Bearing Debt

Shareholders’ Equity

D/E Ratio (times)

191

213

234

248

212

164

165

167

158

163

1.1

1.2

1.4 1.5 1.3

Interest

Coverage

(Times)

’96 ’97 ’98 ’99 ’00

1.8

2.5

2.9

3.3

1.2

Sales in the Business Machines segment fell ¥7.9 billion, or

3.2%, to ¥239.8 billion, primarily as a result of the cancellation

of an OEM contract to supply printers. Konica boosted sales

of business machines in the United States and maintained its

leading share of the market for high-speed digital copiers.

By geographic region, sales in Japan increased ¥4.1 billion,

or 1.2%, to ¥332.6 billion. Overseas, sales in North America

fell ¥21.2 billion, or 14.1%, to ¥129.2 billion; sales in Europe fell

¥7.9 billion, or 9.2%, to ¥78.1 billion; and sales in Asia increased

¥1.6 billion, or 8.4%, to ¥21.0 billion.

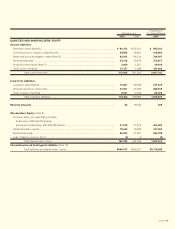

INCOME

Due to measures to reduce procurement costs and improve

the profit structure of the Company’s product lineup, gross profit

slipped only ¥4.6 billion, or 1.9%, to ¥237.2 billion, and the gross

profit margin edged up to 42.3%, from 41.4%.

Selling, general and administrative (SG&A) expenses fell

¥23.2 billion, or 10.2%, to ¥204.1 billion. Savings achieved

through the restructuring of marketing operations in the United

States in fiscal 1999, the sale of the Company’s presensitized

plate business, and other organizational reforms contributed sig-

nificantly to this steep reduction in expenses. SG&A expenses

as a percentage of net sales fell from 38.9% to 36.4%. As a result,

operating income rose ¥18.6 billion, or 127.3%, to ¥33.1 billion,

and the operating income ratio improved to 5.9%, from 2.5%.

Total other income (expenses) declined ¥7.5 billion, or 29.6%,

to expenses of ¥17.9 billion. This mainly reflects the sharp decline

in restructuring costs and decrease in interest expenses that

accompanied a reduction in interest-bearing debt. These gains

more than offset foreign currency losses.

As a result, Konica posted net income of ¥7.6 billion, com-

pared with a net loss of ¥3.2 billion in fiscal 1999. Net income

per share (before dilution) surged from a net loss of ¥8.9 to

net income of ¥21.3.

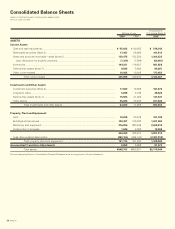

Composition of

Total Capital

Employed

(Billions of yen, %)

Shareholders’ Equity

Interest-Bearing Debt

Other Liabilities

Equity Ratio (%)

’96 ’97 ’98 ’99 ’00

82

74

68

60

68