Konica Minolta 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OPERATING ENVIRONMENT

In fiscal 2000, ended March 31, 2000, despite signs of improve-

ment in the Japanese economy, depressed consumer spending

and a difficult employment market again prevented a full recovery.

Conditions were better overseas, with the United States main-

taining strong economic growth, European countries experienc-

ing a steady rise in demand, and Asian economies starting to

recover.

Amid these circumstances, Konica moved forward with a new

four-year management plan, SAN 2003. Under this plan, the

Company is implementing an internal company system and pro-

moting business reforms that respond to the growing influence

of digital technology on information imaging. Furthermore, Konica

is strengthening its consolidated management and evaluating

businesses based on their contribution to Group results.

The new structure comprises the following internal companies

and groups: Consumer Imaging Company, Medical and Graphic

Company, Inkjet Business Group, and EM and ID Business Group

(grouped as the Photographic Materials and Photo-Related

Industrial Equipment segment); and Office Document Company,

Optics Technology Company, and Camera and Digital Photo

Group (grouped as the Business Machines, Cameras, and

Optical Products segment).

SALES

Consolidated net sales declined ¥23.4 billion, or 4.0%, to

¥560.9 billion. The main reasons for the decline were weak

demand for consumer products in Japan as well as the appre-

ciation of the yen against the U.S. dollar and the deutsche mark.

By segment, sales in the Photographic Materials segment

declined ¥15.6 billion, or 4.6%, to ¥321.1 billion. Overseas,

Konica enjoyed brisk demand for its films and photographic

paper in Europe, Southeast Asia, and the United States. However,

depressed market conditions in Japan (combined with adverse

exchange rate movements) led to a decline in segment sales.

16 KONICA

Net Sales, Cost of

Sales, and Cost

of Sales Ratio

(Billions of yen, %)

Net Sales

Cost of Sales

Cost of Sales Ratio (%)

505

578

584

584

561

298

345

342

343

324

’96 ’97 ’98 ’99 ’00

59 60 59 59 58

505

578

584

584

561

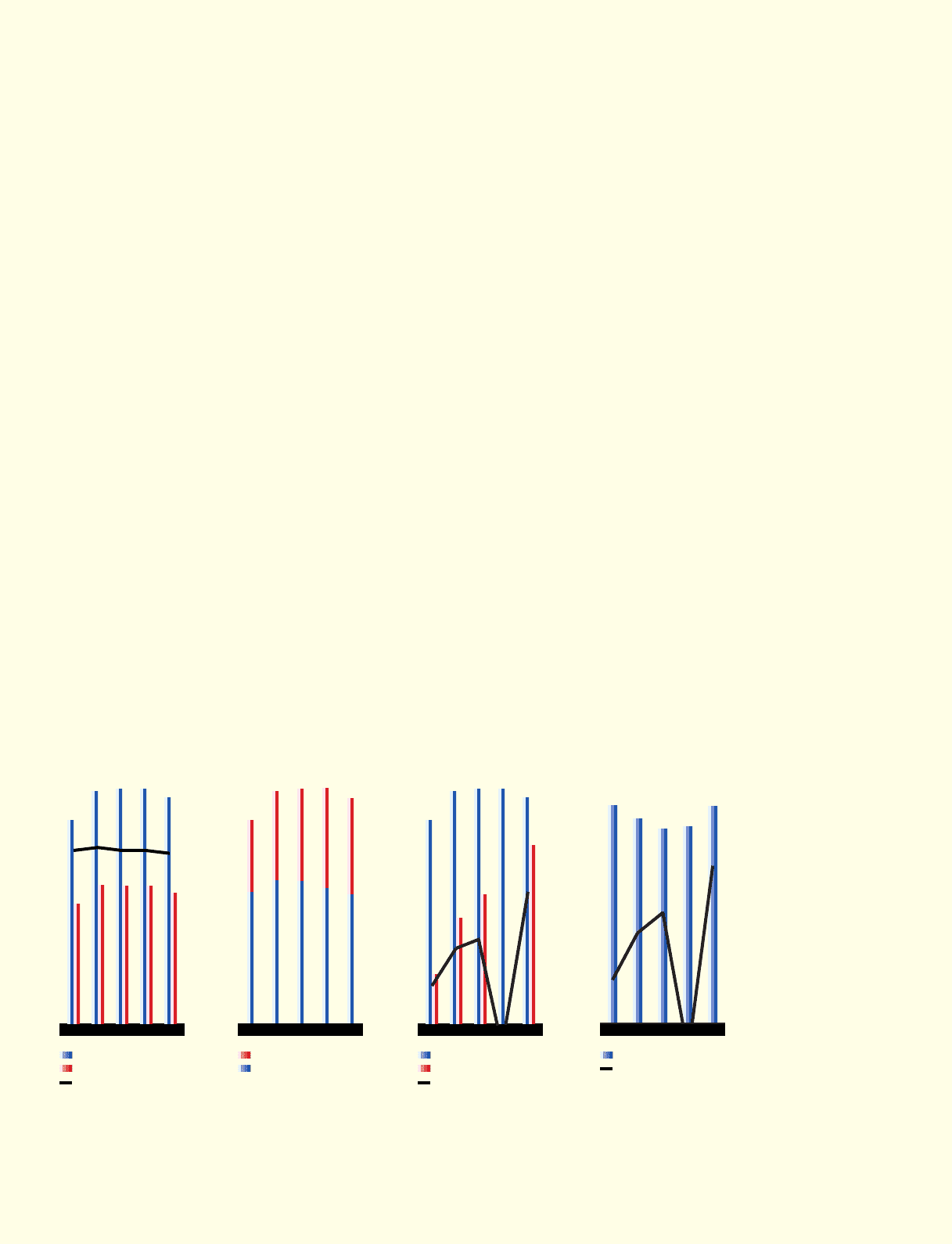

Net Sales by

Product Segment

(Billions of yen)

Business Machines

Photographic Materials

’96 ’97 ’98 ’99 ’00

’96 ’97 ’98 ’00

Net Sales,

Net Income, and

Return on Sales

(Billions of yen, %)

Net Sales

Net Income

Return on Sales (ROS) (%)

505

578

584

584

561

2.1

4.5

5.5

7.6

’99

0.4

–3.2

0.8

0.9

–0.5

1.4

29.8

27.9

26.6

26.9

29.6

’96 ’97 ’98 ’99 ’00

Shareholders’

Equity Ratio and

Return on Equity

(%)

Shareholders’ Equity Ratio

Return on Equity (ROE)

2.7

3.3

–1.9

4.7

1.3

Financial Review

(Consolidated Financial Statements)