Kia 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

6667

Financial Statements & Notes

Pursuant to the decision of the National Tax Tribunal, the tax authorities reassessed the Company’s tax loss carry forw ard and determined the deductible

amount for tax loss carry forw ard as 640,589 million ($533,646 thousand) as of January 1, 2001, after the utilization of 98,093 million ($81,717

thousand) of tax loss carry forw ard during fiscal 2000. In prior years, the future tax benefits from the tax loss carryforw ard w ere not recorded by the

Company as deferred income tax assets pending the outcome of the tax litigation. Accordingly, in 2001, the Company recognized the tax benefits from

the reassessed tax loss carry forw ard as an extraordinary gain in the amount of 197,301 million ($164,363 thousand) (see Note 17). Additionally, in

2001, as a result of the determination of the deductible amount for tax loss carryforw ard, out of 34,256 million ($28,537 thousand) paid and recorded

as other receivables in 2000 w ith respect to the asset revaluation in 1999, the asset revaluation tax amounting to 22,044 million ($18,363 thousand)

w as refunded to the Company.

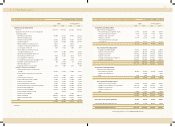

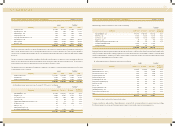

17. INCOM E TAX EXPENSE AND DEFERRED INCOM E TAX ASSETS

Income tax expense in 2002 and 2001 are computed as follow s:

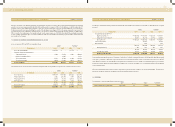

The difference betw een income before tax in financial accounting and taxable income pursuant to Corporate Income Tax Law of Korea is as follow s:

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

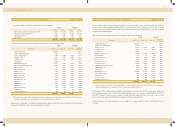

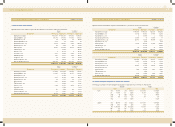

The changes in accumulated temporary difference in 2002 and 2001 and deferred income tax assets as of December 31, 2002 and 2001 are computed

as follow s:

The accumulated temporary differences as of December 31, 2002 do not include the temporary differences of 278,562 million ($232,058 thousand)

for the gain on revaluation of land, w hich may not be disposed of in the near future. In addition, in 2001, the deferred income tax effect of 65,867

million ($54,871 thousand) on the temporary differences arising from the cumulative effect of the change of the financial statements of the investments

accounted for using the equity method and charging the Company’s share in investees’ cumulative loss to its accumulated deficit w ere directly adjusted

in the accumulated deficit.

When each temporary difference reverses in the future, it w ill result in a decrease (increase) of taxable income and income tax payable. Deferred income

tax assets are recognized only w hen it is probable that the differences w ill be realized in the future.

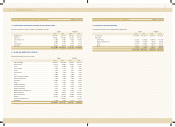

18. DIVIDENDS

The computation of the proposed dividends for 2002 is as follow s:

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

Description 2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Income tax currently payable 105,370 -87,779 -

Changes in deferred income taxes due to:

Temporary differences 12,269 (70,453) 10,221 (58,691)

Added to Accumulated Deficits - 65,867 - 54,871

Tax loss carry forw ard 50,301 147,000 41,904 122,459

Tax credit carry forw ard (8,009) (73,197) (6,672) (60,977)

Income tax expense 159,931 69,217 133,231 57,662

Description 2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Income before tax 801,310 621,452 667,536 517,704

Permanent differences 12,493 (355,789) 10,407 (296,392)

Temporary differences (39,267) 283,719 (32,712) 236,354

Other adjustments 23,227 (78,156) 19,349 (65,109)

797,763 471,226 664,581 392,557

Tax loss carry forw ard (169,363) (471,226) (141,089) (392,557)

Taxable income 628,400 -523,492 -

Description 2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Accumulated temporary difference

Beginning of period, net 1,594,592 1,310,873 1,328,384 1,092,030

Changes in the current year, net (39,267) 283,719 (32,712) 236,354

End of period, net 1,555,325 1,594,592 1,295,672 1,328,384

Tax loss carry forw ard - 169,363 - 141,089

Other difference - 2,044 - 1,702

1,555,325 1,765,999 1,295,672 1,471,175

Statutory tax rate (% ) 29.7 29.7 29.7 29.7

461,932 524,502 384,815 436,940

Tax credit carry forw ard 144,411 136,402 120,302 113,630

Deferred income tax assets 606,343 660,904 505,117 550,570

Number of Korean won U.S. dollars(Note 2)

Shares Dividend rate (in millions) (in thousands)

Common shares, net of treasury shares 368,121,297 5% 92,030 76,666