Kia 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

3839

Operational Report / Auditor' s Report

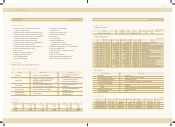

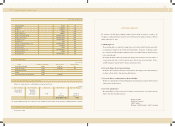

Details on the expected amount of cash dividends to be paid out are as follow s:

10. KEY ISSUES AFTER FISCAL YEAR CLOSURE

No key issues to report.

11. IM PORTANT POINTS RELATED TO OTHER BUSINESS

January 1, 2002 ~ December 31, 2002

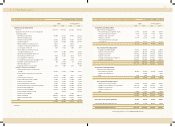

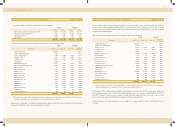

Dongyung Industries

Hyundai Mobis

INI Steel

Kia Japan, Co., Ltd

Kia Motors America, Inc.

Kia Motors Deutschland GmbH.

Kia Motors Europe Gmbh.

Yan ji Kia Motors A/S

Kia Canada, Inc

Dongfeng∙Yueda-Kia Motors Co., Ltd

Asia Motors Do Brazil

PT. Kia Timor Motors

Wuhan Grand Motor Co., Ltd

Kia Service Philippines

Kia-Ihlas Motor A.S.

〃115,382 19.2

〃13,858,120 16.3

〃18,159,517 15.6

〃85,800 100.0

〃1,000,000 100.0

〃Limited Company 100.0

〃Limited Company 100.0

〃Limited Company 100.0

〃3.054 82.5

〃Limited Company 50.0

〃87,206,990 43.0

〃30,000 30.0

〃Limited Company 21.4

〃60,000 20.0

〃Limited Company 15.0

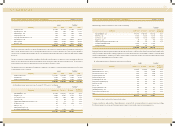

9. M AJOR CREDITORS

Korea Development Bank 178,994

Kyobo Life Insurance 49,636

Bankers Trust Company 39,283

SG ABS 33,595

Korea Development Leasing Corporation 29,527

12,948,790

6,746,368

-

-

2,458,580

3.5%

1.8%

-

Name Credit Outstanding Shares Held Equity Share

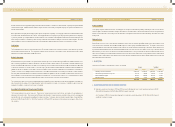

Type of Stock No. of Shares Par Value Payout Ratio Expected Payout

(Won, Shares)

(Shares, millions of Won)

Common Stock 369,730,455

(Treasury Stock) (1,609,158)

368,121,297 5,000 5% 92,030 mn.

Net Income 641,379 mn.

Dividend Propensity 14.35%

The company's dividend yield rate for the fiscal year is 2.6% (dividends per share of 250÷closing share price on dividend basic date of 9,600).

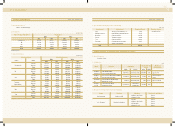

We, members of the Kia Motors Auditing Committee, hereby submit the results of our audit of the

Company's accounting and business operations for the 59th Fiscal Year, starting on January 1, 2002 and

ending on December 31, 2002.

1. Auditing Approach

The accounting audit was conducted by reading the account books and related documents and careful-

ly examining the financial reports and their attached statements. Contrastive, documentary, admis-

sive, referential and other appropriate auditing procedures were applied whenever deemed necessary

in the conduct this audit.

We attended the Board of Directors' meetings and other important meetings to in the performance of

our operational audit, and we received reports from the directors when deemed necessary. We also

carefully examined documents related to all major operational activities.

2. Notes on the Balance Sheet & Income Statement

The Balance Sheet and Income Statement accurately present the Company's assets and profitability in

accordance with the Articles of Incorporation and Korean Law.

3. Notes on the Report on Appropriations of Retained Earnings

The Report on Appropriations of Retained Earnings has been prepared in accordance with the Articles

of Incorporation and Korean Law.

4. Notes on the Annual Report

The Annual Report accurately presents the Company's operational status in accordance with the

Articles of Incorporation and Korean Law.

AUDITOR'S REPORT

February 20, 2003

Kia Motors Coporation

Audit Committee

Chairman of Audit Committee Kim, Jong-chang