Kia 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

5455

Financial Statements & Notes

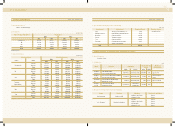

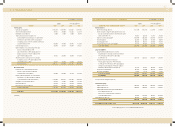

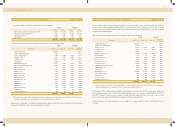

(2) Investment securities as of December 31, 2002 and 2001 consist of the follow ing:

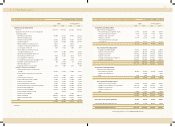

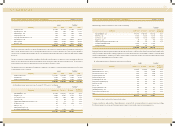

(3) Equity securities accounted for using the equity method as of December 31, 2002 consist of the follow ing:

(* ) Excluded from using the equity method as individual beginning balance of assets are less than the required assets level of 7,000 million ($ 5,831 thousand) and

the differences arising from the use of the equity method are not considered material, w hich are stated at cost.

Equity securities are valued based on the unaudited financial statements w ith adjustments made for the effects of any significant events or transactions.

Also, significant unrealized profit (loss) on intercompany transactions is eliminated.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

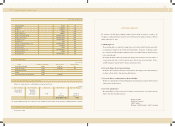

As of December 31, 2002, the difference betw een acquisition cost and equity value of 131,707 million ($109,719 thousand) w as

accounted for as a charge to beginning accumulated deficit for 164,679 million ($137,187 thousand) up to prior year, gain on valuation

of 43,776 million ($36,467 thousand) reflected in current operations and loss on valuation of investment equity securities of 10,804 million ($8,999

thousand) reflected in capital adjustments.

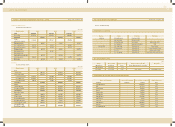

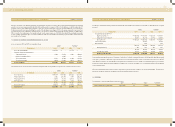

Equity securities accounted for using the equity method as of December 31, 2001 consist of the follow ing:

(* ) Excluded from using the equity method as individual beginning balance of assets are less than the required assets level of 7,000 million ($ 5,831 thousand) and

the differences arising from the use of the equity method are not considered material, w hich are stated at cost.

As of December 31, 2001, the difference betw een acquisition cost and equity value of 178,383 million ($148,603 thousand) w as accounted for as a

charge to beginning accumulated deficit for 29,721 million ($24,759 thousand) up to prior year, a charge to accumulated deficit for 146,954 mil-

lion ($122,421 thousand) in the current year, gain on valuation of 11,996 million ($9,993 thousand) reflected in current operations and loss on valua-

tion of investment equity securities of 13,704 million ($11,416 thousand) reflected in capital adjustments.

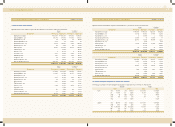

The unamortized balance of the positive goodw ill and the unreversed balance of the negative goodw ill as of December 31, 2002 and 2001 consist of

the follow ing:

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Equity securities accounted for using the equity method 378,281 231,344 315,129 192,722

M arketable investment equity securities 433,234 354,356 360,908 295,198

Unlisted equity securities 40,895 16,605 34,068 13,833

Debt securities 25,646 23,353 21,365 19,455

878,056 625,658 731,470 521,208

Company

Acquisition cost Equity value Equity value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Kia M otors America, Inc. 66,798 -- 100.00

Kia M otors Deutschland GmbH 53,139 - - 100.00

Kia M otors Europe GmbH 41,060 20,666 17,216 100.00

Kia Japan Co., Ltd. 33,197 23,479 19,559 100.00

Kia Tigers Co., Ltd. 20,300 14,094 11,741 100.00

Kia Canada, Inc. 58,507 - - 82.53

Hyundai Pow ertek Co., Ltd. 70,000 70,263 58,533 50.00

Dong feng Yueda-Kia M otors Co., Ltd. 22,316 19,007 15,834 50.00

WIA Corporation 347 32,425 27,012 45.30

Cheju Dynasty Co., Ltd. 8,520 4,788 3,989 40.00

Bontek Co., Ltd. 1,950 6,470 5,390 39.00

Donghui Auto Co., Ltd. 10,530 10,530 8,772 35.12

PT. Kia Timor M otors 10,908 11,532 9,607 30.00

TRW Steering Co., Ltd. 8,952 9,080 7,564 29.00

Hyundai Dymos Co., Ltd. 30,850 33,119 27,590 27.07

e-HD.com Inc. 4,558 3,329 2,773 22.76

Hyundai Hysco Co., Ltd. 64,829 115,086 95,873 21.57

Autoever Co., Ltd. 1,000 2,186 1,821 20.00

Yan Ji Kia M otors A/S (* ) 1,792 1,792 1,493 100.00

NGVTEK.Com (* ) 250 250 208 24.39

Kia Service Philipines Co. (* ) 185 185 154 20.00

509,988 378,281 315,129

Percentage of

ow nership (% )

Company

Acquisition cost Equity value Equity value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Kia M otors America, Inc. 66,798 -- 100.00

Kia M otors Deutschland GmbH 53,139 - - 100.00

Kia Japan Co., Ltd. 33,197 23,598 19,658 100.00

Kia Tigers Co., Ltd. 20,300 18,221 15,179 100.00

Kia Canada, Inc. 58,507 - - 82.53

Hyundai Pow ertek Co., Ltd. 40,000 34,393 28,651 50.00

WIA Corporation 347 347 289 45.30

Cheju Dynasty Co., Ltd. 8,520 4,828 4,022 40.00

Bontek Co., Ltd. 1,950 1,950 1,624 39.00

Hyundai Dymos Co.,Ltd. 30,850 31,531 26,267 30.12

PT. Kia Timor M otors 10,908 11,205 9,334 30.00

Yancheng Yueda-Kia M otors Co., Ltd. 5,503 267 222 30.00

TRW Steering Co., Ltd. 8,952 8,952 7,458 29.00

e-HD.com Inc. 2,700 1,505 1,254 27.07

Hyundai Hysco Co., Ltd. 64,829 91,320 76,075 21.57

Yan Ji Kia M otors A/S (* ) 1,792 1,792 1,493 100.00

NGVTEK.Com (* ) 250 250 208 24.39

Autoever Co., Ltd. (* ) 1,000 1,000 833 20.00

Kia Service Philipines Co. (* ) 185 185 155 20.00

409,727 231,344 192,722

Percentage of

ow nership (% )