Kia 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

5859

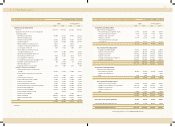

Financial Statements & Notes

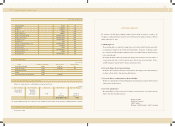

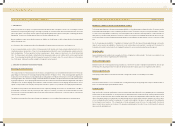

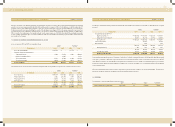

Unlisted equity securities as of December 31, 2001 consist of the follow ing:

Total net equity value of unlisted investment equity securities as of December 31, 2002 and 2001 amount to 44,473 million ($37,048 thousand) and

16,020 million ($13,346 thousand), respectively, based on the investees’ latest financial statements.

(6) Debt securities as of December 31, 2002 consist of the follow ing:

Debt securities as of December 31, 2001 consist of the follow ing:

As the interest rates and repayment periods of corporate bonds w ere changed by mutual agreement in 1999, the difference between nominal value and

present value w as presented as bad debt expense, and amortized using the effective interest method over the remaining period.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

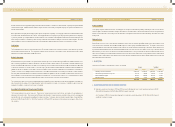

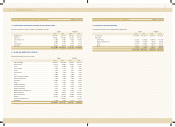

(7) The Company has pledged part of its investment equity securities as collateral for various short-term and long-term borrow ings as of December

31, 2002 as follow s:

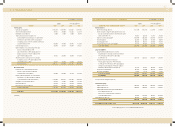

5. INSURANCE

As of December 31, 2002 inventories and property, plant and equipment are insured for 2,864,543 million ($2,386,324 thousand). In addition, the

Company carries general insurance for vehicles and w orkers' compensation and casualty insurance for employees. Also, the Company has insurance to

cover potential product liability arising from its product liability claims w ith maximum coverage of $50,000 thousand in North America and w ith maxi-

mum coverage of 2,000 million ($1,666 thousand) for the domestic market.

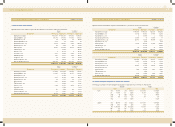

6. PROPERTY, PLANT AND EQUIPM ENT

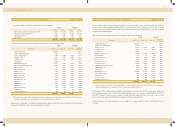

Property, plant and equipment as of December 31, 2002 and 2001 consist of the follow ing:

As of December 31, 2002, the Company's property, plant and equipment are pledged as collateral for various long-term debt to a maximum of

1,115,595 million ($929,353 thousand), and certain machinery of 78,230 million ($65,170 thousand) are mortgaged for various loans (see Notes 9

and 10).

The published value of the Company-ow ned land totals 1,110,428 million ($925,048 thousand) and 1,137,165 million ($947,322 thousand),

respectively, as of December 31, 2002 and 2001, in terms of land prices officially announced by the Korean government.

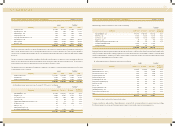

7. INTANGIBLES

Intangibles as of December 31, 2002 and 2001 consist of the follow ing:

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

Company

Acquisition cost Book value Book value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Korea Telecom I Com Co., Ltd. 7,200 7,200 5,998 0.40

Dongw on Capital Co., Ltd. 3,000 3,000 2,499 4.62

Daeshin Factoring Co., Ltd. 2,000 2,000 1,666 3.33

Shinsegi Telecom. Co., Ltd. 837 837 697 0.41

Kihyup Technology Banking Corp. 700 700 583 2.41

M obil com. Co., Ltd. 600 600 500 6.02

A.P. Co., Ltd. 550 550 458 9.20

Donghui Auto Co., Ltd. 500 500 417 19.20

Dongyung Industries Co., Ltd. 240 240 200 19.29

Namyang Industrial Co., Ltd. 200 200 167 8.00

The Korea Economic Daily Co., Ltd. 168 168 140 0.22

Other 610 610 508 -

16,605 16,605 13,833

Acquisition cost Book value Book value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Corporate bonds:

Kia Steel Co., Ltd. 32,698 16,959 15,739 13,111

Seoul Guarantee Insurance Company 16,200 6,382 9,818 8,179

Asset M anagement Co., Ltd. 89 - 89 75

48,987 23,341 25,646 21,365

Percentage of

ow nership (% )

Present value

discount

Acquisition cost Book value Book value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Corporate bonds:

Kia Steel Co., Ltd. 32,698 18,253 14,445 12,033

Seoul Guarantee Insurance Company 16,200 7,292 8,908 7,422

48,898 25,545 23,353 19,455

Present value

discount

Company No. of shares pledged

Kia Steel Co., Ltd. 175,100

Kisan M utual Saving’s & Finance 306,160

Other 1,500

2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Buildings and structures 1,222,836 1,203,497 1,018,690 1,002,580

M achinery and equipment 1,987,189 1,915,268 1,655,439 1,595,525

Vehicles 44,632 42,411 37,181 35,331

Tools, dies and molds 1,077,454 997,678 897,579 831,121

Office equipment 176,730 147,335 147,226 122,738

4,508,841 4,306,189 3,756,115 3,587,295

Less: Accumulated depreciation (1,882,817) (1,534,632) (1,568,491) (1,278,434)

2,626,024 2,771,557 2,187,624 2,308,861

Land 1,399,283 1,433,237 1,165,681 1,193,966

Construction in progress 141,547 98,643 117,916 82,175

4,166,854 4,303,437 3,471,221 3,585,002