Kia 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

4647

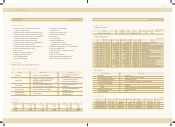

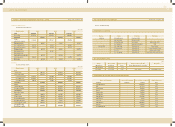

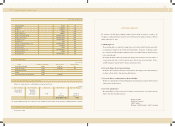

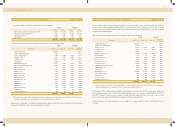

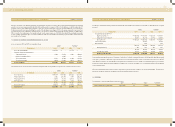

Financial Statements & Notes

Cash flow s from operating activities:

Net income 641,379 552,235 534,304 460,042

Adjustments to reconcile net income to net cash provided

by operating activities:

Depreciation and amortization 462,596 452,117 385,368 376,639

Provision for doubtful accounts - 168,676 - 140,516

Provision for severance benefits 222,579 180,715 185,421 150,546

Provision for w arranties 374,783 462,202 312,215 385,040

Reversal of allow ance for doubtful accounts (5,921) - (4,933) -

Loss (gain) on foreign currency translation, net (47,661) 3,702 (39,704) 3,084

Loss on valuation of inventories 2,520 10,432 2,099 8,690

Gain on valuation of investments accounted

for using the equity method, net (43,776) (11,996) (36,468) (9,993)

Gain on disposal of marketable securities, net - (20,143) - (16,780)

Gain on disposal of investment, net (1,767) (6,375) (1,472) (5,311)

Loss on impairment of investments 2,550 - 2,124 -

Loss on disposal of property, plant and equipment, net 42,874 6,848 35,716 5,705

Amortization of present value discount, net 864 (8,712) 720 (7,258)

Other extraordinary income - (197,301) - (164,363)

Compensation expenses on stock options (368) 2,291 (307) 1,909

Changes in operating assets and liabilities:

Decrease (Increase) in trade notes and accounts

receivable 258,428 (10,053) 215,285 (8,375)

Decrease (Increase) in long-term notes and accounts

receivable (1,164) 6,084 (970) 5,068

Decrease (Increase) in inventories (67,121) 215,397 (55,916) 179,438

Decrease in advances and other receivables 114,600 51,234 95,468 42,681

Decrease in other current assets 66,722 53,891 55,583 44,894

Decrease in deferred income tax assets 54,561 69,218 45,452 57,662

Increase (Decrease) in trade notes and accounts payable 282,928 (441,026) 235,695 (367,399)

Increase in accounts payable-other 50,216 26,958 41,833 22,458

Decrease in other current liabilities (26,730) (35,152) (22,268) (29,284)

Decrease in derivative instruments credit - (39,207) - (32,662)

Increase in income tax payable 70,099 - 58,396 -

Payment of w arranties (296,366) (276,707) (246,889) (230,512)

Payment of severance benefits (55,409) (68,529) (46,159) (57,088)

Other 4,254 15,366 3,547 12,801

2,105,670 1,162,165 1,754,140 968,148

(continued)

NON-CONSOLIDATED STATEM ENTS OF CASH FLOWS

2002 2001 2002 2001

Korean won Translation into U.S. dollars(Note 2)

(in millions) (in thousands)

Korean won Translation into U.S. dollars(Note 2)

(in millions) (in thousands)

FOR THE YEARS ENDED DECEM BER 31, 2002 AND 2001

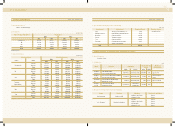

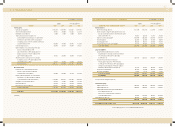

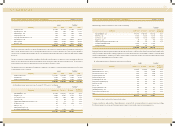

Cash flow s from investing activities:

Cash inflow s from investing activities:

Proceeds from disposal of marketable securities 21,105 228,858 17,582 190,651

Proceeds from disposal of investments 12,018 28,865 10,012 24,046

Reduction in other current assets 136 3,047 113 2,538

Reduction in other assets 46,777 87,635 38,968 73,005

Proceeds from disposal of property, plant

and equipment 56,440 325,553 47,018 271,204

136,476 673,958 113,693 561,444

Cash outflow s from investing activities:

Acquisition of marketable securities (10,051) (34,816) (8,373) (29,004)

Additions to other current assets (367,661) (346,124) (306,282) (288,341)

Acquisition of investments (160,392) (280,310) (133,615) (233,514)

Additions to other assets (151,979) (191,820) (126,607) (159,797)

Acquisition of property, plant and equipment (383,728) (543,720) (319,667) (452,948)

Acquisition of intangible assets (164,441) (112,332) (136,988) (93,579)

(1,238,252) (1,509,122) (1,031,533) (1,257,183)

(1,101,776) (835,164) (917,840) (695,739)

Cash flow s from financing activities:

Cash inflow s from financing activities:

Proceeds from long-term debt 262,489 610,602 218,668 508,665

Refund of asset revaluation tax - 22,044 - 18,364

Other 5,776 6,856 4,812 5,711

268,265 639,502 223,480 532,740

Cash outflow s from financing activities:

Repayment of short-term borrow ings (11,809) (20,286) (9,838) (16,899)

Repayment of current maturities of long-term debt (367,679) (692) (306,297) (576)

Repayment of long-term debt (377,125) (380,531) (314,166) (317,003)

Acquisition of treasury stock - (343,331) - (286,014)

Other (2,656) (2,447) (2,213) (2,038)

(759,269) (747,287) (632,514) (622,530)

(491,004) (107,785) (409,034) (89,790)

Net increase in cash and cash equivalents 512,890 219,216 427,266 182,619

Cash and cash equivalents, beginning of year 250,849 31,633 208,971 26,352

Cash and cash equivalents, end of year 763,739 250,849 636,237 208,971

See accompanying notes to non-consolidated financial statements.

NON-CONSOLIDATED STATEM ENTS OF CASH FLOWS (CONTINUED)

2002 2001 2002 2001

FOR THE YEARS ENDED DECEM BER 31, 2002 AND 2001