Kia 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

5051

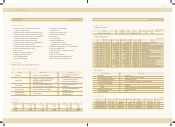

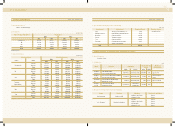

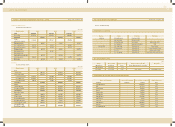

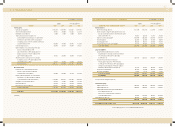

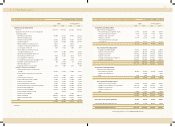

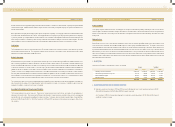

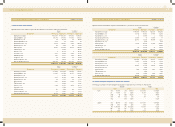

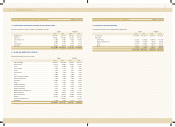

Financial Statements & Notes

Equity securities held for investment that are in companies in w hich the Company is able to exercise significant influence over the operating and financial

policies of the investees are accounted for using the equity method, except investment equity securities in affiliates w hose total assets (non-consolidated

basis) are less than the required level of 7,000 million and the differences arising from the use of the equity method are not considered material, w hich

are stated at cost. The Company’s share in the net income or net loss of investees is reflected in current operations. Changes in the retained earnings,

capital surplus or other capital accounts of investees are accounted for as an adjustment to retained earnings or to capital adjustments.

Debt securities held for investment are classified as either held-to-maturity investment debt securities or available for sale investment debt securities at

the time of purchase. Held-to-maturity debt securities are stated at acquisition cost, as determined by the moving average method. When the face

value of a held-to-maturity investment debt security differs from its acquisition cost, the effective interest method is applied to amortize the difference

over the remaining term of the security. Available-for-sale investment debt securities are stated at fair value, resulting valuation gain or loss reported as a

capital adjustment w ithin shareholder’ equity. How ever, if the fair value of a held-to-maturity or an available-for-sale investment debt security declines

compared to the acquisition cost and is not expected to recover (impaired investment security), the carrying value of the debt security is adjusted to fair

value, w ith the resulting valuation gain or loss charged to current operations. If the fair value of the security subsequently recovers, in the case of a held-

to-maturity debt security, the increase in value is recorded in current operations, up to the amount of the previously recognized impairment loss, and in

the case of an available-for-sale debt security, the increase in value is recorded in capital adjustments.

The low er of acquisition cost of investments in treasury stock funds and the fair value of treasury stock included in a fund is accounted for as treasury

stock in capital adjustments.

Property, Plant and Equipment and Related Depreciation

Property, plant and equipment are stated at cost, except for the assets revalued upw ard in accordance w ith the Asset Revaluation Law of Korea. Routine

maintenance and repairs are expensed as incurred. Expenditures that result in the enhancement of the value or extension of the useful lives of the facili-

ties involved are treated as additions to property, plant and equipment.

Before 2002, the Company capitalized interest as part of the cost of constructing major facilities and equipment. The interest expense capitalized w as

21,344 million ($17,781 thousand) in 2001.

As the Company adopted early SKAS No. 7 - Capitalization of Financing Costs, in 2002, all financing costs incurred w ere charged to current operations.

This change of accounting method resulted in the decrease of net income by 10,220 million ($8,514 thousand) compared w ith the previous method.

Depreciation is computed using the straight-line method based on the estimated useful lives of the assets as follow s

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

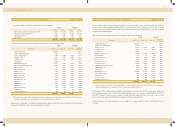

Intangibles

Intangible assets are stated at cost, net of amortization computed using the straight-line method over the estimated economic useful lives of the related

assets from date of usage. Development costs, incurred in conjunction w ith development of new products or technologies and others, are amortized

over the estimated economic useful life (not to exceed 5 years) from the date of usage of the related products, using the straight-line method. Ordinary

development and research costs are expensed as incurred.

Valuation of Receivables and Payables at Present Value

Receivables and payables arising from long-term installment transactions, long-term cash loans (borrow ings) and other similar loan (borrow ing) transac-

tions are stated at present value, if the difference betw een nominal value and present value is material. The present value discount is amortized using

the effective interest rate method, and the amortization is included in interest expense or interest income. The Company's long-term trade notes and

accounts receivable, including current portion, are stated net of unamortized present value discounts of 4,909 million ($4,089 thousand) and 5,601

million ($4,666 thousand) as of December 31, 2002 and 2001, respectively, using an interest rate of 10.0 percent

Accrued Warranties and Product Liabilities

The Company generally provides the ultimate consumer a w arranty for each product sold and accrues w arranty expense at the time of sale based on

actual claims history. In addition, the Company accrues product liability expense w ith respect to its potential product liability claims in North America.

In 2002, the Company recognizes additional accrued liabilities including 15,088 million ($12,569 thousand) of the provision for the projected costs of

all vehicles placed in service prior to December 31, 2001 to comply w ith an European Parliament directive regarding end-of-life vehicles. Under the direc-

tive, manufacturers are financially responsible for at least a portion of the cost of the dismantling and recycling of all vehicles placed in service prior to

July 2002 that are still in operation in January 2007 as w ell as vehicles placed into service after July 2002.

Actual w arranty costs incurred are charged against the accrual w hen paid.

In 2002, the Company changed its estimation of accrued w arranty for the exported vehicles. The Company generally provides the w arranty program

that is limited to certain years in service or certain miles in service from the date of first service, w hichever comes first. Before 2002, the Company esti-

mated the accrual based on the number of vehicles exported w ithin the w arranty period of months in service. How ever, in 2002, the Company accrues

w arranty expenses based on the units in operation w ithin the w arranty term considering miles in service as w ell as months in service. This change result-

ed an increase in net income of 39,860 million ($33,206 thousand).

Accrued Severance Benefits

Employees and directors w ith more than one year of service are entitled to receive a lump-sum payment upon termination of their service with the

Company, based on their length of service and rate of pay at the time of termination. The accrued severance benefits as of December 31, 2002 and

2001 that w ould be payable assuming all eligible employees w ere to resign amount to 1,194,229 million ($994,859 thousand) and 1,026,529 mil-

lion ($855,156 thousand), respectively.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

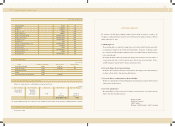

Useful Lives

(Years)

Buildings and structures 20~40

M achinery and equipment 15

Vehicles 5

Tools, Dies and moulds 5

Office equipment 5