Kia 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

6465

Financial Statements & Notes

In accordance w ith the court-approved reorganization plan, on February 2, 1999, all issued shares of common stock, except those ow ned by specific

related persons, w ere reduced by a ratio of 10 to 1, and the shares ow ned by the specific related persons w ere extinguished.

Also, under the court-approved reorganization plan, on M arch 30, 1999, 5,482,181 million ($ 4,566,962 thousand) of the Company’s debt w as for-

given, including its guaranteed obligations, and an additional 1,799,999 million ($1,499,499 thousand) of its liabilities w as converted into capital stock

for w hich 119,999,932 new shares w ere issued at 15,000 per share.

On November 18, 2002, 665million ($554 thousand) of a creditor’s claims in dispute w as additionally determined by the court as the Company’s reor-

ganization claim and converted into capital stock for w hich 133,000 new shares w ere issued.

On November 4, 2000, the shareholders of the Company approved the retirement by December 31, 2001 of 80 million shares, or 17.8 percent of total

common stock issued at the date of shareholders’ meeting. In accordance w ith the consensus reached during the said shareholders’ meeting and the

provisions of the Korean Commercial Code, the Company concluded the stock retirement covering 80 million treasury shares, w hich had been reac-

quired for retirement purposes since the date of the shareholders’ meeting. As a result of the stock retirement, the number of the Company’s total com-

mon shares issued has been reduced to 369,597,455 shares as of December 31, 2001.

Financial institutions, w ith loans to the Company that had been forgiven or converted into the Company’s common stock, and Hyundai M otor

Consortium w ere granted rights to subscribe to the registered non-voting preferred stock w ith a par value of 5,000. On December 28, 1998, the

financial institutions acquired rights equal to 10 percent of the forgiven debt and liabilities converted into new capital stock. Also, on December 28,

1998, the Hyundai M otor Consortium acquired rights up to the extent that the Consortium shall ow n up to 51 percent of all the additional preferred

shares to be issued. These pre-emptive rights can be exercised at once or several times in the fifth or tenth year from December 28, 1999, the date the

court finally approved the reorganization plan, and the Company shall pay the dividend equal to at least 2 percent for the preferred shares to be issued

for the exercise of the rights. In addition, the Asia M otors-invested financial institutions and Hyundai M otor Consortium w ere granted pre-emptive rights

under the same conditions as described above.

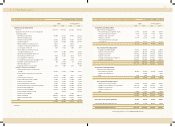

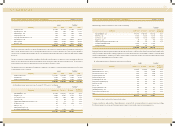

13. CAPITAL SURPLUS

Capital surplus as of December 31, 2002 and 2001 consist of the follow ing

As a result of the capital reduction on February 2, 1999, the Company recognized the gain in capital surplus of 340,848 million ($283,945 thousand).

In 2001, the Company accounted for the loss from the stock retirement amounting to 220,989 million ($184,096 thousand) as a charge against the

gain on capital reduction.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

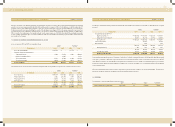

14. DISPOSITIONS OF ACCUM ULATED DEFICIT

The disposition of the Company’s accumulated deficit through December 31, 2002 is summarized below :

The appraisal gain of 1,047,040 million ($872,243 thousand) arising from the Company’s assets revaluation on January 1, 1999 in accordance w ith

the Asset Revaluation Law of Korea w as offset against accumulated deficit.

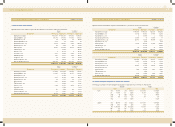

15. CAPITAL ADJUSTM ENTS

Capital adjustments as of December 31, 2002 and 2001 consist of the follow ing:

(1) Treasury stock

As of December 31, 2002 and 2001, the Company has 1,609,158 shares and 1,628,048 shares of treasury stock, respectively, arising mainly

from cross-holdings of investment equity securities due to mergers, and has recorded treasury stock at book value in capital adjustments as of

those dates, respectively.

(2) Stock options

The Company granted stock options to 62 directors (grant date: M arch 17, 2000, exercise date: M arch 17, 2003, expiry date: M arch 18, 2008),

at an exercise price of 5,500 ($4.58) as determined during the meeting of the shareholders on M arch 17, 2000. If all of the stock options,

w hich require at least tw o-year continued service, are exercised, 950,000 new shares or shares held as treasury stock w ill be granted in

accordance w ith the decision of the Board of Directors. The Company calculates the total compensation expense using an option-pricing model.

In the model, the risk-free rate of 10.0 percent, an expected exercise period of 5.5 years and an expected variation rate of stock price of 0.8387

are used. Total compensation expense amounts to 3,735 million ($3,111 thousand) and to be accounted for as a charge to current

operations and a credit to capital adjustment over the required period of service from the grant date using the straight-line method.

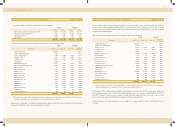

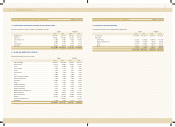

16. EXTRAORDINARY GAIN ON INCOM E TAX BENEFITS

In 1999, the Company and Asia M otors asked the Korean tax authorities to reassess the accumulated tax loss carry forw ard totaling 4,573,584 million

($3,810,050 thousand) for the loss on prior period error corrections that is attributable to events occurring from 1991 to 1997 and charged to the opera-

tions in 1998. How ever, the tax authorities refused to reassess the tax loss carry forw ard and, instead, imposed on M ay 1, 2000, a corporate tax assess-

ment of 380,668 million ($317,118 thousand) pertaining to taxable year 1998.

The Company appealed the dismissal of its request for the reassessment and imposition of corporate tax by the tax authorities and brought the case to

the National Tax Tribunal. On January 31, 2001, the National Tax Tribunal accepted the Company’s assertion and issued its decision for the reassessment

of the Company’s prior years’ taxable income.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Paid-in capital in excess of par value 1,580,065 1,580,065 1,316,282 1,316,282

Gain on capital reduction 119,859 119,859 99,849 99,849

1,699,924 1,699,924 1,416,131 1,416,131

2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Treasury stock (9,631) (9,798) (8,023) (8,162)

Valuation gain on investments (see Note 4) 234,577 175,751 195,416 146,410

Stock option cost 3,735 4,104 3,111 3,419

228,681 170,057 190,504 141,667

Date of Korean won U.S. dollars(Note 2)

disposition (in millions) (in thousands)

Asset revaluation surplus M arch 1999 17,472 14,555

Capital surplus M arch 1999 3,833,190 3,193,261

Other capital surplus M arch 2000 10,609 8,837

3,861,271 3,216,653