Kia 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

5657

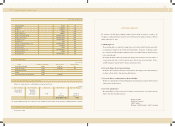

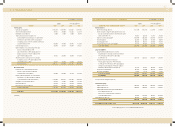

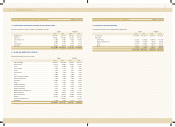

Financial Statements & Notes

The difference betw een the acquisition cost and the Company’s portion of an investee’s net equity at the date the Company w as considered to be

able to exercise significant influence over the operating and financial policy of an investee is amortized over 5 years for positive goodw ill or

reversed over the remaining w eighted average useful life of the identifiable acquired depreciable assets for negative goodw ill, using the straight-

line method.

The value of investments in equity securities of Asia M otors Do Brasil SA has declined and is not expected to recover; accordingly, the difference

betw een the book value and the fair value has been charged to current operations in 1998 as an investment impairment loss. The book value of

these investments is zero and the net equity value has not been recovered as of December 31, 2002.

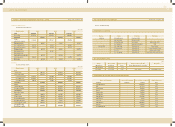

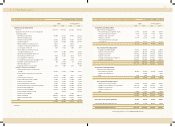

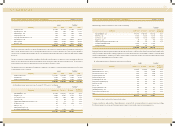

The cumulative losses not recognized by the Company due to suspension of the valuation of investment using the equity method as of December

31, 2002 and 2001 consist of follow ing:

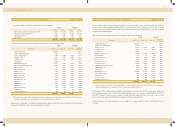

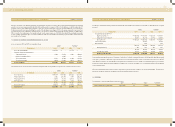

(4) M arketable investment equity securities as of December 31, 2002 consist of the follow ing:

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

M arketable equity securities as of December 31, 2001 consist of the follow ing:

M arketable investment equity securities w ere stated at fair value and the difference of 245,381 million ($204,416 thousand) and 189,455 million

($157,827 thousand) in 2002 and 2001, respectively, betw een the book value and fair value w ere recorded as gain on valuation of investments equity

securities in capital adjustments, excluding 1,515 million ($1,262 thousand) of treasury stock included in the treasury stock fund, w hich w as recorded

in treasury stock in capital adjustments as of December 31, 2001.

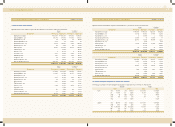

(5) Unlisted equity securities as of December 31, 2002 consist of the follow ing:

(* ) Excluded from using the equity method as temporary invested company

The value of investments in equity securities of Daeshin Factoring Co., Ltd. and A.P. CO., Ltd. has declined and is not expected to recover, accordingly,

the difference between the book value and the fair value has been charged to current operations as an investment impairment loss.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

Company

2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Kia Tigers Co., Ltd 13,804 17,749 11,500 14,786

Hyundai Dymos Co., Ltd. 6,042 8,056 5,033 6,711

TRW Steering Co., Ltd. 2,516 3,145 2,096 2,620

Cheju Dynasty Co., Ltd. 1,350 1,812 1,125 1,509

Dong feng Yueda-Kia M otors Co., Ltd. 3,748 - 3,122 -

Hyundai Hysco Co., Ltd. (77,603) (83,573) (64,648) (69,621)

WIA Corporation (29,486) (32,762) (24,563) (27,293)

Bontek Co., Ltd. (5,421) (6,776) (4,516) (5,645)

(85,050) (92,349) (70,851) (76,933)

Company

2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Kia M otors America, Inc. 110,983 220,066 92,455 183,327

Kia Canada, Inc. 20,162 32,154 16,796 26,786

Kia M otors Deutschland GmbH 63,200 182,075 52,649 151,679

194,345 434,295 161,900 361,792

Company

Acquisition cost Book value Book value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Hyundai M OBIS Co., Ltd. 70,046 302,107 251,672 16.36

INI Steel Co., Ltd. 99,999 105,325 87,742 15.60

LG. Telecom. Co., Ltd. 10,056 8,020 6,681 0.59

Kia Steel Co., Ltd. 96 169 141 0.52

Kanglim Specific Equipment Automotive Co., Ltd. 347 68 57 0.38

SK Telecom. Co., Ltd. 837 5,716 4,762 0.03

Samho Co., Ltd 16 1 1 -

Samlip General Food Co., Ltd. 14 - - -

Stock M arket Stabilization Fund 6,442 11,828 9,852 -

187,853 433,234 360,908

Company

Acquisition cost Book value Book value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Hyundai M OBIS Co., Ltd. 70,046 261,919 218,193 17.55

INI Steel Co., Ltd. 67,680 55,338 46,100 11.52

LG. Telecom. Co., Ltd. 10,056 15,191 12,655 0.59

Kia Steel Co., Ltd. 96 130 108 0.52

Kanglim Specific Equipment Automotive Co., Ltd. 346 120 100 0.38

Stock M arket Stabilization Fund 14,843 21,173 17,638 -

Treasury Stock Funds 2,000 485 404 -

165,067 354,356 295,198

Percentage of

ow nership (% )

Percentage of

ow nership (% )

Company

Acquisition cost Book value Book value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

EUKOR Car Carries, Inc 19,565 19,565 16,299 8.00

Wuhan Grand M otor Co., Ltd. (* ) 7,500 7,500 6,248 21.40

Korea Telecom I Com Co., Ltd. 7,200 7,200 5,998 0.40

Dongw on Capital Co., Ltd. 3,000 3,000 2,499 4.62

Daeshin Factoring Co., Ltd. 2,000 - - 3.33

Asset M anagement Co., Ltd. 950 950 791 19.99

Kihyup Technology Banking Corp. 700 700 583 2.41

M obil com. Co., Ltd. 600 600 500 6.02

A.P. Co., Ltd. 550 - - 9.20

Dongyung Industries Co., Ltd. 241 241 201 19.23

Namyang Industrial Co., Ltd. 200 200 167 8.00

The Korea Economic Daily Co., Ltd. 168 168 140 0.22

Other 771 771 642 -

43,445 40,895 34,068

Percentage of

ow nership (% )