Kia 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

4445

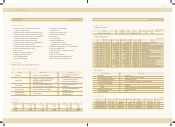

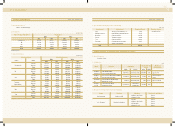

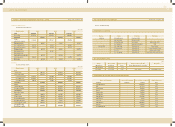

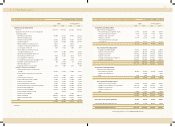

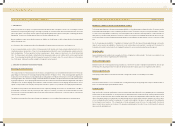

Financial Statements & Notes

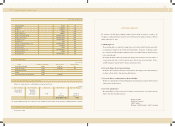

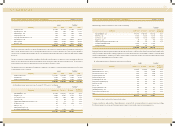

NON-CONSOLIDATED STATEM ENTS OF INCOM E

2002 2001 2002 2001

Korean won Translation into U. S. dollars (Note 2)

(in millions, except per share amounts) (in thousands, except per share amounts)

Korean won Translation into U.S. dollars (Note 2)

(in millions) (in thousands)

FOR THE YEARS ENDED DECEM BER 31, 2002 AND 2001

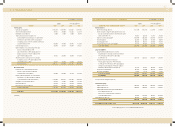

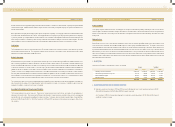

Unappropriated retained earnings (accumulated deficit

before disposition):

Beginning of year (324,952) (783,887) (270,703) (653,021)

Beginning balance adjustments:

Cumulative effects of accounting changes - (39,555) - (32,952)

Asset revaluation tax (Note 16) - (12,212) - (10,173)

Adjustments in investment securities using the

equity method and others - (41,533) - (34,599)

Net income 641,379 552,235 534,304 460,042

316,427 (324,952) 263,601 (270,703)

Appropriations (Disposition)

Legal reserve 9,300 - 7,748 -

Reserve for technology development 214,500 - 178,690 -

Cash dividends declared (Note 18) 92,030 - 76,666

315,830 - 263,104

Unappropriated retained earnings (Undisposed accumulated deficit), end of year

597 (324,952) 497 (270,703)

See accompanying notes to non-consolidated financial statements.

NON-CONSOLIDATED STATEM ENTS OF APPROPRIATIONS OF RETAINED EARNINGS

2002 2001 2002 2001

FOR THE YEARS ENDED DECEM BER 31, 2002 AND 2001

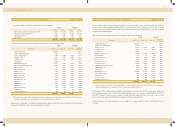

Sales (Note 23) 14,056,450 12,356,346 11,709,805 10,293,524

Cost of sales 11,479,729 9,758,758 9,563,253 8,129,588

Gross profit 2,576,721 2,597,588 2,146,552 2,163,936

Selling and administrative expenses (Note 22) 1,918,228 2,075,347 1,597,991 1,728,879

Operating income 658,493 522,241 548,561 435,057

Other income (expenses), net:

Interest expense, net (13,865) (75,455) (11,551) (62,858)

Foreign exchange gain (loss), net 150,480 (28,179) 125,358 (23,475)

Reversal of allow ance for doubtful accounts 5,921 - 4,933 -

Loss on valuation of inventories (2,520) (10,432) (2,099) (8,690)

Gain on valuation of investments securities

accounted for using the equity method (Note 4) 43,776 11,996 36,468 9,993

Loss on disposal of accounts receivable (40,420) (93,249) (33,672) (77,682)

Gain on disposal of marketable securities, net - 20,143 - 16,780

Gain on disposal of investments 1,767 6,375 1,472 5,311

Loss on impairment of investments (Note 4) (2,550) - (2,124) -

Loss on disposal of property, plant and equipment (42,874) (6,848) (35,716) (5,705)

Other, net 43,102 77,559 35,905 64,610

142,817 (98,090) 118,974 (81,716)

Ordinary income 801,310 424,151 667,535 353,341

Extraordinary item:

Other extraordinary income (Note 16) - 197,301 - 164,363

Income before income tax 801,310 621,452 667,535 517,704

Income tax expense (Note 17) 159,931 69,217 133,231 57,662

Net income 641,379 552,235 534,304 460,042

Ordinary income per common share (Note 2) 1,743 916 1.45 0.76

Earnings per common share (Note 2) 1,743 1,424 1.45 1.19

See accompanying notes to non-consolidated financial statements.