Kia 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

6263

Financial Statements & Notes

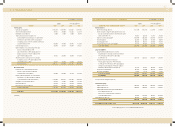

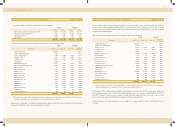

Local currency loans as of December 31, 2002 and 2001 consist of the follow ing:

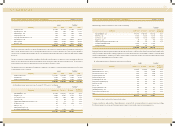

Foreign currency loans as of December 31, 2002 and 2001 consist of the follow ing:

In accordance w ith the court-approved reorganization plan, the above reorganization claims, w ith the exception of current maturities, w ill be

repaid over seven years beginning 2002 to 2008. The applicable interest rate is variable depending on the 3-year non-guaranteed bond circulating

earnings rate.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

In addition to the pledged assets explained in Note 6 to the financial statements, 88 blank checks, 179 blank promissory notes and 2 promissory notes

totalling 1,820 million ($1,516 thousand) are pledged as collateral for the short-term borrowings and the long-term local currency and foreign curren-

cy loans.

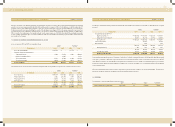

The maturities of long-term debt as of December 31, 2002 are as follow s:

11. COM M ITM ENTS AND CONTINGENCIES

(1) As of December 31, 2002, the outstanding balance of accounts receivable from export sales discounted w ith recourse amounts to 1,068,230

million ($889,895 thousand).

(2) The Company is contingently liable for payment guarantees of indebtedness of 2 million ($2 thousand) to Kisan Corporation as of December

31, 2002.

(3) The Company uses a customer financing system related to a long-term installment sales system and has provided guarantees of 74,682 million

($62,214 thousand) to the banks concerned as of December 31, 2002. These guarantees are all covered by insurance contracts, w hich specifies

a customer and the Company as contractor and beneficiary, respectively.

(4) The Company is a defendant to 2 law suits pertaining to the Company’s denial of creditors’ claim in the in-court reorganization proceedings

amounting to 112,109 million ($93,393 thousand) as of December 31, 2002. In addition, the Company is a defendant in 4 law suits for com

pensation of losses or damages amounting to 6,140 million ($5,115 thousand) as of December 31, 2002. The outcome of those lawsuits is

not currently determinable.

(5) The Company is carrying certain lawsuits pertaining to the disputes w ith the Brazilian Government and the Brazilian shareholders of Asia M otors

Do Brasil S.A. (AM B), w hich w as established as a joint venture by Asia M otors w ith a Brazilian investor, in Brazilian court.

Also, in 2002, the Company brought the case to the International Court of Arbitration to settle the disputes.

The Company, a stockholder of AM B, has already w ritten off its investment of 14,057 million ($11,710 thousand), and the Company estimates

that the above matter does not and w ill not affect the Company’s financial statements at this time.

(6) Effective December 1, 2000, the Company sold its Parts Sales division, w hich had been engaged in selling and distribution of motor parts for

after-sales services, to Hyundai M OBIS. As part of the consideration for the disposal of the division, the Company receives 10 percent of ordinary

income from the former division’s operations during a ten-year period starting in 2001, w hich is payable every year during the said period.

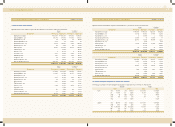

12.CAPITAL STOCK

Capital stock as of December 31, 2002 and 2001 consist of the follow ing:

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Reorganization claims:

Korea Development Bank 134,339 156,726 111,912 130,561

Korea Asset M anagement Corporation. - 77,264 - 64,365

Kyobo Life Insurance Co. 49,636 57,907 41,350 48,240

Chohung Bank - 45,332 - 37,764

Woori Bank - 43,476 - 36,218

SG ABS Ltd. 33,595 39,191 27,987 32,648

Korea Development Leasing Corp. 29,527 34,447 24,598 28,696

Shinhan Bank - 34,086 - 28,396

Hanaro Finance 26,868 31,342 22,383 26,110

Seoul Guarantee Insurance Company 13,849 15,137 11,537 12,610

Others 237,041 407,639 197,466 339,586

524,855 942,547 437,233 785,194

Other loans 20,335 17,928 16,941 14,935

Sub total 545,190 960,475 454,174 800,129

Less: Current maturities (87,784) (135,741) (73,129) (113,080)

457,406 824,734 381,045 687,049

2002 2001 2002 2001

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

Reorganization claims:

Korea Development Bank 44,655 57,552 37,200 47,944

Bankers Trust Company 39,283 50,629 32,725 42,177

Chohung Bank - 27,093 - 22,570

Woori Bank 14,416 18,022 12,009 15,013

First Citicorp Leasing Inc. 10,781 13,895 8,981 11,575

Korea Non-Bank Lease Financing 10,119 13,042 8,430 10,865

Citibank 7,958 10,256 6,629 8,544

Korea Development Leasing Corp. 4,175 5,381 3,478 4,483

Chohung Capital 3,800 4,898 3,166 4,080

Other 13,424 22,795 11,183 18,989

Sub total 148,611 223,563 123,801 186,240

Less: Current maturities (24,767) (31,938) (20,632) (26,606)

123,844 191,625 103,169 159,634

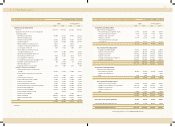

Debentures Local currency loans Foreign currency loans Total Total

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

2004 370,040 88,282 24,766 483,088 402,439

2005 180,060 89,493 24,766 294,319 245,184

2006 228,076 88,947 24,730 341,753 284,699

Thereafter - 190,684 49,582 240,266 200,156

778,176 457,406 123,844 1 ,359,426 1,132,478

Authorized Issued Par value

Korean won U.S. dollars(Note 2)

(in millions) (in thousands)

2002 820,000,000 shares 369,730,455 shares 5,000 1,848,652 1,540,030

2001 820,000,000 shares 369,597,455 shares 5,000 1,847,987 1,539,476