Kia 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 KIA MO TO RS AN N UAL REPORT

4849

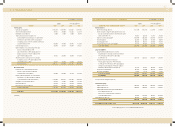

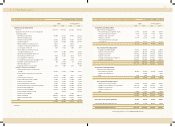

Financial Statements & Notes

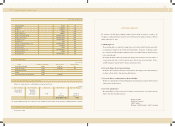

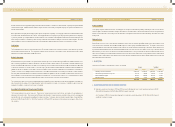

1. THE COM PANY

Kia M otors Corporation (the “ Company” ), incorporated in December 1944 under the law s of the Republic of Korea, is one of the leading motor vehicle

manufacturers in Korea producing and offering for sale a range of passenger cars, recreational vehicles and commercial vehicles both in the domestic

and the export markets. The Company ow ns and operates three principal automobile production plants: the Sohari plant, the Hw asung plant and the

Kwangju plant. The shares of the Company have been listed on the Korea Stock Exchange since 1973.

Overseas subsidiaries for export sales are Kia M otors America, Inc. (KMA) in the U.S, Kia Canada, Inc. (KCI) in Canada, Kia M otors Deutschland GmbH

(KM D) in Germany and others.

As of December 31, 2002, the largest shareholder of Kia is Hyundai M otor Company, w hich holds 36.3 percent of the Company’s stock.

In response to general unstable economic conditions, the Korean government and the private sector have been implementing structural reforms to his-

torical business practices. Implementation of these reforms is progressing slow ly, particularly in the areas of restructuring private enterprises and reform-

ing the banking industry. The Korean government continues to apply pressure to Korean companies to restructure into more efficient and profitable

firms. The Company may be either directly or indirectly affected by these general unstable economic conditions and the reform program described

above. The accompanying financial statements reflect management’s assessment of the impact to date of the economic situation on the financial posi-

tion of the Company. Actual results may differ materially from management’s current assessment.

2. SUM M ARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Financial Statement Presentation

The Company maintains its official accounting records in Korean w on and prepares statutory non-consolidated financial statements in the Korean lan-

guage (Hangul) in conformity w ith the accounting principles generally accepted in the Republic of Korea. Certain accounting principles applied by the

Company that conform w ith financial accounting standards and accounting principles in the Republic of Korea may not conform w ith generally accepted

accounting principles in other countries. Accordingly, these financial statements are intended for use by those w ho are informed about Korean account-

ing principles and practices. The accompanying financial statements have been condensed, restructured and translated into English (with certain expand-

ed descriptions) from the Korean language financial statements. Certain information included in the Korean language financial statements, but not

required for a fair presentation of the Company’s financial position and results of operations, is not presented in the accompanying financial statements.

The US dollar amounts presented in these financial statements w ere computed by translating the Korean w on into US dollars based on the Bank of

Korea Basic Rate of 1,200.40 to US $1.00 at December 31, 2002, solely for the convenience of the reader. This convenience translation into US dol-

lars should not be construed as a representation that the Korean w on amounts have been, could have been, or could in the future be, converted at this

or any other rate of exchange.

The significant accounting policies follow ed by the Company in the preparation of its non-consolidated financial statements are summarized below .

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001

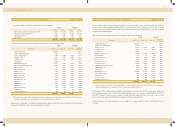

Early Adoption of Statement of Korea Accounting Standards No. 6 and No. 7

The Company adopted Statement of Korea Accounting Standards (SKAS) No. 6 - Events Occurring after the Balance Sheet Date. The statement provides

accounting and reporting standards for events occurring after the balance sheet date. This statement is effective for fiscal years subsequent to December

31, 2002; how ever, earlier application is permitted. As the Company adopted early this statement in 2002, appropriations of retained earnings to be

approved at the stockholders meeting subsequent to December 31, 2002 are not recorded in the accompanying financial statements and to be account-

ed for in 2003. Relevant accounts and unappropriated retained earnings for the preceding year have been adjusted to conform to the provision of SKAS

No. 6.

Also, the Company adopted early SKAS No. 7 - Capitalization of Financing Costs in 2002, w hich presents that principally all financing costs should be

charged to current operations but capitalization of financial costs to meet certain conditions can be acceptable. In accordance w ith this statement, the

Company elected to adopt the accounting method of charging all financing costs to current operations by using the prospective approach.

Revenue Recognition

Revenue, including long-term installment sales, is recognized at the time of shipping motor vehicles and parts. The interest income arising from long-

term installment sales contracts is recognized using the level yield method.

Valuation of M arketable Securities

M arketable securities are recorded at purchase price plus incidental costs. How ever, if the fair value of marketable securities differs from the book value

determined by the moving average method, the securities are stated at fair value and the valuation gain or loss is recognized in current operations.

Allow ance for Doubtful Accounts

The Company provides an allowance for doubtful accounts based on management’s estimate of the collectibility of the receivables.

Inventories

Inventories are stated at the low er of cost or net realizable value, cost being determined by the moving average method except for materials in-transit for

w hich cost is determined using the specific identification method.

Investment Securities

Equity securities held for investment (excluding those accounted for using the equity method discussed in the next paragraph) that are not actively traded

(unlisted security) are stated at acquisition cost, as determined by the moving average method. Actively quoted (listed) securities, including those traded

over-the-counter, are stated at fair value, w ith the resulting valuation gain or loss reported as a capital adjustment w ithin shareholders’ equity. If the fair

value of a listed equity security or the net equity value of an unlisted security held for investment declines compared to acquisition cost and is not expect-

ed to recover (impaired investment security), the carrying value of the equity security is adjusted to fair value or net equity value, w ith the resulting valua-

tion loss charged to current operations. If the net equity value or fair value subsequently recovers, in the case of an unlisted security, the increase in

value is recorded in current operations, up the amount of the previously recognized impairment loss, and in the case of a listed security, the increase in

value is recorded in capital adjustments.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEM ENTS DECEM BER 31, 2002 AND 2001