Intel 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The U.S. Intel Minimum Pension Plan benefit is determined by a participant’s years of service and final average compensation as

defined by the plan document. The plan generates a minimum pension benefit if the participants’ U.S. Intel Minimum Pension

Plan benefit exceeds the annuitized value of their U.S. Intel Retirement Contribution Plan benefit. If participant balances in the

U.S. Intel Retirement Contribution Plan do not grow sufficiently, the projected benefit obligation of the U.S. Intel Minimum Pension

Plan could increase significantly. Consistent with applicable law, assets of the U.S. Intel Minimum Pension Plan are held in trust,

solely for the benefit of plan participants, and are not available for general corporate purposes.

Non-U.S. Pension Benefits. We also provide defined-benefit pension plans in certain other countries, most significantly Germany,

Ireland, and Israel. Consistent with the requirements of local law, we deposit funds for certain plans with insurance companies,

with third-party trustees, or into government-managed accounts, and/or accrue for the unfunded portion of the obligation. The

Ireland pension plan and one of our Germany pension plans were closed to employees hired on or after June 20, 2012 and

January 1, 2014, respectively.

U.S. Postretirement Medical Benefits. Upon retirement, eligible U.S. employees who were hired prior to January 1, 2014 are

credited with a defined dollar amount, based on years of service, into a U.S. Sheltered Employee Retirement Medical Account

(SERMA). These credits can be used to pay all or a portion of the cost to purchase coverage in the retiree’s choice of medical

plan. If the available credits are not sufficient to pay the entire cost of the coverage, the remaining cost is the retiree’s

responsibility. Employees hired on or after January 1, 2014 are not eligible to earn a SERMA benefit.

Funding Policy. Our practice is to fund the various pension plans and the U.S. postretirement medical benefits plan in amounts

sufficient to meet the minimum requirements of applicable local laws and regulations. Additional funding may be provided as

deemed appropriate. Depending on the design of the plan, local customs, and market circumstances, the liabilities of a plan may

exceed qualified plan assets.

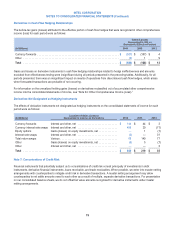

Benefit Obligation and Plan Assets

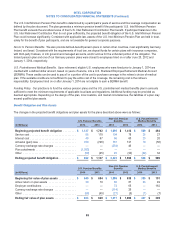

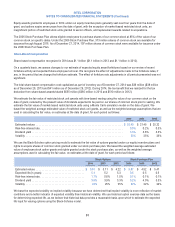

The changes in the projected benefit obligations and plan assets for the plans described above were as follows:

U.S. Pension Benefits

Non-U.S. Pension

Benefits

U.S. Postretirement

Medical Benefits

(In Millions) 2014 2013 2014 2013 2014 2013

Beginning projected benefit obligation ......... $ 1,137 $ 1,742 $ 1,695 $ 1,412 $ 509 $ 484

Service cost ................................ 88 119 104 78 26 27

Interest cost ................................ 49 67 66 60 23 20

Actuarial (gain) loss .......................... 760 (746) 767 121 10 (56)

Currency exchange rate changes ............... ——(254) 46 ——

Plan curtailments ............................ (1,083) —————

Other ..................................... (59) (45) 45 (22) (22) 34

Ending projected benefit obligation ............ $ 892 $ 1,137 $ 2,423 $ 1,695 $ 546 $ 509

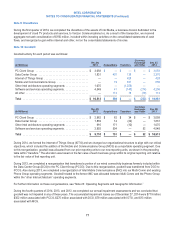

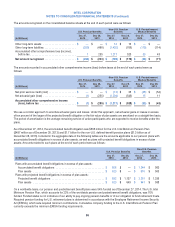

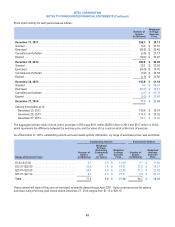

U.S. Pension Benefits

Non-U.S. Pension

Benefits

U.S. Postretirement

Medical Benefits

(In Millions) 2014 2013 2014 2013 2014 2013

Beginning fair value of plan assets ............ $ 649 $ 684 $ 1,005 $ 838 $ 395 $ 191

Actual return on plan assets ................... 30 10 80 81 33 49

Employer contributions ....................... ——73 65 —162

Currency exchange rate changes ............... ——(114) 26 ——

Other ..................................... (56) (45) (27) (5) (1) (7)

Ending fair value of plan assets ............... $ 623 $ 649 $ 1,017 $ 1,005 $ 427 $ 395

85