Intel 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

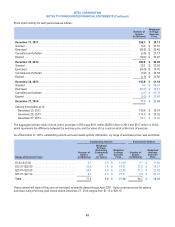

As of December 27, 2014, we had not recognized U.S. deferred income taxes on a cumulative total of $23.3 billion of

undistributed earnings for certain non-U.S. subsidiaries and $1.6 billion of other basis differences of our investments in certain

non-U.S. subsidiaries primarily related to McAfee. Determining the unrecognized deferred tax liability related to investments in

these non-U.S. subsidiaries that are indefinitely reinvested is not practicable. We currently intend to indefinitely reinvest those

earnings and other basis differences in operations outside the U.S.

Current income taxes payable of $443 million as of December 27, 2014 ($542 million as of December 28, 2013) is included in

other accrued liabilities.

Long-term income taxes payable of $262 million as of December 27, 2014 ($188 million as of December 28, 2013) is included in

other long-term liabilities, which includes uncertain tax positions, reduced by the associated federal deduction for state taxes and

non-U.S. tax credits, and may also include other long-term tax liabilities that are not uncertain but have not yet been paid.

Uncertain Tax Positions

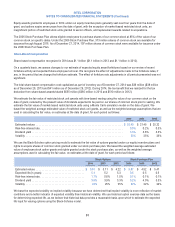

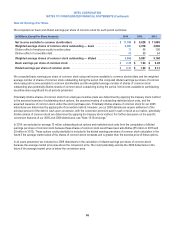

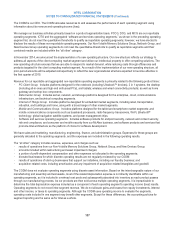

The aggregate changes in the balance of gross unrecognized tax benefits for each period were as follows:

(In Millions) 2014 2013 2012

Beginning gross unrecognized tax benefits ................................... $ 207 $ 189 $ 212

Settlements and effective settlements with tax authorities and related remeasurements . . . (220) (2) (81)

Lapse of statute of limitations ................................................ —— (5)

Increases in balances related to tax positions taken during prior periods ............... 173 21 56

Decreases in balances related to tax positions taken during prior periods .............. (1) (9) (6)

Increases in balances related to tax positions taken during current period .............. 418 813

Ending gross unrecognized tax benefits ...................................... $ 577 $ 207 $ 189

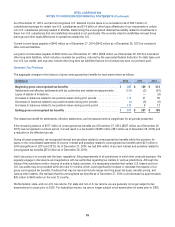

The related tax benefit for settlements, effective settlements, and remeasurements is insignificant for all periods presented.

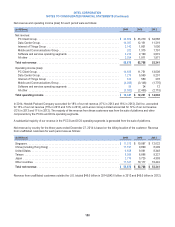

If the remaining balance of $577 million of unrecognized tax benefits as of December 27, 2014 ($207 million as of December 28,

2013) was recognized in a future period, it would result in a tax benefit of $485 million ($81 million as of December 28, 2013) and

a reduction in the effective tax rate.

During all years presented, we recognized interest and penalties related to unrecognized tax benefits within the provision for

taxes on the consolidated statements of income. Interest and penalties related to unrecognized tax benefits were $21 million in

2014 (insignificant in 2013 and 2012). As of December 27, 2014, we had $44 million of accrued interest and penalties related to

unrecognized tax benefits ($73 million as of December 28, 2013).

Intel’s tax policy is to comply with the laws, regulations, filing requirements of all jurisdictions in which Intel conducts business. We

regularly engage in discussions and negotiations with tax authorities regarding tax matters in various jurisdictions. Although the

timing of the resolutions and/or closures of audits is highly uncertain, it is reasonably possible that certain U.S. federal and non-

U.S. tax audits may be concluded within the next 12 months, which could significantly increase or decrease the balance of our

gross unrecognized tax benefits. Positions that may be resolved include issues involving asset tax basis, transfer pricing, and

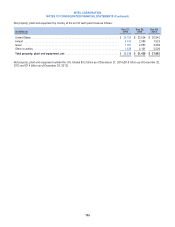

various other matters. We estimate that the unrecognized tax benefits as of December 27, 2014 could decrease by approximately

$25 million to $465 million in the next 12 months.

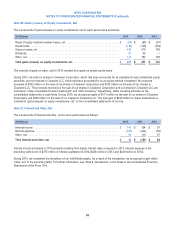

We file federal, state, and non-U.S. tax returns. For state and non-U.S. tax returns, we are generally no longer subject to tax

examinations for years prior to 2002. For federal tax returns, we are no longer subject to tax examination for years prior to 2009.

99