Intel 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

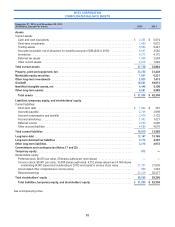

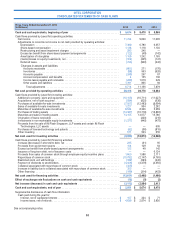

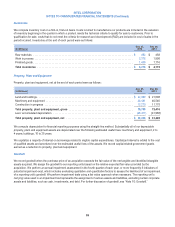

Inventories

We compute inventory cost on a first-in, first-out basis. Costs incurred to manufacture our products are included in the valuation

of inventory beginning in the quarter in which a product meets the technical criteria to qualify for sale to customers. Prior to

qualification for sale, costs that do not meet the criteria for research and development (R&D) are included in cost of sales in the

period incurred. Inventories at the end of each period were as follows:

(In Millions)

Dec 27,

2014

Dec 28,

2013

Raw materials ...................................................................... $ 462 $ 458

Work in process ..................................................................... 2,375 1,998

Finished goods ...................................................................... 1,436 1,716

Total inventories ................................................................... $ 4,273 $ 4,172

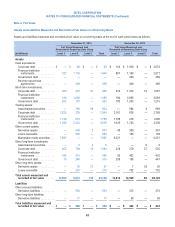

Property, Plant and Equipment

Property, plant and equipment, net at the end of each period were as follows:

(In Millions)

Dec 27,

2014

Dec 28,

2013

Land and buildings ................................................................... $ 22,989 $ 21,098

Machinery and equipment ............................................................. 44,441 40,540

Construction in progress .............................................................. 12,279 11,778

Total property, plant and equipment, gross ............................................. 79,709 73,416

Less: accumulated depreciation ........................................................ (46,471) (41,988)

Total property, plant and equipment, net ............................................... $ 33,238 $ 31,428

We compute depreciation for financial reporting purposes using the straight-line method. Substantially all of our depreciable

property, plant and equipment assets are depreciated over the following estimated useful lives: machinery and equipment, 2 to

4 years; buildings, 10 to 25 years.

We capitalize a majority of interest on borrowings related to eligible capital expenditures. Capitalized interest is added to the cost

of qualified assets and amortized over the estimated useful lives of the assets. We record capital-related government grants

earned as a reduction to property, plant and equipment.

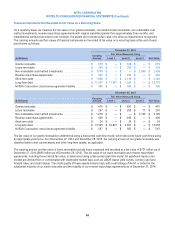

Goodwill

We record goodwill when the purchase price of an acquisition exceeds the fair value of the net tangible and identified intangible

assets acquired. We assign the goodwill to our reporting units based on the relative expected fair value provided by the

acquisition. We perform an annual impairment assessment in the fourth quarter of each year, or more frequently if indicators of

potential impairment exist, which includes evaluating qualitative and quantitative factors to assess the likelihood of an impairment

of a reporting unit’s goodwill. We perform impairment tests using a fair value approach when necessary. The reporting unit’s

carrying value used in an impairment test represents the assignment of various assets and liabilities, excluding certain corporate

assets and liabilities, such as cash, investments, and debt. For further discussion of goodwill, see “Note 10: Goodwill.”

59