Intel 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

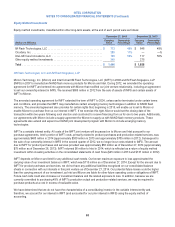

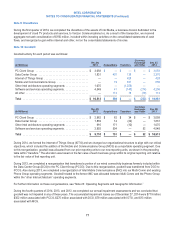

Cloudera, Inc.

During 2014, we invested in Cloudera, Inc. (Cloudera). Our fully-diluted ownership interest in Cloudera is 17% as of

December 27, 2014. Our investment is accounted for under the equity and cost methods of accounting based on the rights

associated with different securities we own, and is classified within other long-term assets. As of December 27, 2014, the carrying

value of our equity method investment was $280 million and of our cost method investment was $454 million.

Intel-GE Care Innovations, LLC

During 2011, Intel and General Electric Company (GE) formed Intel-GE Care Innovations, LLC (Care Innovations), an equally

owned joint venture in the healthcare industry, that focuses on independent living and delivery of health-related services by

means of telecommunications. The company was formed by combining assets of GE Healthcare’s Home Health division and

Intel’s Digital Health Group.

Care Innovations is a variable interest entity and depends on Intel and GE for any additional cash needs. Our known maximum

exposure to loss approximated the carrying value of our investment balance in Care Innovations, which was $108 million as of

December 27, 2014.

Intel and GE equally share the power to direct all of Care Innovations’ activities that most significantly impact its economic

performance. We have determined that we do not have the characteristics of a consolidating investor in the variable interest entity

and, therefore, we account for our interest in Care Innovations using the equity method of accounting.

Clearwire Communications, LLC

During 2013, we sold our interest in Clearwire Communications, LLC (Clearwire LLC), which we originally acquired in 2008, for

proceeds of $328 million. These proceeds are included in other investing within investing activities on the consolidated

statements of cash flows. We recognized a gain on the sale of our interest in Clearwire LLC of $328 million.

For proceeds received and gains recognized for each investment, see “Note 20: Gains (Losses) on Equity Investments, Net.”

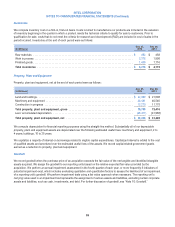

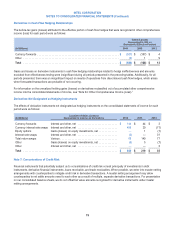

Non-marketable cost method investments

The carrying value of our non-marketable cost method investments was $1.8 billion as of December 27, 2014 ($1.3 billion as of

December 28, 2013), of which $454 million related to our cost method investment in Cloudera. In 2014, we recognized

impairments of $130 million on non-marketable cost method investments, which is included within gains (losses) on equity

investments, net on the consolidated statements of income ($103 million in 2013 and $104 million in 2012).

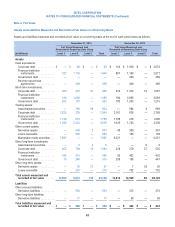

Trading Assets

As of December 27, 2014, and December 28, 2013, all of our trading assets were marketable debt instruments. Net losses

related to trading assets still held at the reporting date were $530 million in 2014 (net losses of $70 million in 2013 and net gains

of $16 million in 2012). Net gains on the related derivatives were $525 million in 2014 (net gains of $86 million in 2013 and

$11 million in 2012).

69