Intel 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

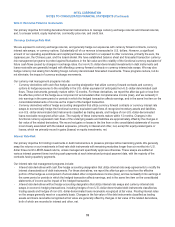

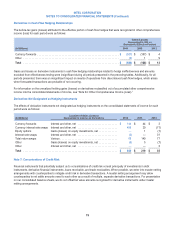

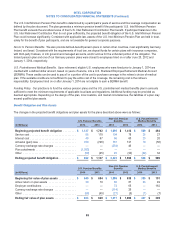

Restructuring and asset impairment charges for each period were as follows:

(In Millions) 2014 2013 2012

Employee severance and benefit arrangements .................................. $ 265 $ 201 $ —

Asset impairments and other restructuring charges ............................... 30 39 —

Total restructuring and asset impairment charges ............................. $ 295 $ 240 $ —

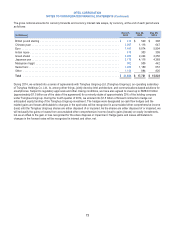

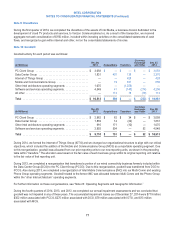

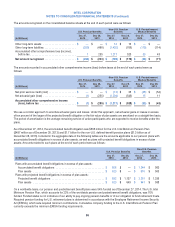

Restructuring and asset impairment activity for each period was as follows:

(In Millions)

Employee

Severance

and Benefits

Asset

Impairments

and Other Total

Accrued restructuring balance as of December 29, 2012 ................... $—$—$—

Additional accruals .................................................... 195 39 234

Adjustments ......................................................... 6 — 6

Cash payments ...................................................... (18) — (18)

Non-cash settlements .................................................. — (39) (39)

Accrued restructuring balance as of December 28, 2013 ................... 183 — 183

Additional accruals .................................................... 252 31 283

Adjustments ......................................................... 13 (1) 12

Cash payments ...................................................... (327) (6) (333)

Non-cash settlements .................................................. — (13) (13)

Accrued restructuring balance as of December 27, 2014 ................... $ 121 $ 11 $ 132

We recorded the additional accruals and adjustments as restructuring and asset impairment charges in the consolidated

statements of income and within the “all other” operating segments category. A majority of the accrued restructuring balance as of

December 27, 2014 is expected to be paid within the next 12 months and was recorded as a current liability within accrued

compensation and benefits on the consolidated balance sheets.

Restructuring actions that were approved in 2014 impacted approximately 3,700 employees. Since the third quarter of 2013, we

have incurred a total of $535 million in restructuring and asset impairment charges. These charges included a total of $466 million

related to employee severance and benefit arrangements for approximately 7,600 employees, and $69 million in asset

impairment charges and other restructuring charges.

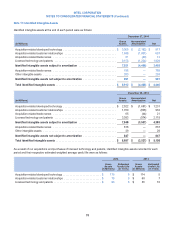

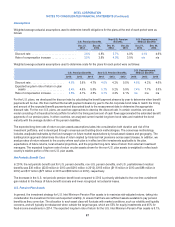

Note 14: Deferred Income

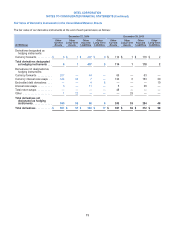

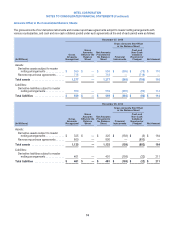

Deferred income at the end of each period was as follows:

(In Millions)

Dec 27,

2014

Dec 28,

2013

Deferred income on shipments of components to distributors .................................. $ 944 $ 852

Deferred income from software and services .............................................. 1,261 1,244

Current deferred income ............................................................. 2,205 2,096

Non-current deferred income from software and services ..................................... 483 506

Total deferred income ............................................................... $ 2,688 $ 2,602

We classify non-current deferred income from software and services within other long-term liabilities on the consolidated balance

sheets.

80