Intel 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

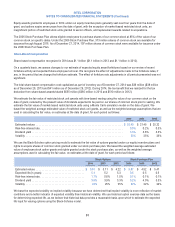

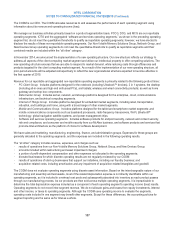

Note 24: Other Comprehensive Income (Loss)

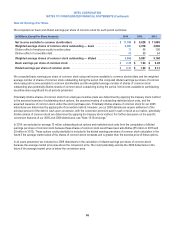

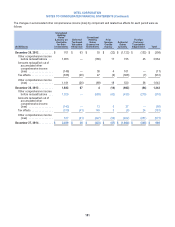

The components of other comprehensive income (loss) and related tax effects for each period were as follows:

2014 2013 2012

(In Millions)

Before

Tax Tax

Net of

Tax

Before

Tax Tax

Net of

Tax

Before

Tax Tax

Net of

Tax

Change in unrealized holding gains

(losses) on available-for-sale

investments .................. $ 1,029 $ (359) $ 670 $ 1,963 $ (687) $ 1,276 $ 909 $ (318) $ 591

Less: adjustment for (gains) losses on

available-for-sale investments

included in net income .......... (142) 49 (93) (146) 51 (95) (187) 66 (121)

Less: adjustment for (gains) losses on

deferred tax asset valuation

allowance included in net

income ..................... — (41) (41) — (26) (26) — (11) (11)

Change in unrealized holding gains

(losses) on derivatives .......... (589) 160 (429) (166) 76 (90) 12 8 20

Less: adjustment for (gains) losses on

derivatives included in net

income ..................... 13 (11) 2 30 (29) 1 78 (13) 65

Change in net prior service costs .... (42) 5 (37) 17 (2) 15 (4) 1 (3)

Less: adjustment for amortization of

net prior service costs .......... 6 (2) 4 4 (1) 3 5 (2) 3

Change in actuarial valuation ....... (433) 3 (430) 725 (275) 450 (321) 91 (230)

Less: adjustment for amortization of

actuarial (gains) losses ......... 37 (9) 28 101 (31) 70 90 (32) 58

Change in net foreign currency

translation adjustment .......... (275) 24 (251) 45 (7) 38 12 (2) 10

Other comprehensive income

(loss) ...................... $ (396) $ (181) $ (577) $ 2,573 $ (931) $ 1,642 $ 594 $ (212) $ 382

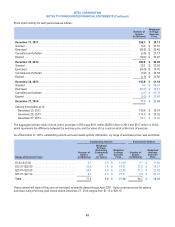

In prior periods, we recorded a reversal of a portion of our deferred tax asset valuation allowance attributed to changes in

unrealized holding gains on our available-for-sale investments. This amount is reduced and included in our provision for taxes as

these investments mature or are sold, and is included in the preceding table as an adjustment for (gains) losses on deferred tax

asset valuation allowance included in net income.

The change in actuarial valuation in 2014 in the preceding table includes $1.4 billion in actuarial losses arising during the year

offset by a $1.0 billion reduction in losses due to a freeze of future benefit accruals in the U.S. Intel Minimum Pension Plan. For

further information, see “Note 16: Retirement Benefit Plans.”

100