Intel 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

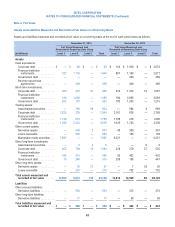

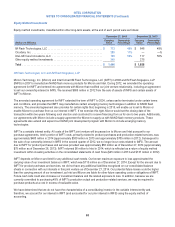

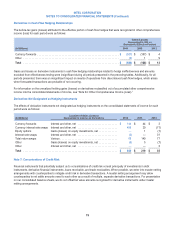

Note 6: Derivative Financial Instruments

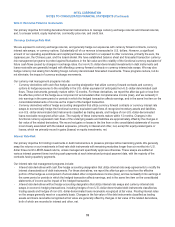

Our primary objective for holding derivative financial instruments is to manage currency exchange rate risk and interest rate risk,

and, to a lesser extent, equity market risk, commodity price risk, and credit risk.

Currency Exchange Rate Risk

We are exposed to currency exchange rate risk, and generally hedge our exposures with currency forward contracts, currency

interest rate swaps, or currency options. Substantially all of our revenue is transacted in U.S. dollars. However, a significant

amount of our operating expenditures and capital purchases is incurred in or exposed to other currencies, primarily the euro, the

Japanese yen, the Chinese yuan, and the Israeli shekel. We have established balance sheet and forecasted transaction currency

risk management programs to protect against fluctuations in the fair value and the volatility of the functional currency equivalent of

future cash flows caused by changes in exchange rates. Our non-U.S.-dollar-denominated investments in debt instruments and

loans receivable are generally hedged with offsetting currency forward contracts or currency interest rate swaps. We may also

hedge currency risk arising from funding foreign currency denominated forecasted investments. These programs reduce, but do

not eliminate, the impact of currency exchange movements.

Our currency risk management programs include:

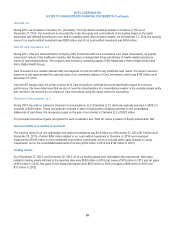

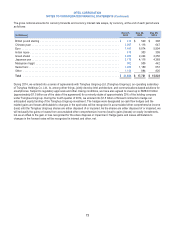

•Currency derivatives with cash flow hedge accounting designation that utilize currency forward contracts and currency

options to hedge exposures to the variability in the U.S.-dollar equivalent of anticipated non-U.S.-dollar-denominated cash

flows. These instruments generally mature within 12 months. For these derivatives, we report the after-tax gain or loss from

the effective portion of the hedge as a component of accumulated other comprehensive income (loss), and we reclassify it

into earnings in the same period or periods in which the hedged transaction affects earnings, and in the same line item on the

consolidated statements of income as the impact of the hedged transaction.

•Currency derivatives without hedge accounting designation that utilize currency forward contracts or currency interest rate

swaps to economically hedge the functional currency equivalent cash flows of recognized monetary assets and liabilities,

non-U.S.-dollar-denominated debt instruments classified as trading assets, and hedges of non-U.S.-dollar-denominated

loans receivable recognized at fair value. The majority of these instruments mature within 12 months. Changes in the

functional currency equivalent cash flows of the underlying assets and liabilities are approximately offset by the changes in

fair value of the related derivatives. We record net gains or losses in the line item on the consolidated statements of income

most closely associated with the related exposures, primarily in interest and other, net, except for equity-related gains or

losses, which we primarily record in gains (losses) on equity investments, net.

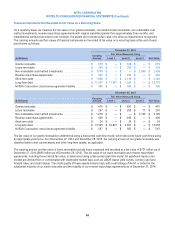

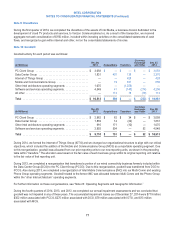

Interest Rate Risk

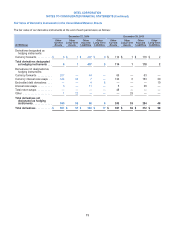

Our primary objective for holding investments in debt instruments is to preserve principal while maximizing yields. We generally

swap the returns on our investments in fixed-rate debt instruments with remaining maturities longer than six months into U.S.

dollar three-month LIBOR-based returns, unless management specifically approves otherwise. These swaps are settled at

various interest payment times involving cash payments at each interest and principal payment date, with the majority of the

contracts having quarterly payments.

Our interest rate risk management programs include:

•Interest rate derivatives with cash flow hedge accounting designation that utilize interest rate swap agreements to modify the

interest characteristics of debt instruments. For these derivatives, we report the after-tax gain or loss from the effective

portion of the hedge as a component of accumulated other comprehensive income (loss), and we reclassify it into earnings in

the same period or periods in which the hedged transaction affects earnings, and in the same line item on the consolidated

statements of income as the impact of the hedged transaction.

•Interest rate derivatives without hedge accounting designation that utilize interest rate swaps and currency interest rate

swaps in economic hedging transactions, including hedges of non-U.S.-dollar-denominated debt instruments classified as

trading assets and hedges of non-U.S.-dollar-denominated loans receivable recognized at fair value. Floating interest rates

on the swaps generally reset on a quarterly basis. Changes in the fair value of the debt instruments classified as trading

assets and loans receivable recognized at fair value are generally offset by changes in fair value of the related derivatives,

both of which are recorded in interest and other, net.

70