Intel 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

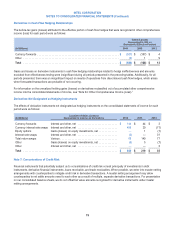

Note 9: Divestitures

During the first quarter of 2014, we completed the divestiture of the assets of Intel Media, a business division dedicated to the

development of cloud TV products and services, to Verizon Communications Inc. As a result of the transaction, we received

aggregate net cash consideration of $150 million, included within investing activities on the consolidated statements of cash

flows, and recognized a gain within interest and other, net on the consolidated statements of income.

Note 10: Goodwill

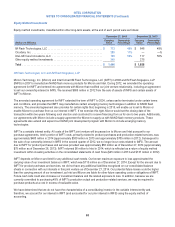

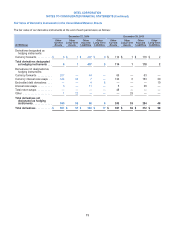

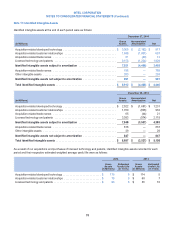

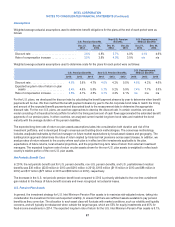

Goodwill activity for each period was as follows:

(In Millions)

Dec 28,

2013 Acquisitions Transfers

Currency

Exchange

and Other

Dec 27,

2014

PC Client Group ..................................... $ 3,058 $ — $ — $ — $ 3,058

Data Center Group ................................... 1,831 407 138 — 2,376

Internet of Things Group ............................... — — 428 — 428

Mobile and Communications Group ...................... — 19 631 — 650

Other Intel architecture operating segments ................ 1,075 — (1,075) — —

Software and services operating segments ................. 4,549 41 (140) (214) 4,236

All other ............................................ — 113 18 (18) 113

Total .............................................. $ 10,513 $ 580 $ — $ (232) $ 10,861

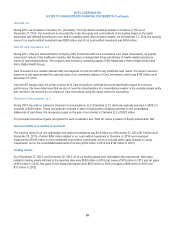

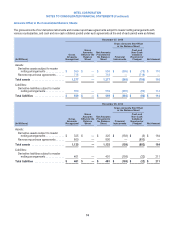

(In Millions)

Dec 29,

2012 Acquisitions Transfers

Currency

Exchange

and Other

Dec 28,

2013

PC Client Group ..................................... $ 2,962 $ 62 $ 34 $ — $ 3,058

Data Center Group ................................... 1,839 14 (22) — 1,831

Other Intel architecture operating segments ................ 916 171 (12) — 1,075

Software and services operating segments ................. 3,993 504 — 52 4,549

Total .............................................. $ 9,710 $ 751 $ — $ 52 $ 10,513

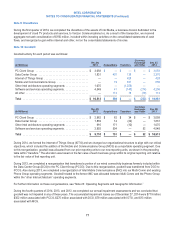

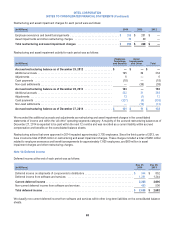

During 2014, we formed the Internet of Things Group (IOTG) and we changed our organizational structure to align with our critical

objectives, which included the addition of the Mobile and Communications Group (MCG) as a reportable operating segment. Due

to this reorganization, goodwill was allocated from our prior reporting units to our new reporting units, as shown in the preceding

table within “transfers.” The allocation was based on the fair value of each business group within its original reporting unit relative

to the fair value of that reporting unit.

During 2013, we completed a reorganization that transferred a portion of our wired connectivity business formerly included within

the Data Center Group (DCG) to the PC Client Group (PCCG). Due to this reorganization, goodwill was transferred from DCG to

PCCG. Also during 2013, we completed a reorganization of Intel Mobile Communications (IMC) into our Multi-Comm and existing

Phone Group operating segments. Goodwill related to the former IMC was allocated between Multi-Comm and the Phone Group

within the “other Intel architecture” operating segments.

For further information on these reorganizations, see “Note 26: Operating Segments and Geographic Information.”

During the fourth quarters of 2014, 2013, and 2012, we completed our annual impairment assessments and we concluded that

goodwill was not impaired in any of these years. The accumulated impairment losses as of December 27, 2014 were $719 million:

$352 million associated with PCCG, $275 million associated with DCG, $79 million associated with IOTG, and $13 million

associated with MCG.

77