Intel 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

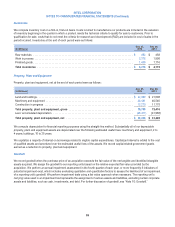

Cash Equivalents

We consider all highly liquid debt investments with original maturities from the date of purchase of approximately three months or

less as cash equivalents. Cash equivalents can include investments such as corporate debt, financial institution instruments,

government debt, and reverse repurchase agreements classified as cash equivalents. See “Note 4: Fair Value” for the

instruments held as cash equivalents.

Trading Assets

Marketable debt instruments are generally designated as trading assets when a market risk is economically hedged at inception

with a related derivative instrument, or when the marketable debt instrument itself is used to economically hedge foreign

exchange rate risk from remeasurement. Investments designated as trading assets are reported at fair value. The gains or losses

of these investments arising from changes in fair value due to interest rate and currency market fluctuations and credit market

volatility, largely offset by losses or gains on the related derivative instruments and balance sheet remeasurement, are recorded

in interest and other, net. We also designate certain floating-rate securitized financial instruments, primarily asset-backed

securities, as trading assets.

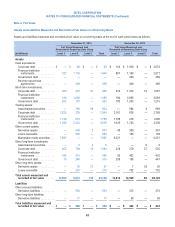

Available-for-Sale Investments

We consider all liquid available-for-sale debt instruments with original maturities from the date of purchase of approximately three

months or less to be cash and cash equivalents. Available-for-sale debt instruments with original maturities at the date of

purchase greater than approximately three months and remaining maturities of less than one year are classified as short-term

investments. Available-for-sale debt instruments with remaining maturities beyond one year are classified as other long-term

investments.

Investments that we designate as available-for-sale are reported at fair value, with unrealized gains and losses, net of tax,

recorded in accumulated other comprehensive income (loss), except as noted in the “Other-Than-Temporary Impairment” section

that follows. We determine the cost of the investment sold based on an average cost basis at the individual security level. Our

available-for-sale investments include:

•Marketable debt instruments when the interest rate and foreign currency risks are not hedged at the inception of the

investment or when our criteria for designation as trading assets are not met. We generally hold these debt instruments to

generate a return commensurate with the U.S.-dollar three-month LIBOR. We record the interest income and realized gains

and losses on the sale of these instruments in interest and other, net.

•Marketable equity securities when there is no plan to sell or hedge the investment at the time of original classification. We

acquire these equity investments to promote business and strategic objectives. To the extent that these investments continue

to have strategic value, we typically do not attempt to reduce or eliminate the equity market risks through hedging activities.

We record the realized gains or losses on the sale or exchange of marketable equity securities in gains (losses) on equity

investments, net.

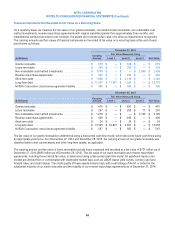

Non-Marketable and Other Equity Investments

Our non-marketable equity and other equity investments are included in other long-term assets. We account for non-marketable

equity and other equity investments for which we do not have control over the investee as:

•Equity method investments when we have the ability to exercise significant influence, but not control, over the investee.

Equity method investments include marketable and non-marketable investments. Our proportionate share of the income or

loss is recognized on a one-quarter lag and is recorded in gains (losses) on equity investments, net.

•Non-marketable cost method investments when the equity method does not apply.

We record the realized gains or losses on the sale of equity method and non-marketable cost method investments in gains

(losses) on equity investments, net.

56