Home Depot 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

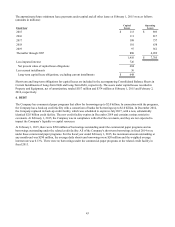

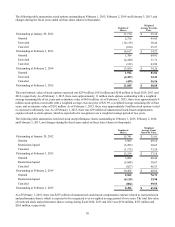

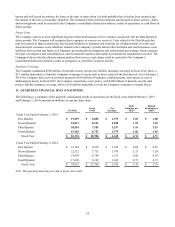

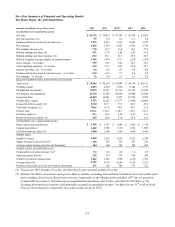

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The assets and liabilities of the Company that are measured at fair value on a recurring basis as of February 1, 2015 and

February 2, 2014 were as follows (amounts in millions):

Fair Value at February 1, 2015 Using Fair Value at February 2, 2014 Using

Level 1 Level 2 Level 3 Level 1 Level 2 Level 3

Derivative agreements - assets $ — $ 124 $ — $ — $ 30 $ —

Derivative agreements - liabilities ————(10) —

Total $ — $ 124 $ — $ — $ 20 $ —

The Company uses derivative financial instruments from time to time in the management of its interest rate exposure on

long-term debt and its exposure on foreign currency fluctuations. The fair value of the Company’s derivative financial

instruments was measured using level 2 inputs. The Company’s derivative agreements are discussed further in Note 4.

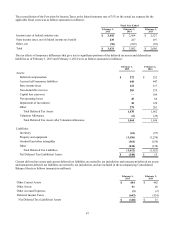

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Long-lived assets, goodwill and other intangible assets were analyzed for impairment on a nonrecurring basis using fair value

measurements with unobservable inputs (level 3). Impairment charges related to long-lived assets, goodwill and other

intangible assets in fiscal 2014 and 2013 were not material, as further discussed in Note 1 under the captions "Impairment of

Long-Lived Assets" and "Goodwill and Other Intangible Assets," respectively.

The aggregate fair value of the Company’s senior notes, based on quoted market prices, was $19.0 billion and $15.6 billion at

February 1, 2015 and February 2, 2014, respectively, compared to a carrying value of $16.2 billion and $14.2 billion at

February 1, 2015 and February 2, 2014, respectively.

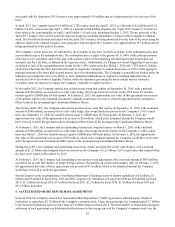

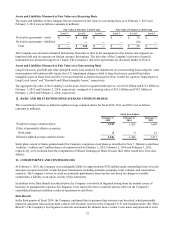

12. BASIC AND DILUTED WEIGHTED AVERAGE COMMON SHARES

The reconciliation of basic to diluted weighted average common shares for fiscal 2014, 2013 and 2012 was as follows

(amounts in millions):

Fiscal Year Ended

February 1,

2015 February 2,

2014 February 3,

2013

Weighted average common shares 1,338 1,425 1,499

Effect of potentially dilutive securities:

Stock plans 89 12

Diluted weighted average common shares 1,346 1,434 1,511

Stock plans consist of shares granted under the Company’s employee stock plans as described in Note 7. Options to purchase

1 million, 1 million and 1 million shares of common stock at February 1, 2015, February 2, 2014 and February 3, 2013,

respectively, were excluded from the computation of Diluted Earnings per Share because their effect would have been anti-

dilutive.

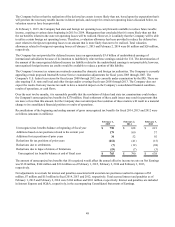

13. COMMITMENTS AND CONTINGENCIES

At February 1, 2015, the Company was contingently liable for approximately $392 million under outstanding letters of credit

and open accounts issued for certain business transactions, including insurance programs, trade contracts and construction

contracts. The Company’s letters of credit are primarily performance-based and are not based on changes in variable

components, a liability or an equity security of the other party.

In addition to the Data Breach described below, the Company is involved in litigation arising from the normal course of

business. In management's opinion, this litigation is not expected to have a material adverse effect on the Company's

consolidated financial condition, results of operations or cash flows.

Data Breach

In the third quarter of fiscal 2014, the Company confirmed that its payment data systems were breached, which potentially

impacted customers who used payment cards at self-checkout systems in the Company's U.S. and Canadian stores (the "Data

Breach"). The Company's investigation to date has determined the intruder used a vendor’s user name and password to enter