Home Depot 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

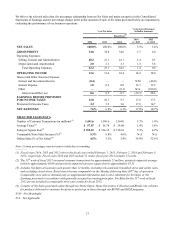

Liquidity and Capital Resources

Cash flow generated from operations provides us with a significant source of liquidity. For fiscal 2014, Net Cash Provided by

Operating Activities, excluding a $323 million gain on the sale of HD Supply common stock, was $8.2 billion compared to

$7.6 billion for fiscal 2013. This increase was primarily due to a $960 million increase in Net Earnings resulting from higher

comparable store sales and expense leverage. The gain on the sale of a portion of our equity ownership in HD Supply is

classified as an investing activity in our Consolidated Statements of Cash Flows.

Net Cash Used in Investing Activities for fiscal 2014 was $1.3 billion compared to $1.5 billion for fiscal 2013. This change

was primarily due to the $323 million of proceeds from the sale of a portion of our equity ownership in HD Supply in fiscal

2014, partially offset by $53 million more in Capital Expenditures and $40 million less in Proceeds from Sales of Property

and Equipment in fiscal 2014 compared to fiscal 2013.

Net Cash Used in Financing Activities for fiscal 2014 was $7.1 billion compared to $6.7 billion for fiscal 2013. This change

was primarily the result of $2.0 billion less of net proceeds from long-term borrowings, partially offset by $1.5 billion less in

repurchases of common stock in fiscal 2014 compared to fiscal 2013.

In fiscal 2014, we entered into ASR agreements with third-party financial institutions to repurchase $2.7 billion of our

common stock. Under the agreements, we paid $2.7 billion to the financial institutions and received a total of 34 million

shares in fiscal 2014. Also in fiscal 2014, we repurchased 46 million additional shares of our common stock for $4.3 billion

through the open market. Since the inception of our initial share repurchase program in 2002, we have repurchased 1.2 billion

shares of our common stock for a total of $53.1 billion as of the end of fiscal 2014. In February 2015, our Board of Directors

authorized a new $18.0 billion share repurchase program that replaces the previous authorization.

In June 2014, we issued $1.0 billion of 2.00% senior notes due June 15, 2019 (the "2019 notes") at a discount of $4 million

and $1.0 billion of 4.40% senior notes due March 15, 2045 (the "2045 notes") at a discount of $15 million (together, the

"June 2014 issuance"). Interest on the 2019 notes is due semi-annually on June 15 and December 15 of each year, beginning

December 15, 2014. Interest on the 2045 notes is due semi-annually on March 15 and September 15 of each year, beginning

September 15, 2014. The net proceeds of the June 2014 issuance were used for general corporate purposes, including

repurchases of shares of our common stock.

In September 2013, we issued $1.15 billion of 2.25% senior notes due September 10, 2018 (the "2018 notes") at a discount of

$1 million, $1.1 billion of 3.75% senior notes due February 15, 2024 (the "2024 notes") at a discount of $6 million and $1.0

billion of 4.875% senior notes due February 15, 2044 (the "2044 notes") at a discount of $15 million (together, the

"September 2013 issuance"). Interest on the 2018 notes is due semi-annually on March 10 and September 10 of each year,

beginning March 10, 2014. Interest on the 2024 notes and the 2044 notes is due semi-annually on February 15 and August 15

of each year, beginning February 15, 2014. The net proceeds of the September 2013 issuance were used for general corporate

purposes, including repayment of our $1.25 billion 5.25% senior notes that matured December 16, 2013 and repurchases of

shares of our common stock.

In April 2013, we issued $1.0 billion of 2.70% senior notes due April 1, 2023 at a discount of $2 million and $1.0 billion of

4.20% senior notes due April 1, 2043 at a discount of $4 million (together, the "April 2013 issuance"). Interest on these notes

is due semi-annually on April 1 and October 1 of each year, beginning October 1, 2013. The net proceeds of the April 2013

issuance were used for general corporate purposes, including repurchases of shares of our common stock.

In November 2013, we entered into an interest rate swap that expires on September 10, 2018, with a notional amount of $500

million, accounted for as a fair value hedge, that swaps fixed rate interest on the 2018 notes for variable interest equal to

LIBOR plus 88 basis points. At February 1, 2015, the approximate fair value of this agreement was an asset of $8 million,

which is the estimated amount we would have received to settle the agreement and is included in Other Assets in the

accompanying Consolidated Balance Sheets.

Also in November 2013, we entered into an interest rate swap that expires on September 15, 2020, with a notional amount of

$500 million, accounted for as a fair value hedge, that swaps fixed rate interest on our 3.95% senior notes due September 15,

2020 for variable interest equal to LIBOR plus 183 basis points. At February 1, 2015, the approximate fair value of this

agreement was an asset of $25 million, which is the estimated amount we would have received to settle the agreement and is

included in Other Assets in the accompanying Consolidated Balance Sheets.

At February 1, 2015, we had an outstanding interest rate swap that expires on March 1, 2016, with a notional amount of $500

million, accounted for as a fair value hedge, that swaps fixed rate interest on our 5.40% senior notes due March 1, 2016 for